W 9 Acrobat Reader Fillable Form Printable Forms Free Online

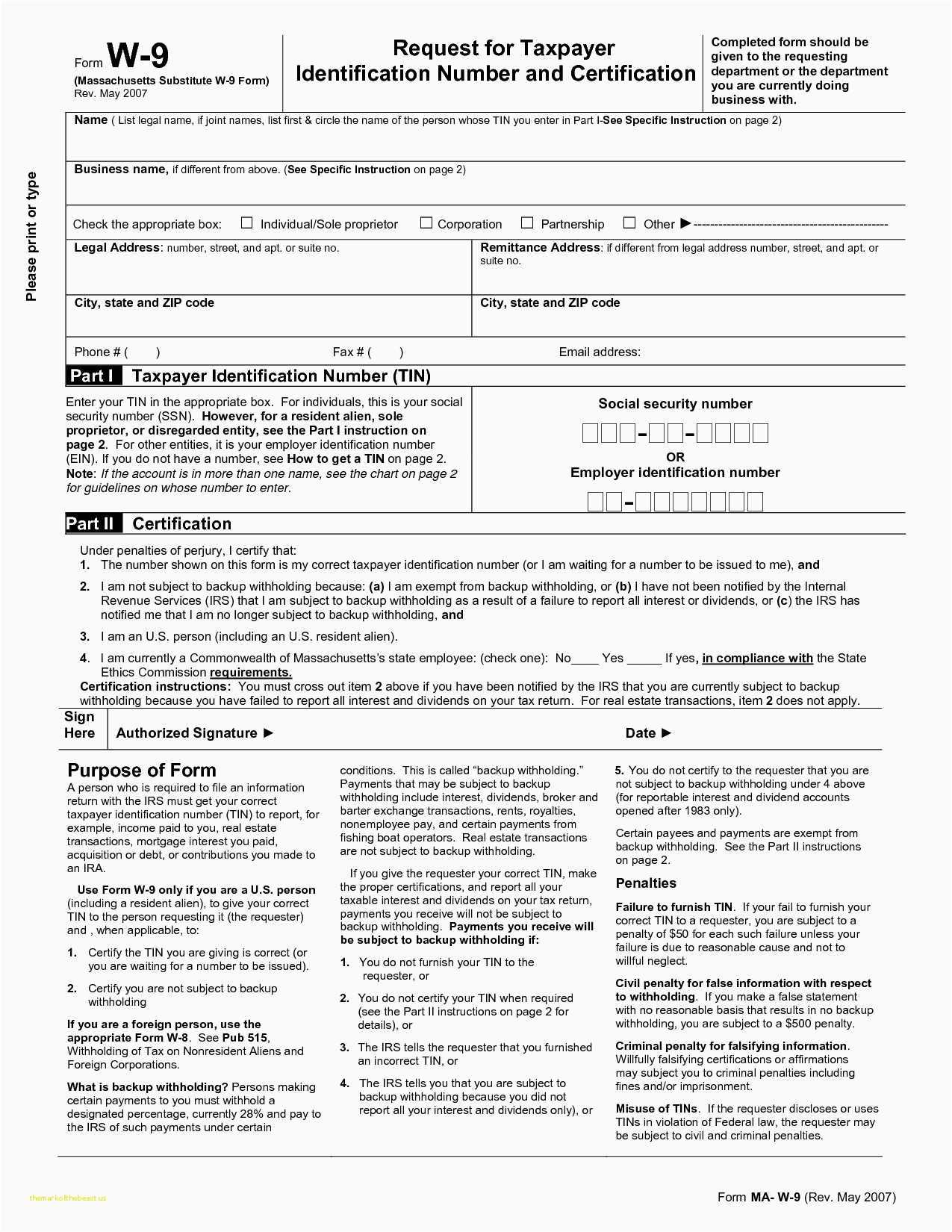

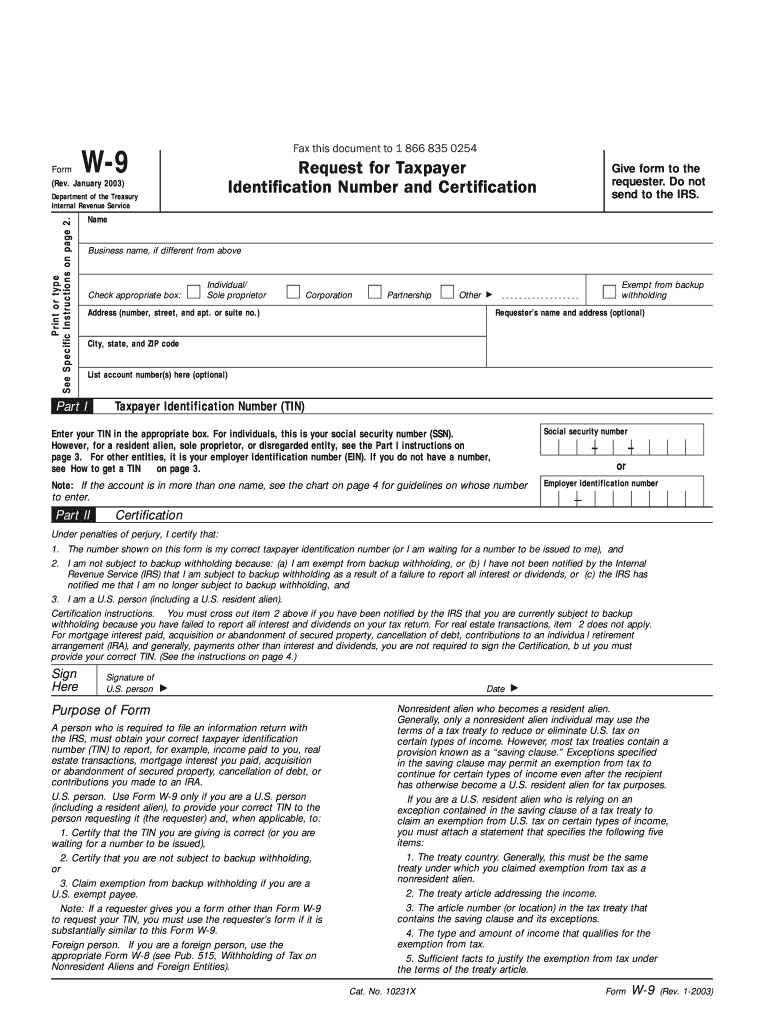

W 9 Acrobat Reader Fillable Form Printable Forms Free Online See pub. 515, withholding of tax on nonresident aliens and foreign entities. the following persons must provide form w 9 to the payor for purposes of establishing its non foreign status. in the case of a disregarded entity with a u.s. owner, the u.s. owner of the disregarded entity and not the disregarded entity. How to fill out a w9 form. before you file information from a w 9, verify that your contractor has filled out all the pertinent fields. line 1. the payee’s name. this name should be the payee’s full legal name and match the name on the payee’s income tax return. line 2.

Irs W9 Printable Form 2023 Printable Forms Free Online An irs form w 9, or "request for taxpayer identification number and certification," is a document used to obtain the legal name and tax identification number (tin) of an individual or business entity. it is commonly required when making a payment and withholding taxes are not being deducted. create document. pdf. updated october 24, 2024. Information about form w 9, request for taxpayer identification number (tin) and certification, including recent updates, related forms, and instructions on how to file. form w 9 is used to provide a correct tin to payers (or brokers) required to file information returns with irs. If you're using a mac you can just download the w9 pdf from the irs website and fill it out using preview. if you're on windows i believe you can download and use acrobat reader for free. Form w 9 is an internal revenue service (irs) tax form that self employed individuals fill out with their identifying information. businesses issue this form and collect it once the self employed individuals have completed it. then, they use the details the self employed individuals provided to report nonemployee compensation to the irs properly.

Irs Printable W 9 Form 2023 Printable Cards If you're using a mac you can just download the w9 pdf from the irs website and fill it out using preview. if you're on windows i believe you can download and use acrobat reader for free. Form w 9 is an internal revenue service (irs) tax form that self employed individuals fill out with their identifying information. businesses issue this form and collect it once the self employed individuals have completed it. then, they use the details the self employed individuals provided to report nonemployee compensation to the irs properly. This policy includes forms printed from irs.gov and output on high quality devices such as laser or ink jet printers, unless otherwise specified on the form itself. forms that must be ordered from the irs are labeled "for information only" and can be ordered online. find out how to save, fill in or print irs forms with adobe reader. With our online pdf editor, we have made sure you’ll find the latest version of the w 9 form from the irs website (for the 2023 tax year) for you to work on. right after accessing the web tool, you can start to fill out the blank w 9 by clicking on each box and entering your personal information. for the signature section, click “esign.

Comments are closed.