Understanding Your Personal Credit Report Centrix

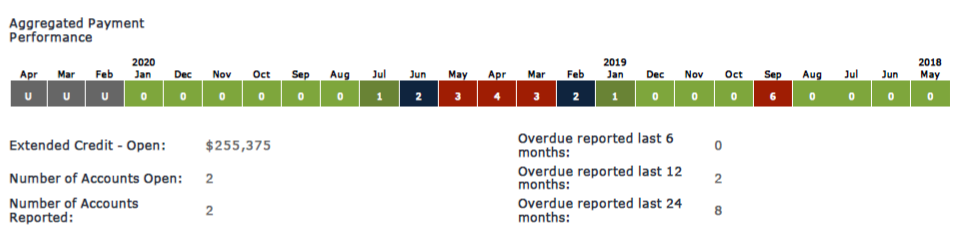

Understanding Your Personal Credit Report Centrix Understanding your personal credit report. your personal credit report is a summary of how often you’ve bought products or services on credit, and how well you’ve paid your bills on time. it’s not just credit card, loan and mortgage information; the information in your consumer credit report is collected from multiple sources. Your credit score is mostly based on your credit report information and usually includes the following: length of credit history: how long have you had credit accounts. payment history: how often you made payments on time and how many (if any) late payments. amount owed: how large or small were the lending amounts. types of credit: are the.

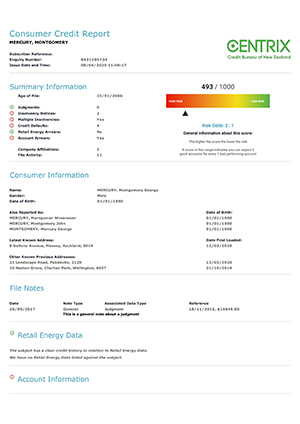

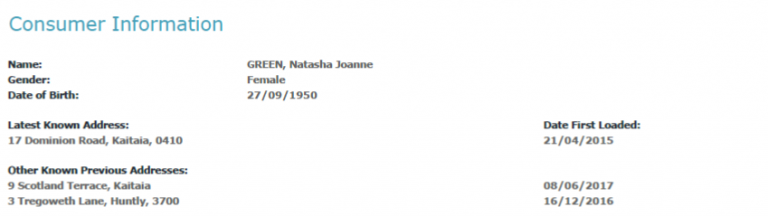

Understanding Your Personal Credit Report Centrix My personal credit report. your credit score is a number between 1 and 1000 that indicates how likely you are to pay your bills on time. the higher the score, the better your credit rating is. if your score is low, companies may be reluctant to lend to you or may charge you a higher rate. get a free copy of your personal credit report from. You can request your credit report in spanish directly from each of the three major credit bureaus: · transunion: call 800 916 8800. · equifax: visit the link or call 888 378 4329. · experian. Step 2. verify your personal information. ensure that your name,address, social security number, and employer history are correct. your employment history may be listed on your creditreport if you provided information about where you work to a creditor. step 3. review your credit information. A credit report is a detailed record of your credit history, compiled by the three nationwide credit bureaus: equifax, experian, and transunion. it includes information about your borrowing and repayment activities, including auto loans, credit cards, and other types of accounts. lenders use this report to assess your creditworthiness when you.

Understanding Your Personal Credit Report Centrix Step 2. verify your personal information. ensure that your name,address, social security number, and employer history are correct. your employment history may be listed on your creditreport if you provided information about where you work to a creditor. step 3. review your credit information. A credit report is a detailed record of your credit history, compiled by the three nationwide credit bureaus: equifax, experian, and transunion. it includes information about your borrowing and repayment activities, including auto loans, credit cards, and other types of accounts. lenders use this report to assess your creditworthiness when you. Knowing the type of bankruptcy is important for your credit report and score. chapter 7: generally, 10 years from the date the bankruptcy was filed. chapter 13: 7 years from the date the bankruptcy was filed. bankruptcies can have a severe negative impact to your credit score. your score can improve even if there are bankruptcies present on. The first step in managing your debt is to understand who you owe, and how much you owe, by checking your centrix personal credit report for free. read our top tips to managing your consumer debt.

Understanding Your Personal Credit Report Centrix Knowing the type of bankruptcy is important for your credit report and score. chapter 7: generally, 10 years from the date the bankruptcy was filed. chapter 13: 7 years from the date the bankruptcy was filed. bankruptcies can have a severe negative impact to your credit score. your score can improve even if there are bankruptcies present on. The first step in managing your debt is to understand who you owe, and how much you owe, by checking your centrix personal credit report for free. read our top tips to managing your consumer debt.

Sample Credit Report Sample Credit Report Pdf Centrix

Understanding Your Personal Credit Report Centrix

Comments are closed.