Unlock Early Retirement With The Roth Conversion Ladder

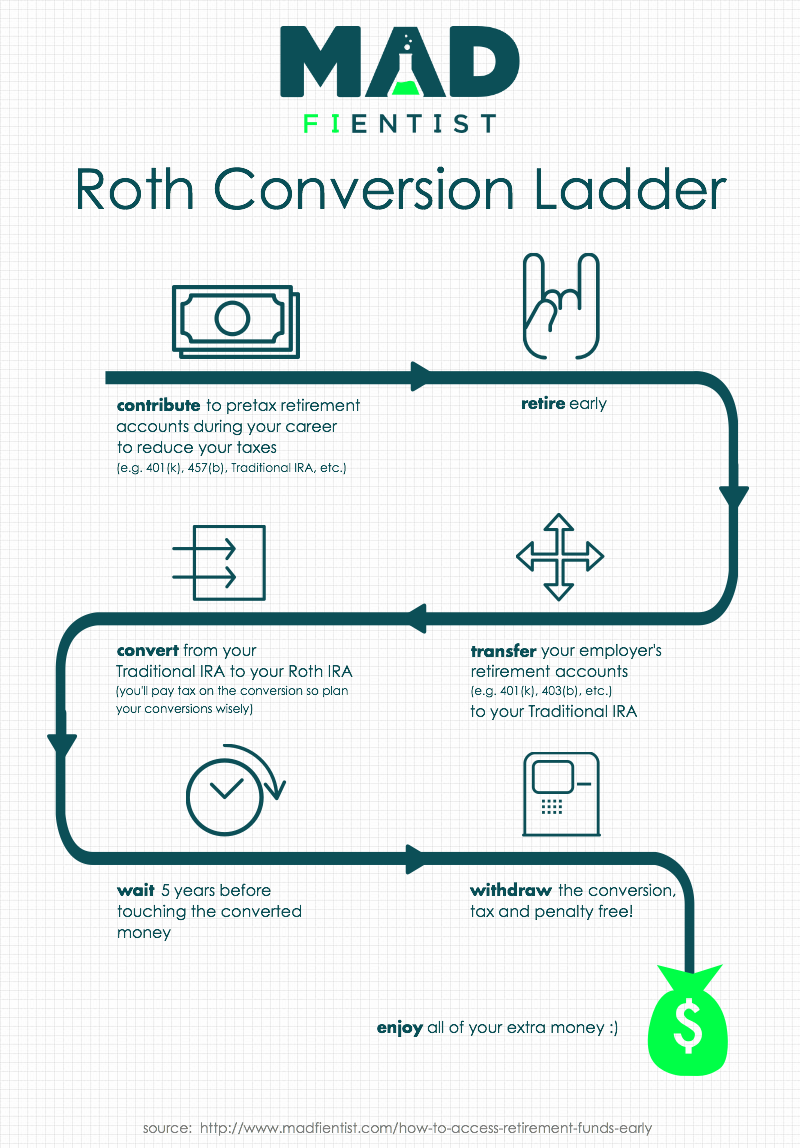

Unlock Early Retirement With The Roth Conversion Ladder If you want, you can convert $5,000 or $500,000 from your traditional ira to your roth ira in a single tax year. naturally, roth conversions are a popular strategy among high earners who no longer qualify for annual roth contributions. they’re also helpful for anyone who wants to contribute more than $6,500 a year. A roth conversion ladder allows early retirees to access their largest pool of money (401k or ira) tax and penalty free. without this technique, anyone who retires before age 59 ½ and tries to tap into their retirement savings will be subjected to an early withdrawal 10% penalty.

Unlock Early Retirement The Roth Conversion Ladder Explained Access The main disadvantage to a roth ira conversion is that you have to pay income tax— but not the 10% early withdrawal penalty—on the amount converted. for example, if you were to convert $50,000 from a traditional ira to a roth ira, and you are in the 15% tax bracket, you will have to pay income tax of $7,500 in the year of conversion. The roth conversion ladder is a strategic approach allowing individuals to transfer funds from a traditional ira to a roth ira. the main point of a conversion is to avoid incurring early withdrawal penalties. money has to sit in a roth ira for five years before being withdrawn, so this is a proactive retirement strategy. A roth ira conversion ladder is when you move money from a traditional ira into a roth ira. if you do so in small amounts and wait 5 years to touch it you can do this conversion without paying additional taxes or any penalties. A roth conversion ladder is a multi year transfer of retirement funds from pretax accounts to post tax accounts. it’s a process that lets you access tax advantaged savings early, side stepping early withdraw penalties and minimizing tax liability. since it’s a multi year plan, a conversion ladder requires attention to detail and thorough.

Roth Conversion Ladder And Sepp How To Access Your Retirement Accounts A roth ira conversion ladder is when you move money from a traditional ira into a roth ira. if you do so in small amounts and wait 5 years to touch it you can do this conversion without paying additional taxes or any penalties. A roth conversion ladder is a multi year transfer of retirement funds from pretax accounts to post tax accounts. it’s a process that lets you access tax advantaged savings early, side stepping early withdraw penalties and minimizing tax liability. since it’s a multi year plan, a conversion ladder requires attention to detail and thorough. A roth conversion ladder is a multiyear strategy designed to give you tax free and penalty free ira withdrawals before you reach the standard age (59 ½) for distributions. to create the ladder. However, you can tap roth conversions without the 10% penalty or taxes after five years to "unlock some of your money early," cherry said. but a separate five year period applies to each conversion.

Comments are closed.