Unsecured Vs Secured Loan Understanding The Difference Transunion

Unsecured Vs Secured Loan Understanding The Difference Transunion A secured loan is backed by collateral, such as property or assets, while an unsecured loan is not backed by specific assets, relying on the borrower’s credit score factors. in this guide, learn more about the differences between unsecured and secured loans, how to determine which type is best for you and tips for paying down these types of debt. Of course, this "freedom" comes with a price. unsecured loans usually have higher interest rates than secured loans, and the amount you can borrow is limited by your credit history and income. when considering an unsecured loan, keep these advantages and disadvantages in mind: pros. cons.

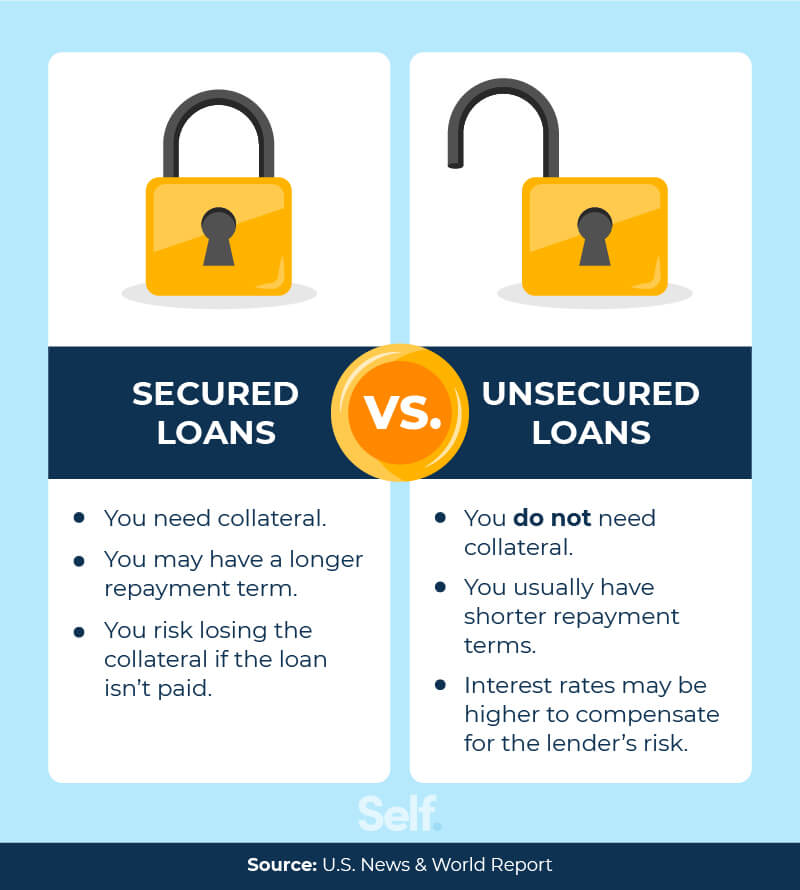

Unsecured Vs Secured Loan Understanding The Difference Transunion Secured loans. if you have a low credit score, you may have an easier time qualifying compared with an unsecured loan. if you fail to repay the loan, the lender can seize the collateral. unsecured. The primary difference between secured and unsecured loans comes down to collateral. with a secured loan, you give the lender the right to seize the asset you use as collateral should you fail to. Secured loans are cheaper than unsecured loans but require collateral, which makes them riskier. weigh the potential to lose your collateral against the benefits secured loans offer. if you're. The main difference between a secured and unsecured loan is the need for collateral. a secured loan requires you to put up an asset that the lender can seize if you default on your loan. an.

Secured Loans Vs Unsecured Loans The Key Differences Self Credit Secured loans are cheaper than unsecured loans but require collateral, which makes them riskier. weigh the potential to lose your collateral against the benefits secured loans offer. if you're. The main difference between a secured and unsecured loan is the need for collateral. a secured loan requires you to put up an asset that the lender can seize if you default on your loan. an. Qualifying requirements: unsecured personal loans are harder to qualify for, and you will usually need excellent credit. secured loans are easier to get approved for. if your credit score is a. The two main categories of personal loans are secured and unsecured. knowing which type fits your situation better can go a long way in improving your financial stability and management. in this guide, we’ll go over the differences between secured and unsecured loans, as well as the pros and cons of each type. the basics of personal loans.

Unsecured Vs Secured Loan Understanding The Difference Transunion Qualifying requirements: unsecured personal loans are harder to qualify for, and you will usually need excellent credit. secured loans are easier to get approved for. if your credit score is a. The two main categories of personal loans are secured and unsecured. knowing which type fits your situation better can go a long way in improving your financial stability and management. in this guide, we’ll go over the differences between secured and unsecured loans, as well as the pros and cons of each type. the basics of personal loans.

Unsecured Vs Secured Loan Understanding The Difference Transunion

Comments are closed.