Understanding Invoice Discounting How It Works Altline

Understanding Invoice Discounting How It Works Altline Invoice discounting companies offer loans of up to 95% of the total invoice value so that businesses can get the cash within a few days instead of waiting weeks. after the clients pay, the small business pays the loan back. some companies use invoice factoring for revenue stability. however, invoice discounting is distinct because it’s more. With invoice financing, (also known as invoice discounting or ar financing), a financing company provides a business with a loan that is secured against the business’s invoices. the loan is then repaid once the invoices are paid by the borrower’s customers.

Understanding Invoice Discounting How It Works Altline Invoice financing is also known as invoice discounting and is another common type of alternative financing. with invoice financing, a business owner receives a loan from the financing company that is secured against the business’ invoices. this loan is typically 70% to 90% of the invoice value. Cons. can be expensive. fees for invoice discounting are generally 1% 5% of the value of the invoice you’re advancing per week. for example, for a $100,000 invoice on which you receive a 90%. Invoice discounting helps you receive a percentage of the total from the lender when you invoice a customer or client, providing your business with a cash flow boost. in short, invoice discounting help you in many ways like: improves your business cash flow. providing flexibility in getting quick cash. Invoice discounting is a strategic financial tool that enables businesses to unlock the value of their accounts receivable swiftly. this blog explores the step by step process of invoice discounting and its significance for businesses looking to streamline cash flow management and support growth.understanding invoice discountinginvoice.

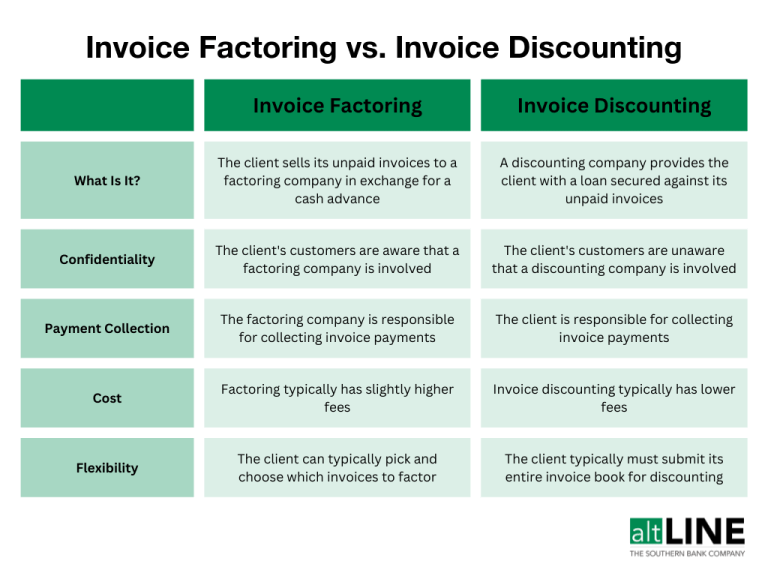

All You Need To Know About Invoice Discounting 2024 Guide Invoice discounting helps you receive a percentage of the total from the lender when you invoice a customer or client, providing your business with a cash flow boost. in short, invoice discounting help you in many ways like: improves your business cash flow. providing flexibility in getting quick cash. Invoice discounting is a strategic financial tool that enables businesses to unlock the value of their accounts receivable swiftly. this blog explores the step by step process of invoice discounting and its significance for businesses looking to streamline cash flow management and support growth.understanding invoice discountinginvoice. Invoice discounting is a way that allows businesses to borrow money against the amounts due from its customers that are currently tied up in outstanding sales invoices. it is a form of short term borrowing aimed to significantly improve a company’s working capital and cash flow. Invoice discounting, also known as ‘confidential invoice discounting’ works similarly to ‘invoice factoring’. both services come under the larger classification of invoice finance, meaning that both solutions are typically used to help businesses operating in the following industries: manufacturing. construction. recruitment. wholesale.

Comments are closed.