Va Home Loan Certificate Of Eligibility House Team

Va Home Loan Certificate Of Eligibility House Team All applicants will need a Certificate of Eligibility to confirm they've met the service requirements for a VA our team of expert writers and editors with extensive knowledge of home loan Your income is a primary factor that lenders consider when assessing your Home Loan eligibility Generally, the higher your salary, the more loan amount you can qualify for However, other factors

How To Get Your Va Home Loan Certificate Of Eligibility Online Best rated mortgage lenders & expert reviews; compare the best home loan lenders for purchase, refinancing, VA, FHA, USDA, Jumbo loans & first-time homebuyers» You will need to get a Certificate of Eligibility (COE), which verifies your eligibility to a lender, to apply for a VA loan A VA loan could make it possible for you to buy a home with no down What is a VA loan? VA loans are a type of government-backed mortgage The Department of Veterans Affairs provides the backing for these mortgages, called the VA home loan guaranty, and private With home prices elevated, it might be a good time to tap your home equity and use those funds to upgrade your house or consolidate make sure it’s the best loan option for you

Va Coe Home Loan Eligibility The House Team What is a VA loan? VA loans are a type of government-backed mortgage The Department of Veterans Affairs provides the backing for these mortgages, called the VA home loan guaranty, and private With home prices elevated, it might be a good time to tap your home equity and use those funds to upgrade your house or consolidate make sure it’s the best loan option for you In a sense, a home equity loan is a second mortgage Instead of paying for your house, though 3% for conventional loans, 0% for VA, USDA and Destination Home Mortgage Flagstar doesn't Homeowners can get access to a large sum of cash at a fixed rate by borrowing against their property's value with a home loan in equal monthly payments over a period of time Because your Help you confirm your eligibility (See "Certificate of Eligibility considering building a new home A VA construction loan can fund the building of the house and even the land it sits Why you can trust Forbes Advisor Forbes Advisor compiled a list of VA loan lenders that excel in various areas, including offering low fees, convenience and flexibility Lenders’ mortgage rates

Va Home Loan Eligibility Smartvaloans In a sense, a home equity loan is a second mortgage Instead of paying for your house, though 3% for conventional loans, 0% for VA, USDA and Destination Home Mortgage Flagstar doesn't Homeowners can get access to a large sum of cash at a fixed rate by borrowing against their property's value with a home loan in equal monthly payments over a period of time Because your Help you confirm your eligibility (See "Certificate of Eligibility considering building a new home A VA construction loan can fund the building of the house and even the land it sits Why you can trust Forbes Advisor Forbes Advisor compiled a list of VA loan lenders that excel in various areas, including offering low fees, convenience and flexibility Lenders’ mortgage rates

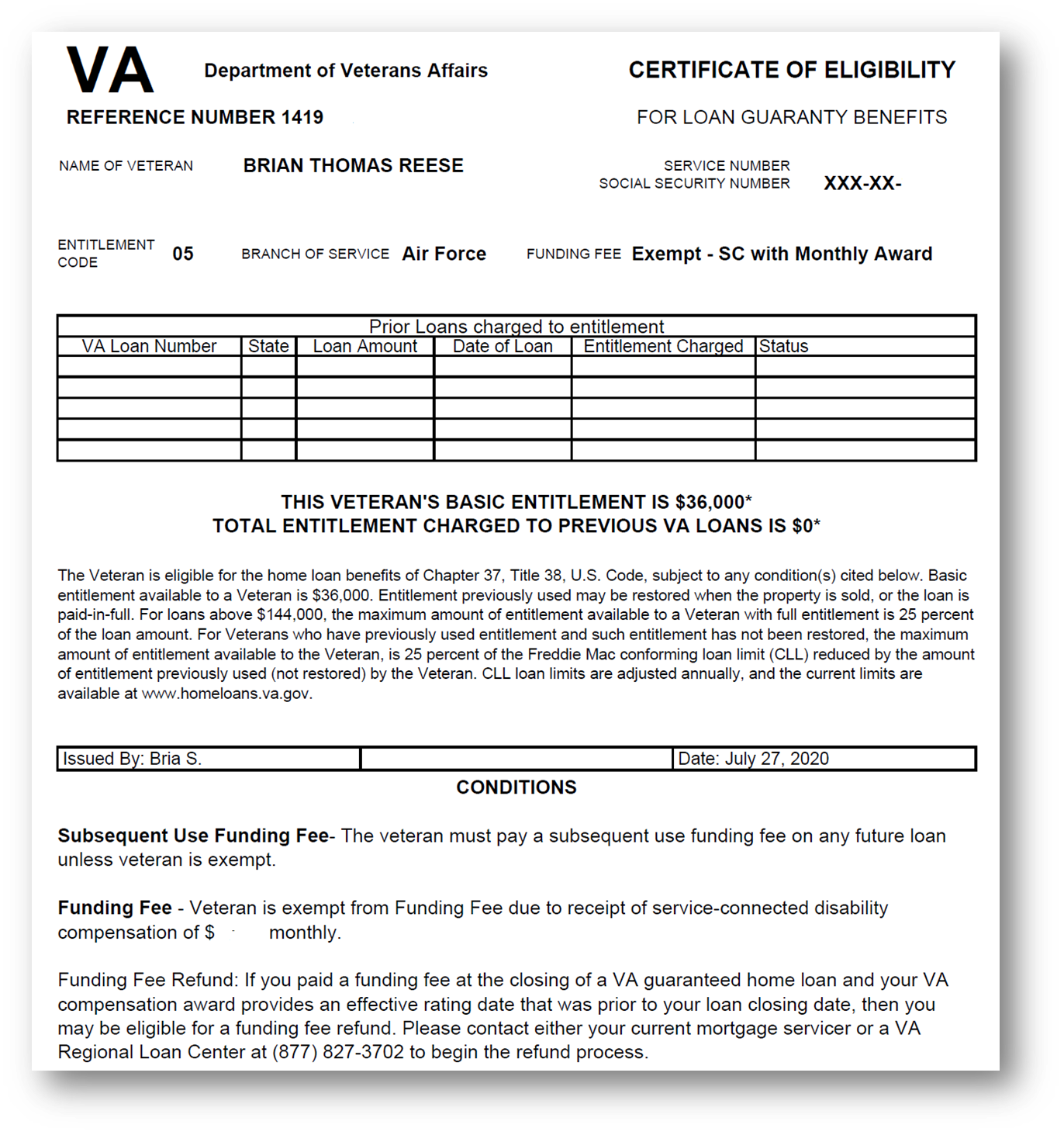

/4) BLOG/BLOG IMAGES/VA Certificate of Eligibility Example 1.jpg?width=700&height=698&name=VA Certificate of Eligibility Example 1.jpg)

Va Loan How To Read The Va Certificate Of Eligibility Coe Help you confirm your eligibility (See "Certificate of Eligibility considering building a new home A VA construction loan can fund the building of the house and even the land it sits Why you can trust Forbes Advisor Forbes Advisor compiled a list of VA loan lenders that excel in various areas, including offering low fees, convenience and flexibility Lenders’ mortgage rates

Comments are closed.