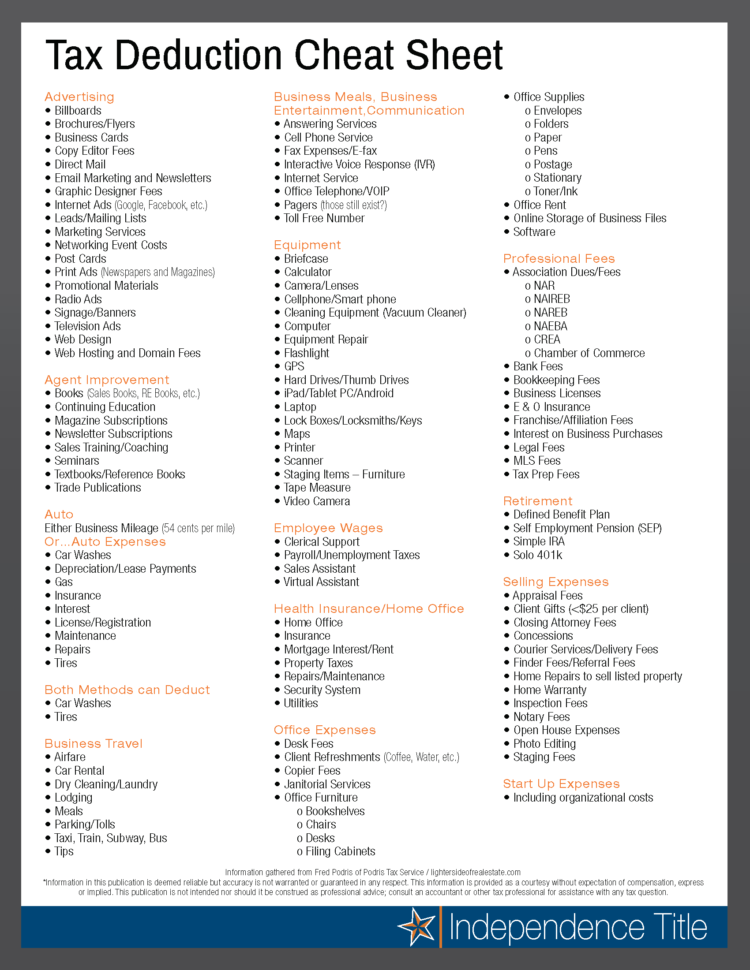

Usa Real Estate Agents Tax Deduction Cheat Sheet Are You Claiming

Tax Deduction Cheat Sheet For Real Estate Agents Db Excel Such a cheat sheet is exactly what’s below, thanks to two folks: 1) fred podris of podris tax service who compiled the list, and realtor® brenda douglas who kindly posted it to facebook for all to benefit from. one problem, though. this cheat sheet, which was originally intended as a print out, isn’t legible in digital format (see below). The irs allows agents to deduct expenses related to maintaining and operating this space, like rent, mortgage interest, utilities, and repairs. to calculate the deduction, agents can use the simplified method ($5 per square foot) or the regular method, based on the percentage of the home used for business.

Printable Real Estate Agent Tax Deductions Worksheet Tax deductions can reduce your income, saving thousands of dollars in yearly taxes. some common tax deductions for real estate agents include advertising costs, auto travel expenses, and professional services fees, such as those paid to an accountant or marketing firm. one significant real estate tax deduction is the business gifts deduction. Assuming you’re a self employed real estate agent, your income will be subject to the standard self employment tax of 15.3%. this accounts for social security and medicare taxes, but it can still be a substantial expense. thankfully, 50% of this cost is tax deductible, meaning you’ll recoup half of it in the end. 2. 3. marketing & advertising . this deduction includes all costs related to marketing and promoting a real estate business, like digital advertising, print ads, billboards, and promotional materials. these expenses are 100% tax deductible, so agents can deduct all costs of marketing their business. A desk fee is a payment agreement between a real estate agent and their broker in which the broker charges a monthly fee for providing office space and a desk to the agent. if you exercise your license for a broker and pay a desk fee, then your desk fee is 100% deductible. you may deduct your desk fee or home office expenses, but not both.

Tax Deduction Cheat Sheet 3. marketing & advertising . this deduction includes all costs related to marketing and promoting a real estate business, like digital advertising, print ads, billboards, and promotional materials. these expenses are 100% tax deductible, so agents can deduct all costs of marketing their business. A desk fee is a payment agreement between a real estate agent and their broker in which the broker charges a monthly fee for providing office space and a desk to the agent. if you exercise your license for a broker and pay a desk fee, then your desk fee is 100% deductible. you may deduct your desk fee or home office expenses, but not both. Realtor real estate agent tax deduction cheat sheet. nizational costs for your entity (pllc, s corp, etc.)the information inc. uded on this cheat sheet is meant as an outline only. please always confirm all deductions with your cpa o. tax professional as the laws may change at any time. this document is not inten. The typical real estate agent’s business expenses during the year average $6,500, while top performers’ expenses can exceed $10,000. if you’re not tracking and deducting all of your eligible business expenses, you’re shrinking your net income and take home pay by paying too much in taxes. if you had time in your busy schedule to monitor.

Comments are closed.