W 9 What Is It And How Do You Fill It Out Smartasset

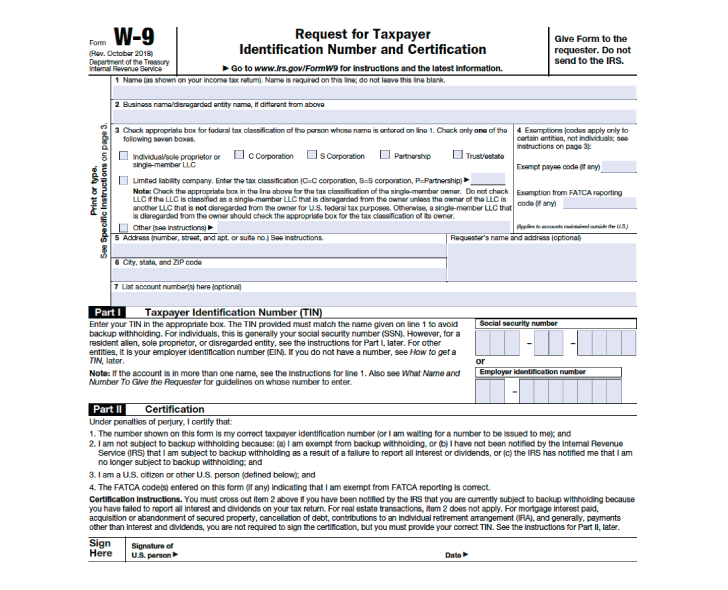

W 9 What Is It And How Do You Fill It Out Smartasset W 9 forms are necessary for independent contractors and consultants. the form is an agreement that you will handle your own income taxes. Form w 9 is an irs document that businesses use to collect a person's tax identification number (tin). independent contractors who were paid at least $600 during the year need to fill out a w 9.

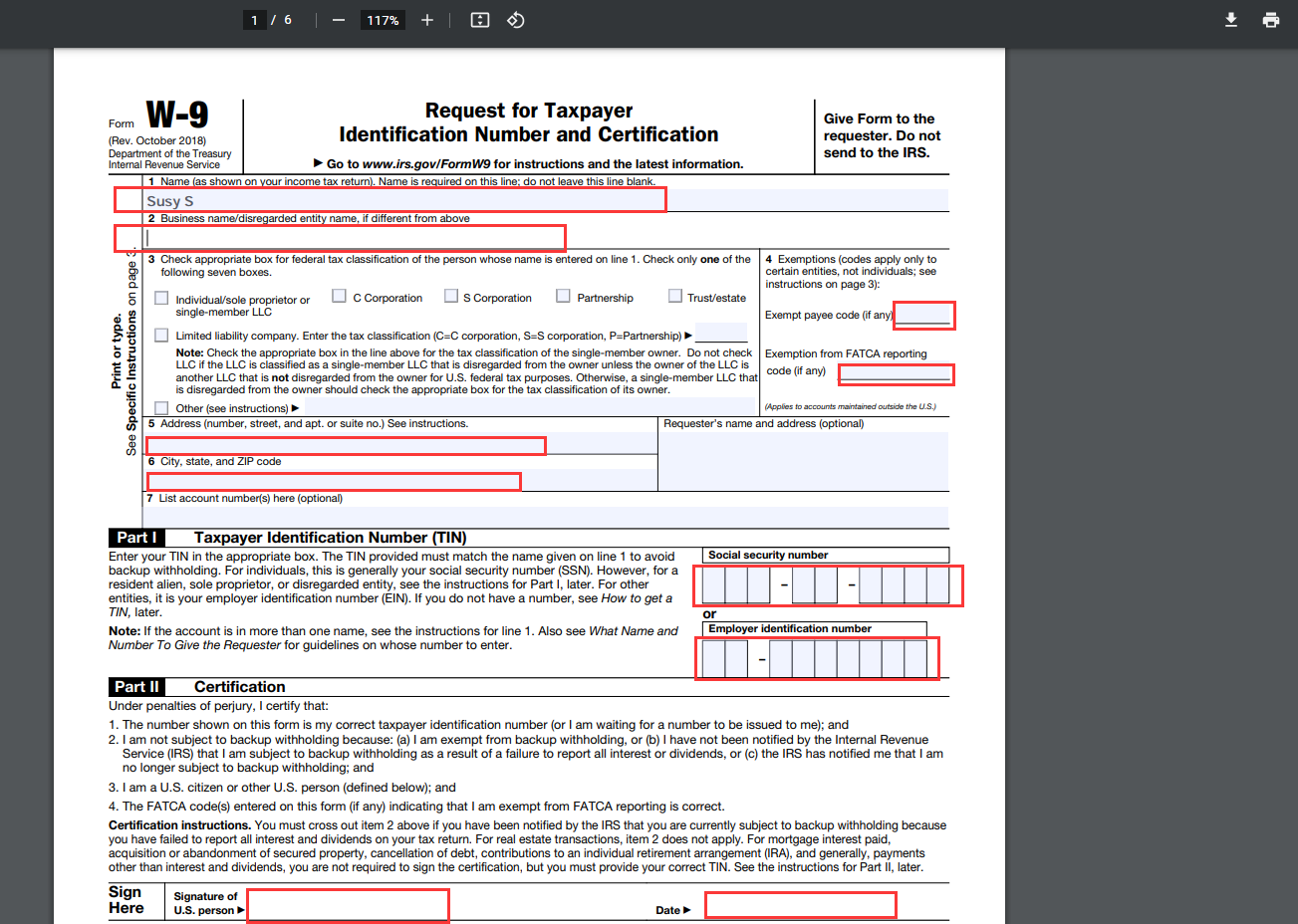

W 9 What Is It And How Do You Fill It Out Smartasset Form w 9 is an “information return,” meaning it’s just for giving someone else a piece of information they need (rather than the irs). but because you’re not sending it to the irs, you need to be careful about who exactly you send it to. the irs made two updates to form w 9 in december 2023, affecting form w 9 for the 2024 tax year. A w 9 form is an internal revenue service (irs) tax form that is used to confirm a person's name, address, and taxpayer identification number (tin) for employment or other income generating. Use form w 9 to provide your correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: income paid to you. real estate transactions. mortgage interest you paid. acquisition or abandonment of secured property. cancellation of debt. contributions you made to an ira. Section one of the w 9 is where you will need to fill in your name, and address. for box 1, type or write your full name. for box 2, type or write your business's name (if you have one). if not, leave it blank. for box 3, check the box that describes you or the legal status of your business.

W 9 Form What Is It And How Do You Fill It Out Smartasset Use form w 9 to provide your correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: income paid to you. real estate transactions. mortgage interest you paid. acquisition or abandonment of secured property. cancellation of debt. contributions you made to an ira. Section one of the w 9 is where you will need to fill in your name, and address. for box 1, type or write your full name. for box 2, type or write your business's name (if you have one). if not, leave it blank. for box 3, check the box that describes you or the legal status of your business. The first section of form w 9 is where you must provide information about yourself and your federal tax classification, including details of exemption if it applies to you. line 1: enter your name as it appears on your income tax return. line 2: enter your business name or disregarded entity name if it is different from the name that you. Form w 9 is a commonly used irs form for providing necessary information to a person or company that will be making payments to another person or company. one of the most common situations is when someone works as an independent contractor for a business. when you are hired as a contractor for a business or beginning work as a freelancer, you may be asked to complete a w 9 and provide it to.

W 9 Form What Is It And How Do You Fill It Out 60 Off The first section of form w 9 is where you must provide information about yourself and your federal tax classification, including details of exemption if it applies to you. line 1: enter your name as it appears on your income tax return. line 2: enter your business name or disregarded entity name if it is different from the name that you. Form w 9 is a commonly used irs form for providing necessary information to a person or company that will be making payments to another person or company. one of the most common situations is when someone works as an independent contractor for a business. when you are hired as a contractor for a business or beginning work as a freelancer, you may be asked to complete a w 9 and provide it to.

All About W 9 Form What It Is What It Is Used For And How To Fill It Out

Comments are closed.