W 9 Vs 1099 Learn The Differences And When To Use Each

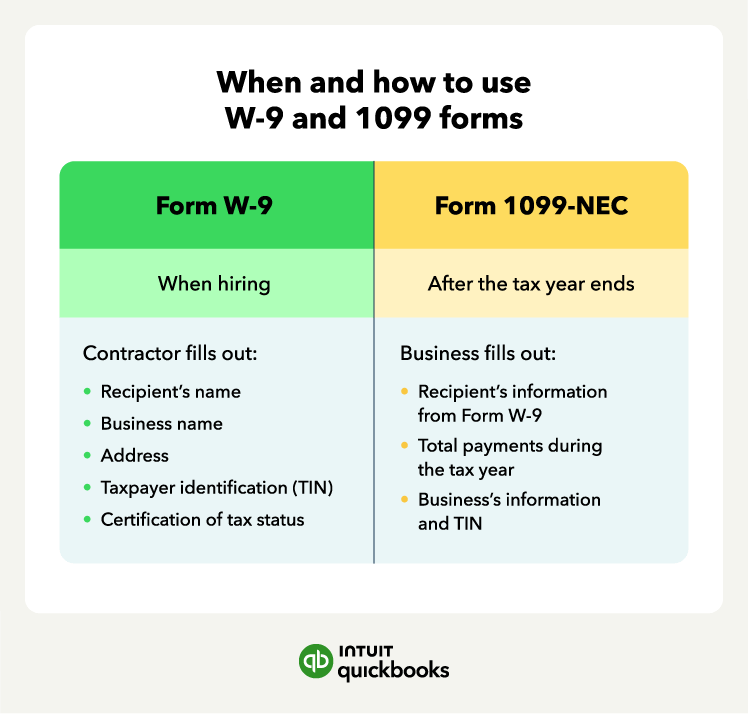

W 9 Vs 1099 Understanding The Differences Between Irs Contractor Tax Use the information for 1099 reporting: when filling out each 1099, use the information collected on the w 9 and report the total payments made to the recipient. meet deadlines: adhere to irs deadlines by providing a copy of the 1099 form to the recipient by jan 31 and submitting copies to the irs by the appropriate deadline. The primary difference between these two forms is that form w 9 is used to request information from the individual being paid, while form 1099 is used to report income to the irs. form w 9 requests the taxpayer’s information, such as name, address, and social security number. the taxpayer must then sign the form for them to be issued a 1099 form.

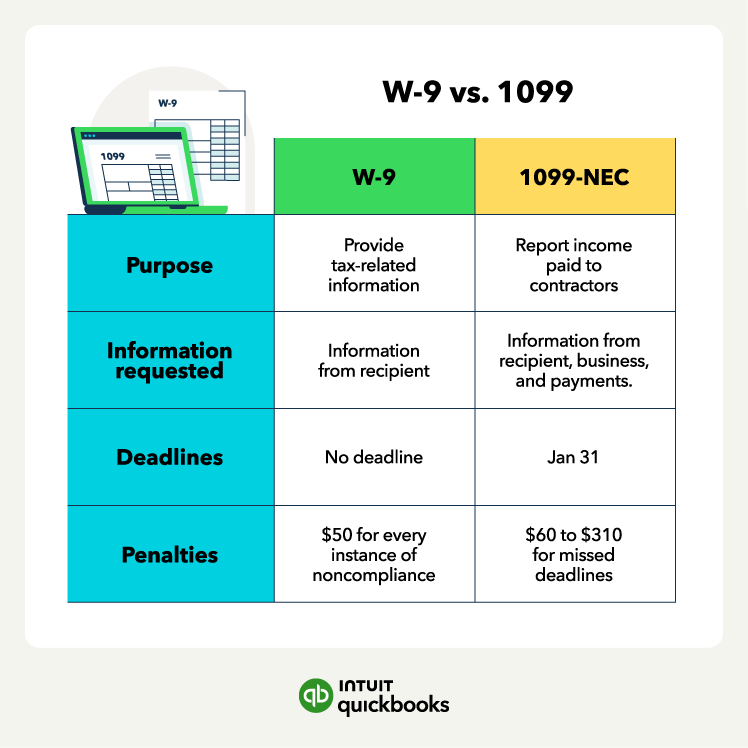

W 9 Vs 1099 Key Differences Quickbooks Independent contractors receive 1099 forms rather than w 2s as a record of income earned. you will be issued a 1099 form at the end of the year with the information that was provided on your w 9. Make w 9 vs.1099 compliance easy with remote’s contractor management. w 9 and 1099 tax forms both regulate aspects of employing independent contractors and freelancers. the difference is that the w 9 collects information that can then be used in 1099 income reporting forms. Jennifer soper. the difference between irs forms w 9 vs 1099 is that the former is given to contractors for the purpose of collecting personal information, while the latter is for reporting wages to the irs. form w 9 is used to gather information about a contractor (like name, address, and tax id ss number) so their earnings can be reported at. Conclusion. while form w 9 and form 1099 tend to get mixed up, the two irs forms are not the same. form w 9 is used for the purpose of requesting and submitting a tin, while form 1099 is used to report payments of $600 or more at the end of the tax year. both forms are commonly used by businesses and independent contractors.

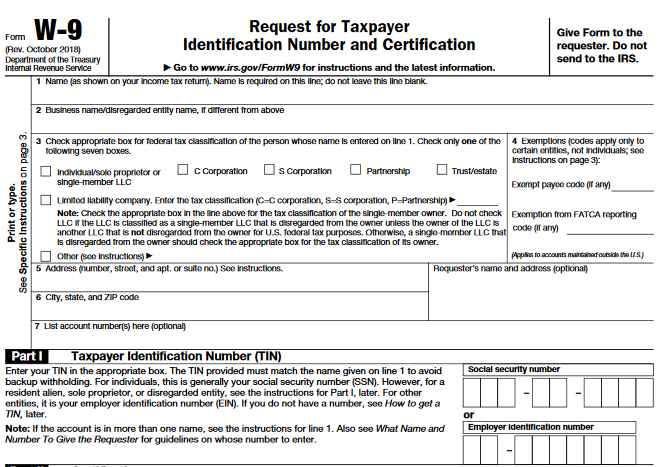

W 9 Vs 1099 Key Differences Quickbooks Jennifer soper. the difference between irs forms w 9 vs 1099 is that the former is given to contractors for the purpose of collecting personal information, while the latter is for reporting wages to the irs. form w 9 is used to gather information about a contractor (like name, address, and tax id ss number) so their earnings can be reported at. Conclusion. while form w 9 and form 1099 tend to get mixed up, the two irs forms are not the same. form w 9 is used for the purpose of requesting and submitting a tin, while form 1099 is used to report payments of $600 or more at the end of the tax year. both forms are commonly used by businesses and independent contractors. Use form w 9 to complete forms 1099 nec and 1099 misc. form w 9 is prepared by a required u.s. person, as defined by the irs. we have included the irs definition of a u.s. person. the u.s. person may be a sole proprietor with a legal form of sole proprietorship, corporation (including llc), partnership, or estate or domestic trust. A w 9 is sent by a client to a contractor to collect their contact information and tax number. then, the client uses that info to fill out a form 1099. it’s the client’s duty, as someone who is contracting work, to send the contractor form w 9 before the end of the financial year. the contractor’s job is to fill it out with tax info for.

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint Use form w 9 to complete forms 1099 nec and 1099 misc. form w 9 is prepared by a required u.s. person, as defined by the irs. we have included the irs definition of a u.s. person. the u.s. person may be a sole proprietor with a legal form of sole proprietorship, corporation (including llc), partnership, or estate or domestic trust. A w 9 is sent by a client to a contractor to collect their contact information and tax number. then, the client uses that info to fill out a form 1099. it’s the client’s duty, as someone who is contracting work, to send the contractor form w 9 before the end of the financial year. the contractor’s job is to fill it out with tax info for.

1099 Vs W 9 Tax Forms What S The Difference Zippia

Comments are closed.