Unearned Income Bookkeeping Rules Shared Economy Tax

Unearned Revenue Recording And Financial Statements Bookstime At the end of the year, using the accrual method, revenue on the income statement would be recognized for $20,000, and an expense of $8,000 would be recognized. on the balance sheet, the cash balance would go from $100,000 to $92,000, and the deferred revenue balance would go from $100,000 to $80,000. in summary, the net income would be $12,000. For 2023, any unearned income above $2,500 ($2,600 for 2024) may be subject to an unearned income tax. this is known as the kiddie tax. alternatively, interest and dividend income of less than.

Unearned Income What Is It Examples Types Importance Similar to rev. proc. 2004 34, under the proposed regulations, an advance payment is a payment received by the taxpayer in which (1) taking the full amount of the payment into income in the year of receipt is a permissible method of accounting; (2) a portion of the payment is included in revenue by the taxpayer in an afs for a subsequent year. September 6, 2019. topics. two sets of proposed treasury regulations issued on thursday provide new rules on how taxpayers treat income from advance payments under new book tax conformity rules. one set of proposed regulations (reg 104554 18) governs the timing of inclusion under sec. 451 (c) of advance payments for goods, services, and other. Unearned income is received from non employment sources such as investment dividends. here is how it works and how it might be taxed. Earned income is what you receive from actively working. it includes wages, salaries, and self employment income. unearned income is from anything other than work, unemployment, retirement, investments, etc. unearned includes investment type income such as taxable interest, ordinary dividends, and capital gains distributions.

Unearned Income What Is It Examples Types Importance Unearned income is received from non employment sources such as investment dividends. here is how it works and how it might be taxed. Earned income is what you receive from actively working. it includes wages, salaries, and self employment income. unearned income is from anything other than work, unemployment, retirement, investments, etc. unearned includes investment type income such as taxable interest, ordinary dividends, and capital gains distributions. Passive or unearned income is the other side of the “active or earned income” coin, which is income you receive from a job or business venture that requires active participation. as with active income, passive income is taxable. generally, passive income is the result of your having worked on something upfront that then reaps rewards for. Overview. ias 12 income taxes implements a so called 'comprehensive balance sheet method' of accounting for income taxes which recognises both the current tax consequences of transactions and events and the future tax consequences of the future recovery or settlement of the carrying amount of an entity's assets and.

What Is Unearned Revenue A Complete Guide Pareto Labs Passive or unearned income is the other side of the “active or earned income” coin, which is income you receive from a job or business venture that requires active participation. as with active income, passive income is taxable. generally, passive income is the result of your having worked on something upfront that then reaps rewards for. Overview. ias 12 income taxes implements a so called 'comprehensive balance sheet method' of accounting for income taxes which recognises both the current tax consequences of transactions and events and the future tax consequences of the future recovery or settlement of the carrying amount of an entity's assets and.

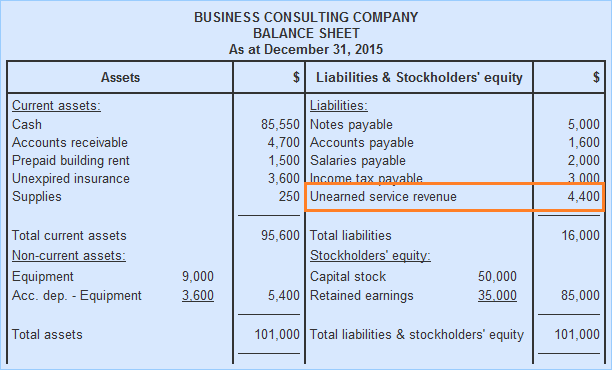

Unearned Revenue On Balance Sheet Definition Examples

Comments are closed.