What Are Credit Default Swaps

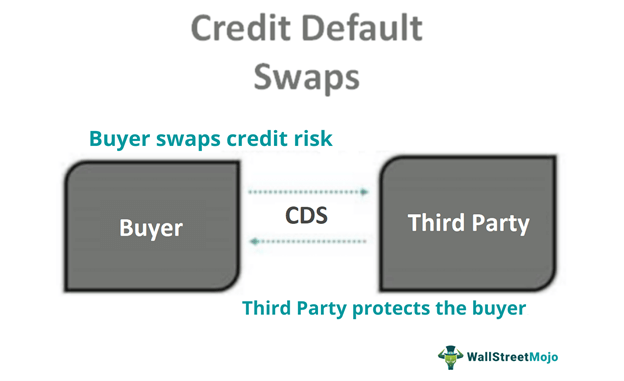

Credit Default Swap Definition And Meaning Market Business News A credit default swap (cds) is a financial derivative that allows an investor to swap or offset their credit risk with that of another investor. learn how cdss work, what types of credit events trigger them, and how they were involved in the 2008 financial crisis. A credit default swap (cds) is a financial contract that transfers the risk of default of a debt instrument to a third party. learn about the uses, history, pricing, criticisms and regulation of cdss from .

Introduction To Credit Derivatives And Credit Default Swaps Cds are financial derivatives that transfer the risk of default on a loan or debt product to another party for a fee. learn how cds work, who created them, and how they contributed to the 2008 financial crisis. Credit default swaps (cds) are contracts that insure against the risk of default on a debt obligation. learn how they work, how they trigger, how they are regulated and how they contributed to the 2008 financial crisis. Learn what credit default swaps (cdss) are, how they work, and why they are important for risk management and speculation. find out how cdss were involved in the 2008 financial crisis and how they are regulated today. A credit default swap (cds) is a type of credit derivative that provides protection against default and other risks. learn how cds works, why investors use it, what risks it involves, and how it was affected by the financial crisis of 2008.

Credit Default Swap Cds Definition Example Pros Cons Learn what credit default swaps (cdss) are, how they work, and why they are important for risk management and speculation. find out how cdss were involved in the 2008 financial crisis and how they are regulated today. A credit default swap (cds) is a type of credit derivative that provides protection against default and other risks. learn how cds works, why investors use it, what risks it involves, and how it was affected by the financial crisis of 2008. Learn what credit default swaps (cds) are, how they work, and what happens when a credit event occurs. find out how cds contracts are settled via physical or cash methods, and how the lehman brothers auction in 2008 tested the systems. A credit default swap protects bondholders and lenders against the risk that the borrower will default. the lender 's insuring counterparty takes on this risk in return for income payments. in this respect it is important for the insuring counterparty to fully assess the swap's risk return feature to ensure it is receiving fair compensation vis.

What Is A Credit Default Swap Cds Meaning And How They Work Ig Uk Learn what credit default swaps (cds) are, how they work, and what happens when a credit event occurs. find out how cds contracts are settled via physical or cash methods, and how the lehman brothers auction in 2008 tested the systems. A credit default swap protects bondholders and lenders against the risk that the borrower will default. the lender 's insuring counterparty takes on this risk in return for income payments. in this respect it is important for the insuring counterparty to fully assess the swap's risk return feature to ensure it is receiving fair compensation vis.

:max_bytes(150000):strip_icc()/Term-Definitions_Credit-default-swap-63dfdd6f916e4dfa8fb524fc387273c6.jpg)

Credit Default Swap What It Is And How It Works

Understanding Credit Default Swaps Cds Benefits And Risks Explained

Comments are closed.