Va Loans Infographic

Va Loans Infographic Va home loans are provided by private lenders, such as banks and mortgage companies. va guarantees a portion of the loan, enabling the lender to provide you with more favorable terms. read our guide for buying a home. before you buy, be sure to read the va home loan buyer's guide. this guide can help you under the homebuying process and how to. Vba support: 1 800 827 1000 gi bill: 1 888 442 4551 find your nearest va benefits office.

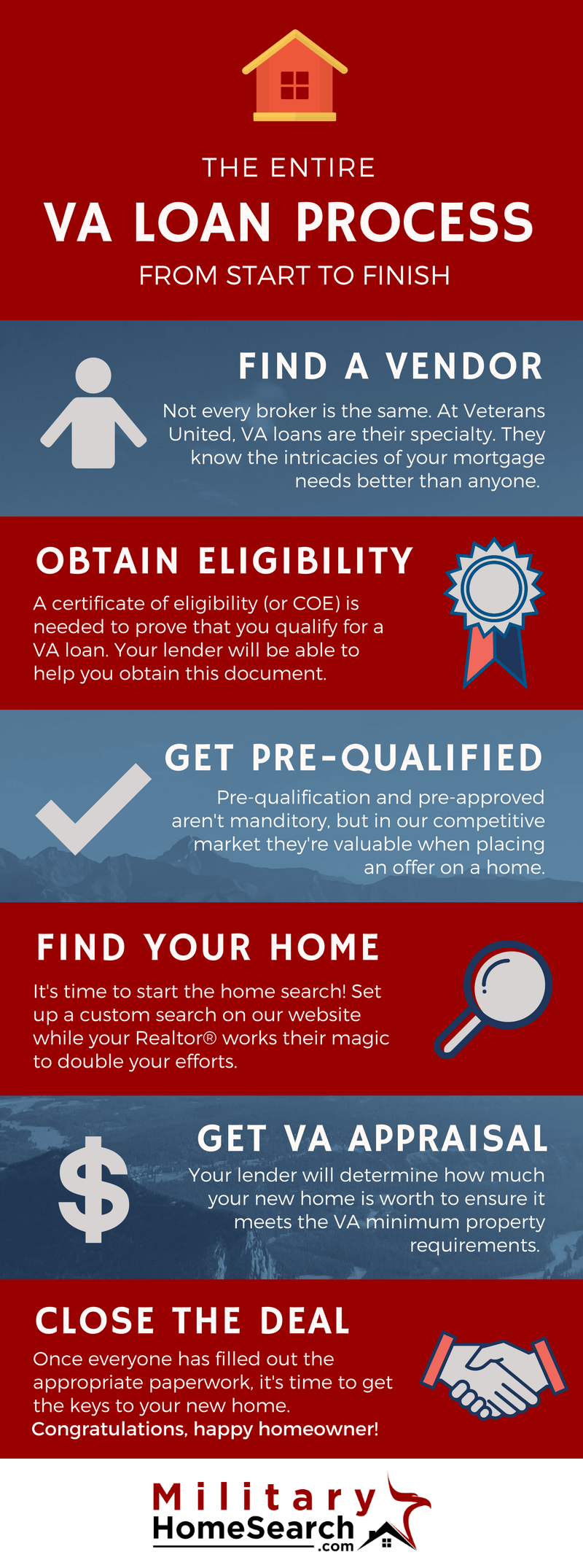

How To Start The Va Loan Process A Comprehensive Guide Pt Bbu Va backed home loans. in this section. va home loan types. we offer va home loan programs to help you buy, build, or improve a home or refinance your current home loan—including a va direct loan and 3 va backed loans. learn more about the different programs, and find out if you can get a certificate of eligibility for a loan that meets your. When using the benefit for the first time, veterans pay 2.15% of the loan amount on a purchase or cash out refinance. for all subsequent uses, the fee rises to 3.3% of the loan amount. the funding fee for a va streamline refinance is 0.5%. buyers can lower their funding fee exposure by making a down payment. For homebuyers, the va loan has five basic steps: preapproval, house hunting, getting under contract, underwriting and closing. this process typically results in a stronger financial future, using arguably the most powerful mortgage product on the market. here we detail the step by step process of getting a va loan and how veterans can get the. Many lenders charge veterans using va backed home loans a 1% flat fee (sometimes called a “loan origination fee”). lenders may also charge you additional fees. if you don’t know what a fee is for, ask the lender. in some cases, lender fees are negotiable. to learn more: read about the va funding fee and other closing costs.

2014 Colorado Va County Loan Limits Infographic Infographic Loan For homebuyers, the va loan has five basic steps: preapproval, house hunting, getting under contract, underwriting and closing. this process typically results in a stronger financial future, using arguably the most powerful mortgage product on the market. here we detail the step by step process of getting a va loan and how veterans can get the. Many lenders charge veterans using va backed home loans a 1% flat fee (sometimes called a “loan origination fee”). lenders may also charge you additional fees. if you don’t know what a fee is for, ask the lender. in some cases, lender fees are negotiable. to learn more: read about the va funding fee and other closing costs. You can ask the seller to pay all of your closing costs, regardless of the total amount. the va does have a cap on seller concessions at 4 percent of the loan amount. but feel free to ask for the moon when it comes to the closing costs. there's no guarantee the seller will bite, but you won't know if you don't ask. Between september 8, 1980, and august 1, 1990. you meet the minimum active duty service requirement if you served for: at least 24 continuous months, or. the full period (at least 181 days) for which you were called to active duty, or. at least 181 days if you were discharged for a hardship, or a reduction in force, or.

Va Home Loans Infographic You can ask the seller to pay all of your closing costs, regardless of the total amount. the va does have a cap on seller concessions at 4 percent of the loan amount. but feel free to ask for the moon when it comes to the closing costs. there's no guarantee the seller will bite, but you won't know if you don't ask. Between september 8, 1980, and august 1, 1990. you meet the minimum active duty service requirement if you served for: at least 24 continuous months, or. the full period (at least 181 days) for which you were called to active duty, or. at least 181 days if you were discharged for a hardship, or a reduction in force, or.

Va Loans Explained Once Again We Re Va Experts Jvm Lending

Comments are closed.