What Are Commercial Real Estate Asset Types

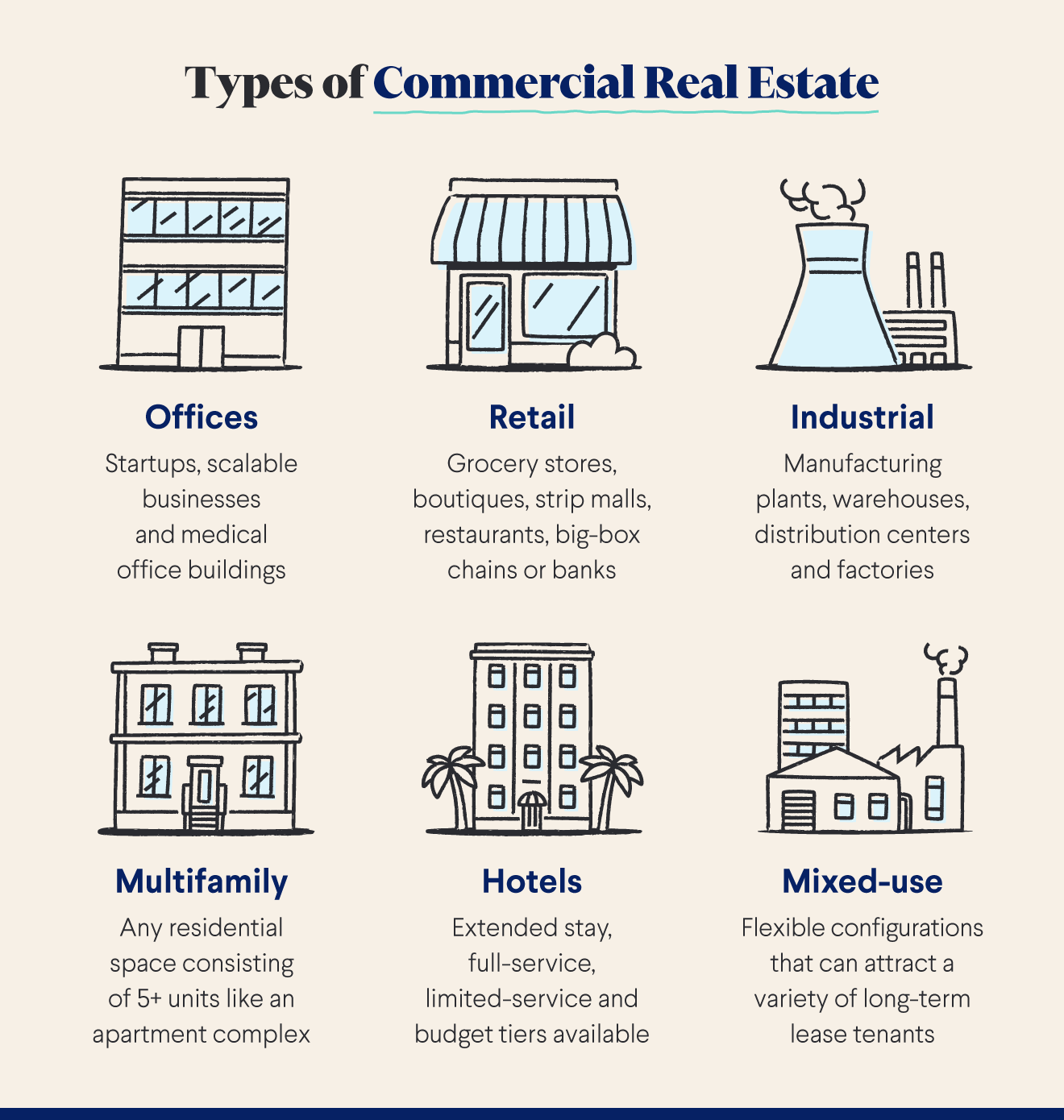

15 Types Of Real Estate Investments For 2023 Key takeaways. commercial real estate is a type of asset that is purchased and leased to business tenants with the intent to earn a return through rental income and or price appreciation. there are eight types of commercial real estate, each of which include their own operational quirks and risk profile. they include: hotel, retail, industrial. 10 types of commercial real estate buildings & properties. 1. multifamily. the term multifamily real estate comprises all residential real estate, with the exception of single family homes. this type of commercial real estate includes high priority investments like apartments, co ops, townhomes, and more.

Commercial Real Estate Asset Classes Supereminent Newsletter Navigateur The primary role of a commercial property is to generate revenue through capital gain or rental income. while office, industrial, retail and multifamily are considered the main categories of cre properties, the commercial industry also encompasses hospitality and mixed use assets, as well as land and special purpose real estate. Diversification: private commercial real estate provides diversification benefits, as it often has low correlation with other asset classes like stocks and bonds. appreciation: commercial properties have the potential for long term appreciation, offering investors capital gains. tax benefits: investors can take advantage of tax deductions such. Commercial real estate is property used for business purposes rather than as a living space. like all forms of real estate, commercial space is a distinct asset class that can provide. Low rise or garden style: 2 4 stories high. mid rise: 5 9 stories. high rise: 10 stories or higher. in the past, multifamily properties were regarded less as commercial real estate assets and more closely associated with other residential assets such as single family homes.

A Guide To Real Estate Asset Classes Property Types And Property Classes Commercial real estate is property used for business purposes rather than as a living space. like all forms of real estate, commercial space is a distinct asset class that can provide. Low rise or garden style: 2 4 stories high. mid rise: 5 9 stories. high rise: 10 stories or higher. in the past, multifamily properties were regarded less as commercial real estate assets and more closely associated with other residential assets such as single family homes. The basics of commercial real estate property types. commercial real estate is the third most valuable asset class in the us, right behind stocks and bonds. with an estimated market value of about $17 trillion, it’s understandable why a growing number of investors are adding commercial real estate to their investment portfolios. Commercial real estate asset classes are categories that are used to classify different types of commercial properties based on their use, location, and other factors. these classes are used by investors, lenders, and real estate professionals to evaluate and compare properties.

A Guide To Cre Investment Classes Sagestreet The basics of commercial real estate property types. commercial real estate is the third most valuable asset class in the us, right behind stocks and bonds. with an estimated market value of about $17 trillion, it’s understandable why a growing number of investors are adding commercial real estate to their investment portfolios. Commercial real estate asset classes are categories that are used to classify different types of commercial properties based on their use, location, and other factors. these classes are used by investors, lenders, and real estate professionals to evaluate and compare properties.

Comments are closed.