Understanding Mortgage Conditions Multi Prets Mortgages

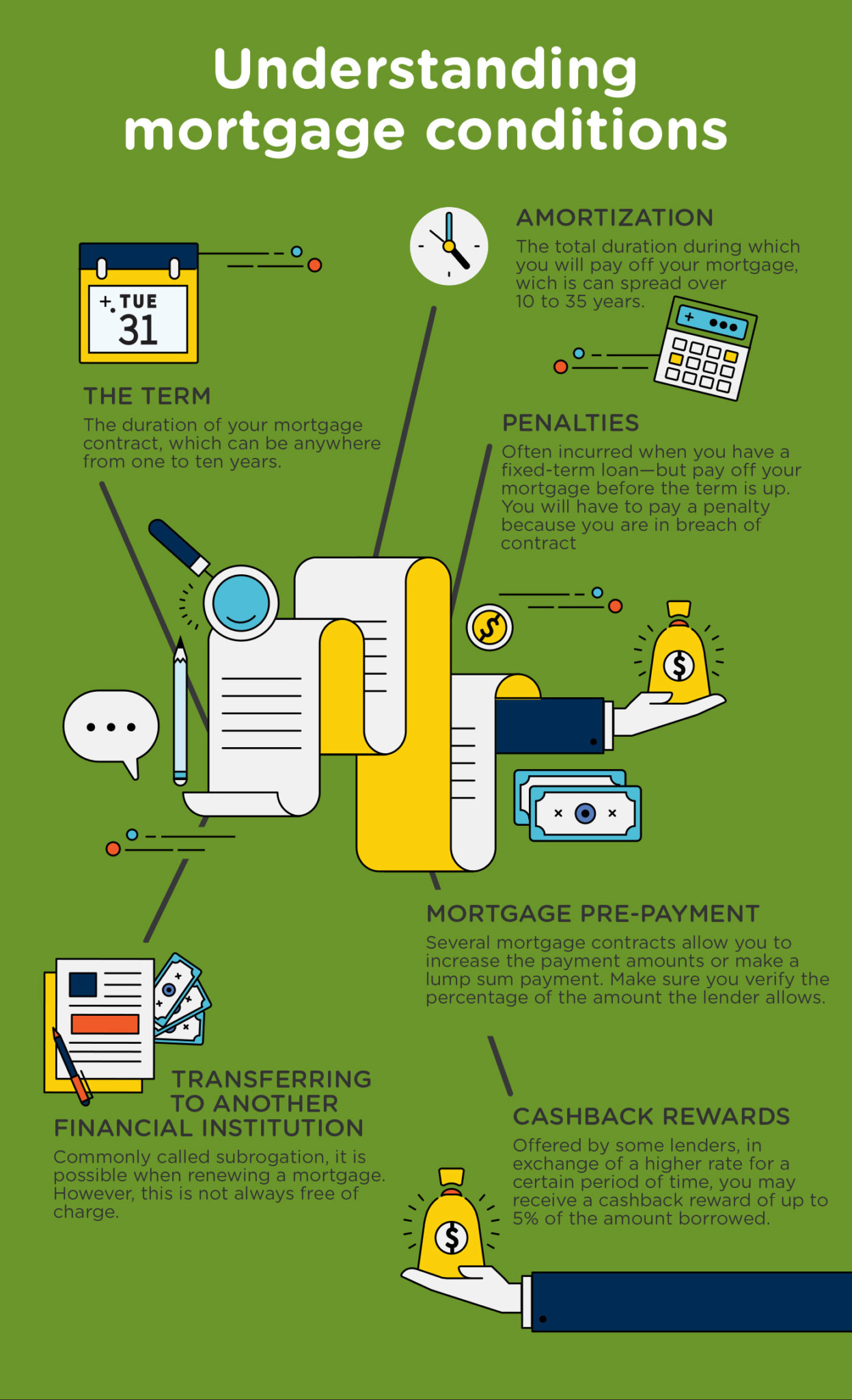

Understanding Mortgage Conditions Multi Prêts Mortgages Interest rates are not the only aspect you should consider when signing a mortgage contract. there are many conditions you need to look at when shopping for a mortgage, including payment terms, pre payments, amortizations, and penalties. a mortgage broker is your go to source for all the questions you may have regarding your mortgage loan. The interest rate directly affects the amount of your payments: the higher the rate, the higher your monthly payments. for example, a $300,000 mortgage amortized over 25 years at 2% interest will cost you $1,270.35 per month. the same mortgage at 3% interest will cost you $1,419.74 per month, or almost $150 more.

Understanding Mortgage Conditions Multi Prêts Mortgages Although this mortgage product allows you to avoid taking on more debt, for most people, it’s not financially beneficial. for example, let’s take a look at a cash back mortgage on a $300,000 loan at a fixed rate of 5.25% over five years, vs. a standard mortgage at a fixed rate of 3.5%. in the first case, your monthly payment will be $1,788. A mortgage and conditions that match our performance! ma succursale is a search tool offered by multi prêts hypothèques so that you can find the multi prêts branch closest to you! all our branches in quebec have the same mission: to offer you, free mortgage loans at the best possible rate. A mortgage and conditions that match our performance! ma succursale is a search tool offered by multi prêts hypothèques so that you can find the multi prêts branch closest to you! all our branches in quebec have the same mission: to offer you, free mortgage loans at the best possible rate. Your financial situation and the amount of money you have for a down payment have a direct impact on the interest rate you will be offered. if your down payment is less than 20% of the value of your property, you will have to take out mortgage insurance with the canada mortgage and housing corporation (cmhc), the costs of which will be reflected in a higher rate.

Understanding The Different Types Of Mortgage Loans Infographic A mortgage and conditions that match our performance! ma succursale is a search tool offered by multi prêts hypothèques so that you can find the multi prêts branch closest to you! all our branches in quebec have the same mission: to offer you, free mortgage loans at the best possible rate. Your financial situation and the amount of money you have for a down payment have a direct impact on the interest rate you will be offered. if your down payment is less than 20% of the value of your property, you will have to take out mortgage insurance with the canada mortgage and housing corporation (cmhc), the costs of which will be reflected in a higher rate. At multi prêts, our brokers take on multiple responsibilities: first by negotiating for you the best rates and conditions for your mortgage loan, but also by offering you financial services aimed at improving your savings and making your money grow, and this, for free. …representing you to financial institution partners. Here is the minimum percentage of the down payment based on the price of your property: 500,000 or less: 5%. 500,000 to $999,999: 5% for the first $500,000 and 10% for the rest. 1 million or more: 20. the minimum down payment for a rental property (duplex, triplex or quadruplex) varies depending on whether or not you wish to live in the property.

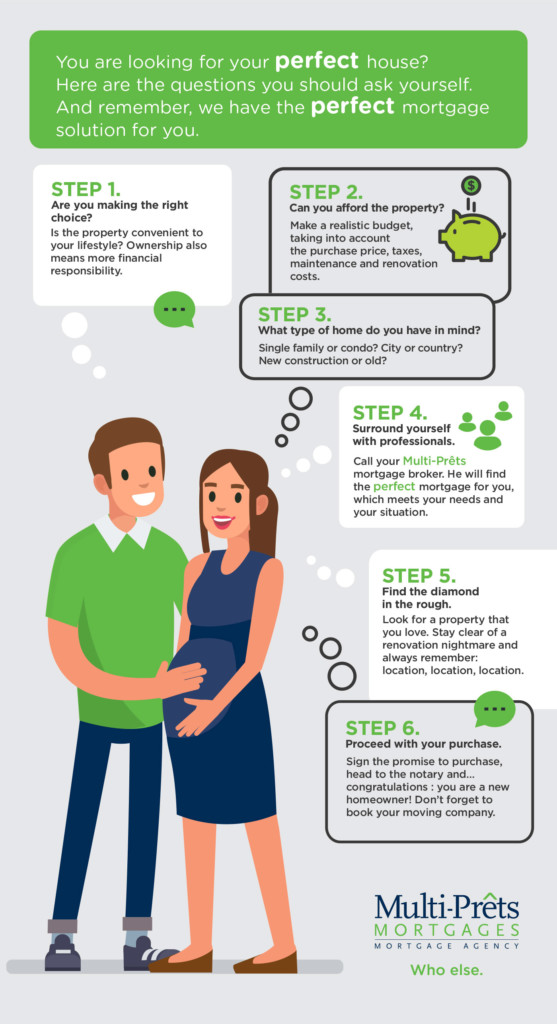

Buying A Property Follow The Guide Multi Prêts Mortgages At multi prêts, our brokers take on multiple responsibilities: first by negotiating for you the best rates and conditions for your mortgage loan, but also by offering you financial services aimed at improving your savings and making your money grow, and this, for free. …representing you to financial institution partners. Here is the minimum percentage of the down payment based on the price of your property: 500,000 or less: 5%. 500,000 to $999,999: 5% for the first $500,000 and 10% for the rest. 1 million or more: 20. the minimum down payment for a rental property (duplex, triplex or quadruplex) varies depending on whether or not you wish to live in the property.

Multi Prets Montreal Lowest Mortgage Rates Online Mortgages Claudio

Understanding Mortgage Rates Garden State Home Loans

Comments are closed.