Va Funding Fee Lower Fees In 2023

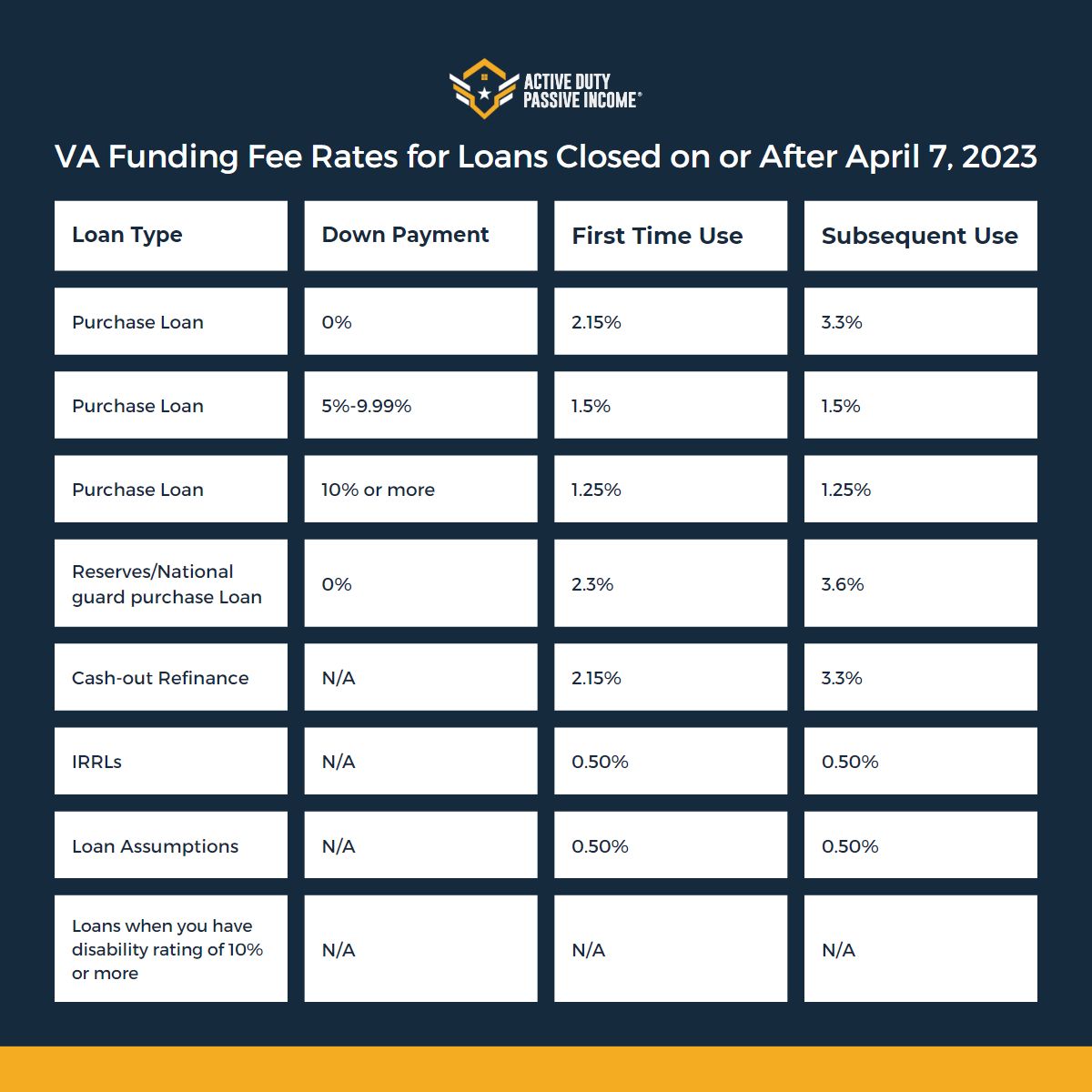

2023 Va Funding Fee Complete Explainer With Charts And Exemptions For example: let’s say you’re using a va backed loan for the first time, and you’re buying a $200,000 home and paying a down payment of $10,000 (5% of the $200,000 loan). you’ll pay a va funding fee of $2,850, or 1.5% of the $190,000 loan amount. the funding fee applies only to the loan amount, not the purchase price of the home. As you'll see in the va funding fee table for 2024 below, veterans purchasing with a va loan for the first time receive a lower fee than subsequent users. though not required, first time and subsequent purchasers can decrease the funding fee with a minimum 5% down payment. the following table shows the current va funding fee rates on purchase.

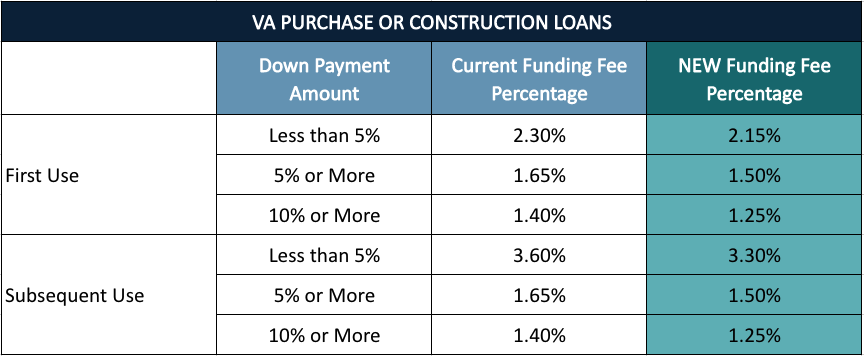

Changes To Va Funding Fees In 2023 Maple Tree Funding New funding fee percentage from the loan fee table. exhibit b contains the funding fee rates for loans closing on or after april 7, 2023 and prior to november 14, 2031. 2. 4. fee calculation for transactions with a down payment. pursuant to 38 u.s.c. §3729(b)(2), va loans made to purchase or construct a dwelling are subject to a reduced. The va funding fee is a one time charge that can be paid upfront or rolled into the mortgage. 2023 · 3 min read. funding fees for a subsequent va loan are 3.3% with a down payment less. As of april 7, 2023, the va funding fee rate is 2.15% of the total loan amount for first time va loan homebuyers with no down payment. the funding fee increases to 3.30% for those borrowing a second va loan. borrowers can decrease their funding fee rate by putting at least 5% down on a va home loan, and about one third of all borrowers are. Va cash out refinance . funding fee percentage first use . 2.15% . subsequent use . 3.3% . other va home loan types . loan type funding fee percentage . interest rate reduction refinance loan (irrrls) 0.5% manufactured home loans (not permanently affixed) 1% loan assumptions 0.5% native american direct loan (non irrrl) 1.25% . note: reduced.

Va Announces New Funding Fee Savings As of april 7, 2023, the va funding fee rate is 2.15% of the total loan amount for first time va loan homebuyers with no down payment. the funding fee increases to 3.30% for those borrowing a second va loan. borrowers can decrease their funding fee rate by putting at least 5% down on a va home loan, and about one third of all borrowers are. Va cash out refinance . funding fee percentage first use . 2.15% . subsequent use . 3.3% . other va home loan types . loan type funding fee percentage . interest rate reduction refinance loan (irrrls) 0.5% manufactured home loans (not permanently affixed) 1% loan assumptions 0.5% native american direct loan (non irrrl) 1.25% . note: reduced. Veterans and service members pay the same rate, although you will pay more if you've used your entitlement for a va cash out refinance before. here are the cash out funding fees, as of april 2023: first use. after first use. 2.15%. 3.3%. chart source: the u.s. department of veterans affairs website. A $300,000 home loan would have a $6,450 funding fee ($300,000 x 0.0215 = $6,450). decide how you want to pay the fee. in most cases, the funding fee is rolled into your loan amount and financed over the life of the loan. however, you can also cover it out of pocket at closing or negotiate with the seller to cover it.

Va Funding Fee Reductions Coming Soon Veterans and service members pay the same rate, although you will pay more if you've used your entitlement for a va cash out refinance before. here are the cash out funding fees, as of april 2023: first use. after first use. 2.15%. 3.3%. chart source: the u.s. department of veterans affairs website. A $300,000 home loan would have a $6,450 funding fee ($300,000 x 0.0215 = $6,450). decide how you want to pay the fee. in most cases, the funding fee is rolled into your loan amount and financed over the life of the loan. however, you can also cover it out of pocket at closing or negotiate with the seller to cover it.

2023 Va Funding Fee Changes What You Need To Know

Comments are closed.