Understanding The Life Insurance Long Term Care Rider Ltc

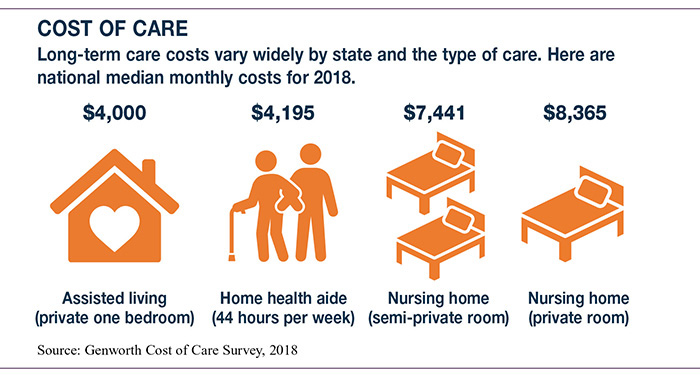

Understanding The Life Insurance Long Term Care Rider Ltc With most insurers, the amount available for long term care expenses is limited to between 70% and 80% of the death benefit, paid out monthly. at the time of the rider application, you’ll choose the percentage (from 1% to 3%) you want to receive each month if you need to use the rider. for example, if you have a $250,000 life insurance policy. Life insurance. call (855) 596 3655 to speak with a licensed insurance agent and get quotes for car, home, or renters insurance. long term care riders are policy additions that can be used to pay for assisted living expenses, such as caregivers or nursing homes. with the rising cost of long term care insurance, options such as long term care.

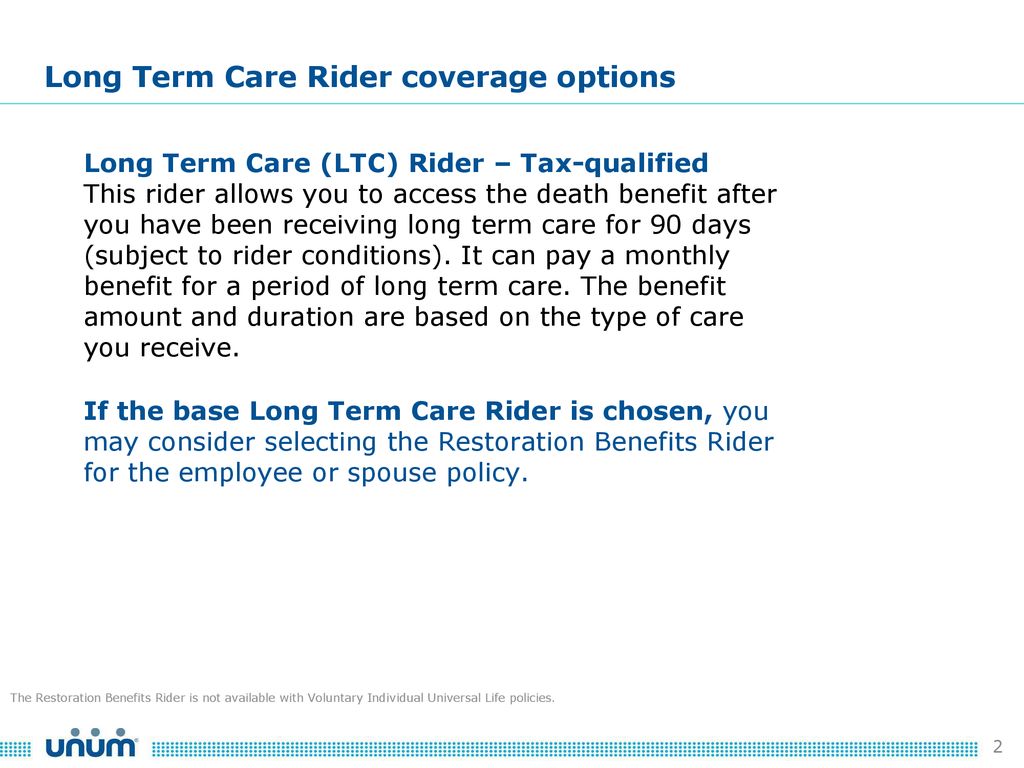

Understanding The Life Insurance Long Term Care Rider Ltc Financial considerations when adding a long term care rider. adding a long term care rider to a life insurance policy can significantly increase annual premiums, often by $600 to $800. this additional cost can vary based on personal factors such as age and health. despite the higher premiums, adding a rider typically results in lower initial. Standalone long term care insurance policies are an option, but they're expensive. according to the american association for long term care insurance, a long term care policy worth $165,000 in coverage for a 60 year old male costs an average of $1,175 per year. and unlike most life insurance, your premium will increase as you get older. The long term care rider will have a maximum monthly benefit. you might, for example, be able to receive 1%, 2%, 3%, or 4% of your policy's death benefit per month, the rider will also have a. With a long term care rider, a fixed percentage of your life insurance policy can go toward covering the cost of care. your insurer may cap it anywhere from 60% to 80%, paid out in part each month. payments for long term care riders work in one of two ways: reimbursement or indemnity.

Life Insurance With Long Term Care Rider Example Youtube The long term care rider will have a maximum monthly benefit. you might, for example, be able to receive 1%, 2%, 3%, or 4% of your policy's death benefit per month, the rider will also have a. With a long term care rider, a fixed percentage of your life insurance policy can go toward covering the cost of care. your insurer may cap it anywhere from 60% to 80%, paid out in part each month. payments for long term care riders work in one of two ways: reimbursement or indemnity. A long term care (ltc) rider is an add on to a life insurance policy that allows the policyholder to use a portion of the death benefit to cover long term care expenses. this rider transforms a traditional life insurance policy into a dual purpose product, offering both a death benefit and coverage for long term care needs. A long term care rider (ltc rider) is an add on to a life insurance policy that provides financial assistance for long term care services, should the policyholder require them due to illness, disability, or cognitive impairment. the primary purpose of this provision is to offer the insured an avenue for accessing the policy's death benefit to.

+Rider.jpg)

Long Term Care Ltc Rider Ppt Download A long term care (ltc) rider is an add on to a life insurance policy that allows the policyholder to use a portion of the death benefit to cover long term care expenses. this rider transforms a traditional life insurance policy into a dual purpose product, offering both a death benefit and coverage for long term care needs. A long term care rider (ltc rider) is an add on to a life insurance policy that provides financial assistance for long term care services, should the policyholder require them due to illness, disability, or cognitive impairment. the primary purpose of this provision is to offer the insured an avenue for accessing the policy's death benefit to.

Long Term Care Ltc Rider Ppt Download

Life Insurance With Long Term Care Benefits Retirement Planning Partners

Comments are closed.