W 2 Form 2024 Printable Download Elita Anne Corinne

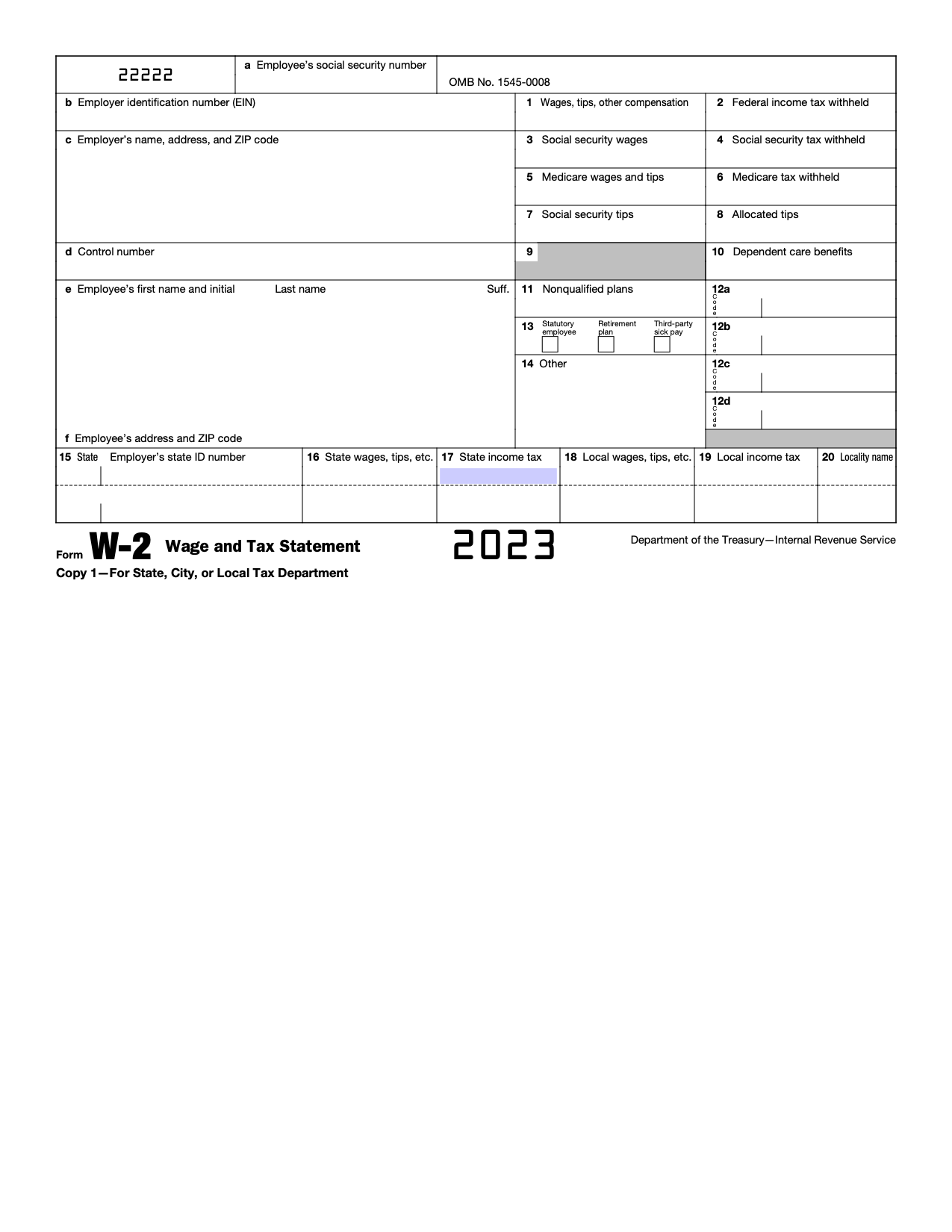

W 2 Form 2024 Printable Download Elita Anne Corinne The ssa is unable to process these forms. instead, you can create and submit them online. see e filing, later. due dates. by january 31, 2025, furnish copies b, c, and 2 to each person who was your employee during 2024. mail or electronically file copy a of form(s) w 2 and w 3 with the ssa by january 31, 2025. Download w 2 form pdf 2024 in one click. above is a fillable form w 2 that you can print or download. if you need a w 2 form from the previous year, here’s the the 2023 version. think of it this way: if you have employees and paid them at any time throughout the year, you probably need to provide them with a w 2 come january.

W 2 Form 2024 Printable Download Elita Anne Corinne The entries on form w 2 must be based on wages paid during the calendar year. use form w 2 for the correct tax year. for example, if the employee worked from december 15, 2024, through december 28, 2024, and the wages for that period were paid on january 3, 2025, include those wages on the 2025 form w 2. If you need w 2 information for retirement purposes, you should contact the ssa at 800 772 1213. copy. if you e filed your tax return or you didn't attach your form w 2 to your paper return, then use one of the transcript options above. otherwise, you'll need to contact your employer or ssa for a copy. the quickest way to obtain a copy of your. A w 2 form, also known as a wage and tax statement, is an irs document used by an employer to report an employee's annual wages and the amount of taxes withheld from their paycheck. forms are submitted to the social security administration and shared with the irs. employees use the information in the w2 to file their annual tax returns. pdf. A w 2 form, known officially as a “wage and tax statement,” is an important tax document providing valuable information for employees and the internal revenue service (irs). this document shows the total earnings of an employee for the year, as well as the amount of taxes withheld from their paychecks. it also includes other deductions such.

2024 W 2 Form Irs Angel Blondie A w 2 form, also known as a wage and tax statement, is an irs document used by an employer to report an employee's annual wages and the amount of taxes withheld from their paycheck. forms are submitted to the social security administration and shared with the irs. employees use the information in the w2 to file their annual tax returns. pdf. A w 2 form, known officially as a “wage and tax statement,” is an important tax document providing valuable information for employees and the internal revenue service (irs). this document shows the total earnings of an employee for the year, as well as the amount of taxes withheld from their paychecks. it also includes other deductions such. A w 2 form, also known as a wage and tax statement, is a form that an employer completes and provides to the employee to complete their tax return. form w 2 must contain certain information, including wages earned and state, federal, and other taxes withheld from an employee's earnings. the form w 2 must be provided to employees by january 31. 2024 pre printed w 2 kits. starting at $57.99. use for reporting employee wages and salaries to federal, state and local agencies; each kit includes a copy for your employee. easily print w 2 information directly from quickbooks desktop onto the correct blank section of each tax form. specifically designed for small businesses available in.

Comments are closed.