Understanding Cap Rate In Commercial Real Estate

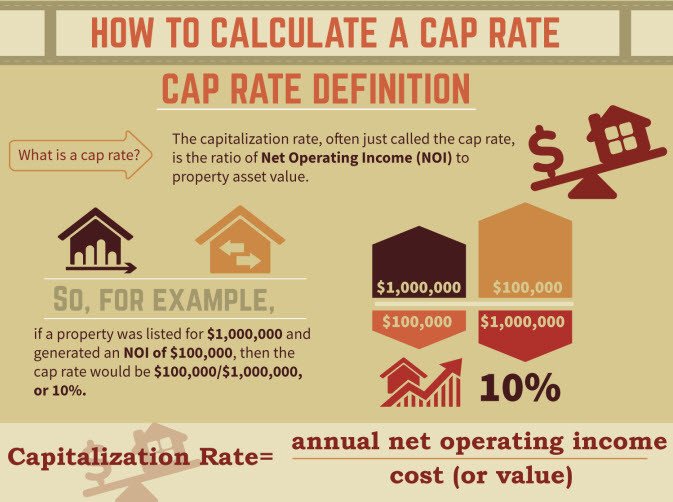

Understanding Cap Rate A Beginner S Guide For Commercial Real Estate A cap rate would be the anticipated cash on cash return if the asset were purchased in all cash. for example, if an office building is listed at $1,000,000 with a 10% cap rate, that means that the annual noi is $100,000. to find the value of a property, we divide the noi of $100,000 by the 10% cap rate (100,000 .1), which brings you to $1,000,000. The cap rate formula. annual net operating income (noi) the property’s market value. calculated by dividing a property’s net operating income by its asset value, the cap rate is an assessment of the yield of a property over one year. for example, a property worth $14 million generating $600,000 of noi would have a cap rate of 4.3%.

Understanding Cap Rate In Commercial Real Estate Leveraged Cre Az A cap rate between 4% and 10% is considered standard in the commercial real estate industry. however, what could be seen as an exceptional cap rate for one investor might not suit another's investment goals. for an investor seeking a safer, more stable return, a building in a prime location with a cap rate of 4% to 6% might be seen as "good. Understanding taxes in retirement 401(k) minimum distributions money. credit cards because commercial real estate uses cap rates to value properties instead of comparable sales, a low cap rate. Cap rates are calculated by dividing the noi by the market value of the property. for example, if a property generates $100,000 in noi and is valued at $1 million, the cap rate would be 10% ($100,000 divided by $1 million). cap rates can also be used to estimate the value of a property by multiplying the noi by the cap rate. Cap rates are a crucial factor in commercial real estate investing because they provide a quick and easy way to evaluate the potential profitability of a property. a property with a higher cap rate can be seen as more attractive as it boasts a higher risk but higher potential for return. a lower cap rate inversely means a potential lower rate.

The Beginner S Guide To The Cap Rate Calculation In Real Estate Mashvisor Cap rates are calculated by dividing the noi by the market value of the property. for example, if a property generates $100,000 in noi and is valued at $1 million, the cap rate would be 10% ($100,000 divided by $1 million). cap rates can also be used to estimate the value of a property by multiplying the noi by the cap rate. Cap rates are a crucial factor in commercial real estate investing because they provide a quick and easy way to evaluate the potential profitability of a property. a property with a higher cap rate can be seen as more attractive as it boasts a higher risk but higher potential for return. a lower cap rate inversely means a potential lower rate. There is no “good” cap rate per se since the target return is a subjective matter, but most commercial real estate (cre) investors perceive cap rates around the 5% to 10% range as ideal. the shortcoming of the cap rate is the implicit assumption that the economic benefit retrieved in one period will continue in perpetuity. Step 4. use the cap rate formula to divide the noi by the current property market value: cap rate = noi property value. cap rate = $25,000 $300,000 = 0.0833 or 8.33%. an 8.33% cap rate is on the higher side but still falls within the recommended range, depending on the level of risk tolerance.

Comments are closed.