Understanding The Loan Estimate And Closing Disclosure

Understanding The Loan Estimate Le And Closing Disclosure Cd What Use our closing disclosure explainer to review and understand the details within your disclosure before closing on your mortgage loan. some lenders may provide you with an initial loan worksheet, which can be any type of document explaining your estimated rates, terms, and payments based on initial information you’ve provided. Closing disclosure explainer. use this tool to double check that all the details about your loan are correct on your closing disclosure. lenders are required to provide your closing disclosure three business days before your scheduled closing. use these days wisely—now is the time to resolve problems.

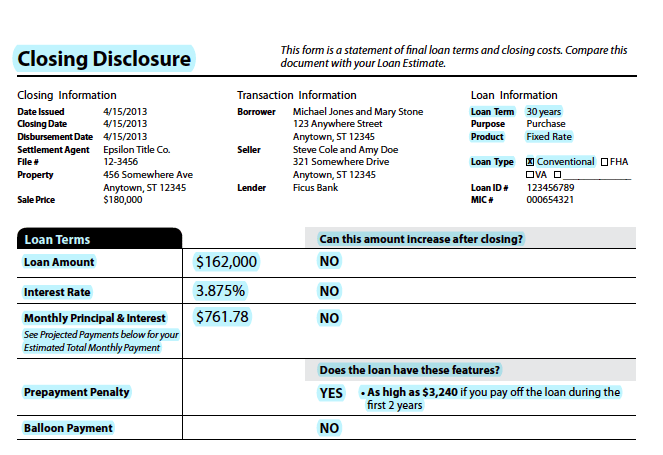

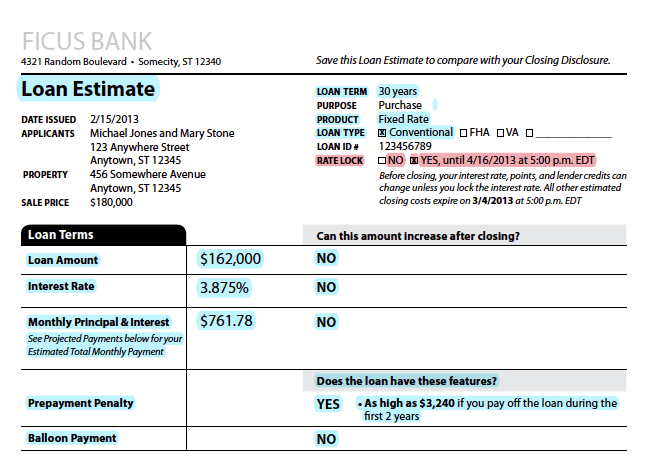

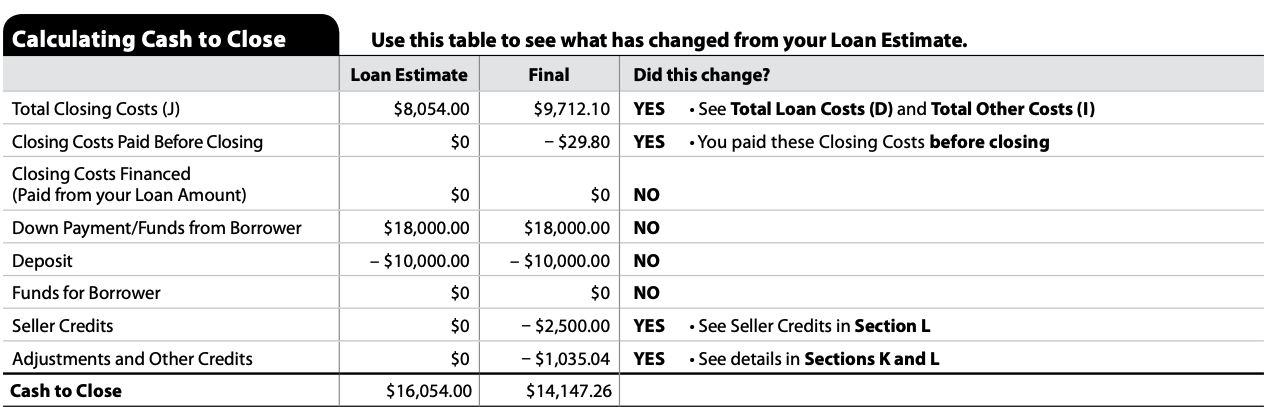

Understanding The Loan Estimate Le And Closing Disclosure Cd What The closing disclosure is a five page form that describes the critical aspects of your mortgage loan, including purchase price, loan fees, interest rate, estimated real estate taxes, insurance, closing costs and other expenses. it’s important that you review it thoroughly – in fact, it’s one of the most important steps you can take while. Here’s what you’ll find on each page of your closing disclosure: page 1. contains the same information as your loan estimate, in the same format. it’s easy to compare these pages to look for changes. page 2. breaks down who pays each closing cost (borrower, seller, or other) and when (before closing or at closing). The loan estimate and closing disclosure are designed to be easily compared by a buyer so that they can understand how the loan estimate changed during the transaction. the closing disclosure will contain a section titled “calculating cash to close” with side by side comparisons between your original loan estimate and your final loan. Closing disclosures help borrowers understand the upfront and ongoing costs of taking out a mortgage before signing the final paperwork. differences between the loan estimate and closing.

The Loan Estimate And Closing Disclosure Your Guide The loan estimate and closing disclosure are designed to be easily compared by a buyer so that they can understand how the loan estimate changed during the transaction. the closing disclosure will contain a section titled “calculating cash to close” with side by side comparisons between your original loan estimate and your final loan. Closing disclosures help borrowers understand the upfront and ongoing costs of taking out a mortgage before signing the final paperwork. differences between the loan estimate and closing. The loan estimate comes at the beginning, after you apply, while the closing disclosure comes at the end before you sign the final paperwork for your mortgage. knowing how to interpret these standardized documents will help you get the best loan possible and avoid any unpleasant surprises at closing. A closing disclosure is a mandatory form provided to you by your lender three days before closing on a home. it contains all of the necessary details about your mortgage: the loan terms, what your.

Understanding The New Loan Estimate And Closing Disclosure The loan estimate comes at the beginning, after you apply, while the closing disclosure comes at the end before you sign the final paperwork for your mortgage. knowing how to interpret these standardized documents will help you get the best loan possible and avoid any unpleasant surprises at closing. A closing disclosure is a mandatory form provided to you by your lender three days before closing on a home. it contains all of the necessary details about your mortgage: the loan terms, what your.

Comments are closed.