Understanding Zero Capital Gains Rate Benefits Drawbacks

Understanding Zero Capital Gains Rate Benefits Drawbacks Leverage tax advantages for retirement. zero capital gains tax rates can further enhance the benefits of tax advantaged retirement accounts like iras or 401 (k)s. these accounts often allow for tax free growth or on withdrawal, depending on the account type. with no capital gains tax, investors can fully utilize these accounts to grow their. Having a rate of zero percent on capital gains has a number of advantages. low capital gains taxes, according to their supporters, are a fantastic incentive to save money and invest it in stocks and bonds. this increasing investment drives the economy’s expansion. businesses have the resources to grow and develop, adding to the number of jobs.

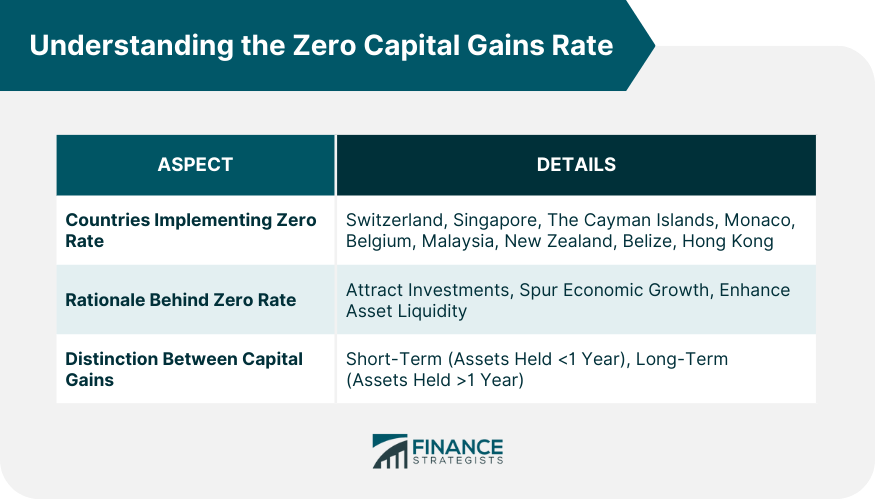

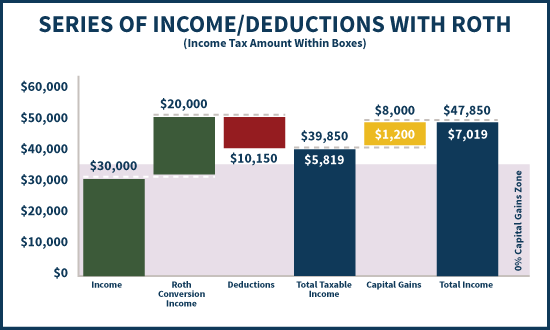

Understanding Zero Capital Gains Rate Benefits Drawbacks A zero capital gains rate implies a tax rate of 0% on capital gains. this 0% rate may be charged to individuals who sell property within a so called “enterprise zone.” such zones are geographic areas that have been granted special tax breaks, regulatory exemptions, or other public assistance to encourage private economic development and job. Zero capital gains can be an important tool in tax planning for retirement, as it can help retirees minimize the amount they owe in capital gains taxes. 1. understanding zero capital gains. zero capital gains refers to the tax rate of 0% that applies to long term capital gains for taxpayers in the 10% and 12% income tax brackets. Coordinating 0% long term capital gains rates with ordinary income tax brackets. while the three long term capital gains tax brackets of 0%, 15%, and 20% are relatively straightforward to apply – with 0% on the first $73,800, 15% on the next $383,800, and 20% on the rest (plus a potential 3.8% medicare surtax on top of the 20% rate and some. The 0% long term capital gains tax rate has been around since 2008, and it lets you take a few steps to realize tax free earnings on your investments. harvesting capital gains is the process of intentionally selling an investment in a year when any gain won't be taxed. this occurs in years when you're in the 0% capital gains tax bracket.

Understanding Zero Capital Gains Rate Youtube Coordinating 0% long term capital gains rates with ordinary income tax brackets. while the three long term capital gains tax brackets of 0%, 15%, and 20% are relatively straightforward to apply – with 0% on the first $73,800, 15% on the next $383,800, and 20% on the rest (plus a potential 3.8% medicare surtax on top of the 20% rate and some. The 0% long term capital gains tax rate has been around since 2008, and it lets you take a few steps to realize tax free earnings on your investments. harvesting capital gains is the process of intentionally selling an investment in a year when any gain won't be taxed. this occurs in years when you're in the 0% capital gains tax bracket. The tax system in the u.s. benefits long term investors. capital gains tax rates are the same in 2024 as they were in 2023: 0%, 15%, or 20%, depending on your income. the maximum zero rate. 1. the pros of zero capital gains. the biggest benefit of zero capital gains is obvious: you wont have to pay taxes on your investment gains. this can save you a significant amount of money over the long term. additionally, this strategy can help you avoid the temptation to sell your investments prematurely in order to avoid paying taxes.

Mechanics Of The 0 Long Term Capital Gains Rate The tax system in the u.s. benefits long term investors. capital gains tax rates are the same in 2024 as they were in 2023: 0%, 15%, or 20%, depending on your income. the maximum zero rate. 1. the pros of zero capital gains. the biggest benefit of zero capital gains is obvious: you wont have to pay taxes on your investment gains. this can save you a significant amount of money over the long term. additionally, this strategy can help you avoid the temptation to sell your investments prematurely in order to avoid paying taxes.

Mechanics Of The 0 Long Term Capital Gains Rate

Zero Capital Gains Rate Handel 2024

Comments are closed.