W4 Form 2024 Quick Overview Filling Out The W 4 Tax Form Money Instructor

W4 Form 2024 Quick Overview Filling Out The W 4 Tax Form Money An overview of filling out the w4 tax form. learn how to quickly and easily fill out the irs w 4 form, understand its purpose, and grasp its impact on your. How to fill out a w 4. step 1: enter your personal information. fill in your name, address, social security number and tax filing status. importantly, your tax filing status is the basis for which.

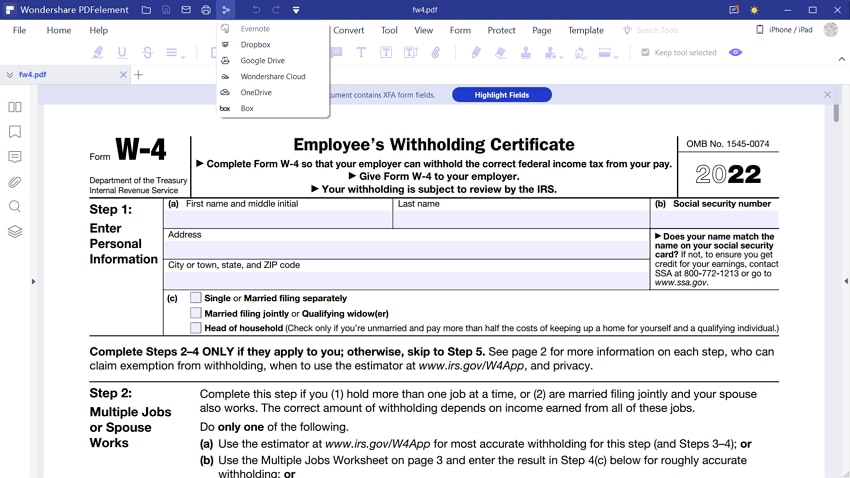

W4 Form 2024 Filling Out The W 4 Tax Form Money Instructor 2024 form w 4. form. w 4. department of the treasury internal revenue service. employee’s withholding certificate. complete form w 4 so that your employer can withhold the correct federal income tax from your pay. give form w 4 to your employer. your withholding is subject to review by the irs. omb no. 1545 0074. Step by step guide on how to accurately fill out the irs w 4 form, including tips for dealing with multiple jobs, claiming dependents, and utilizing deductio. Step 2: account for all jobs you and your spouse have. unlike when you filled out w 4 forms in the past, you’ll have to fill out your w 4 with your combined income in mind, including self employment. otherwise, you may set up your withholding at too low a rate. to fill out this part correctly, you have three choices. Step 3: claim dependents and children. if you earn less than $200,000 per year as a single filer or less than $400,000 per year if married filing jointly, you can follow the steps on your w 4 form to include the $2,000 in credit for each dependent under 17 years of age and $500 for other dependents.

How To Fill Out An Exempt W4 Form 2024 Money Instructor Youtube Step 2: account for all jobs you and your spouse have. unlike when you filled out w 4 forms in the past, you’ll have to fill out your w 4 with your combined income in mind, including self employment. otherwise, you may set up your withholding at too low a rate. to fill out this part correctly, you have three choices. Step 3: claim dependents and children. if you earn less than $200,000 per year as a single filer or less than $400,000 per year if married filing jointly, you can follow the steps on your w 4 form to include the $2,000 in credit for each dependent under 17 years of age and $500 for other dependents. How to fill out the w 4 form (2024) the redesigned w 4 form no longer has allowances. we explain the five steps to filling it out and answer other faq about the form. W4 form 2024 | filling out the w 4 tax form. w 4 form 2024. the irs w 4 form for 2024 is a crucial part of your employment paperwork, as it guides your employer in determining the correct amount of federal income tax to withhold from your paycheck. the irs w 4 form a document you provide to your employer when starting a new job or when your tax.

W4 Form 2024 How To Fill Out Dena Morena How to fill out the w 4 form (2024) the redesigned w 4 form no longer has allowances. we explain the five steps to filling it out and answer other faq about the form. W4 form 2024 | filling out the w 4 tax form. w 4 form 2024. the irs w 4 form for 2024 is a crucial part of your employment paperwork, as it guides your employer in determining the correct amount of federal income tax to withhold from your paycheck. the irs w 4 form a document you provide to your employer when starting a new job or when your tax.

How To Fill In 2024 W 4 Form Step By Step Instructions

W4 Form 2024 Irs Alina Beatriz

Comments are closed.