Understanding Cap Rate A Beginner S Guide For Commercial Real Estate

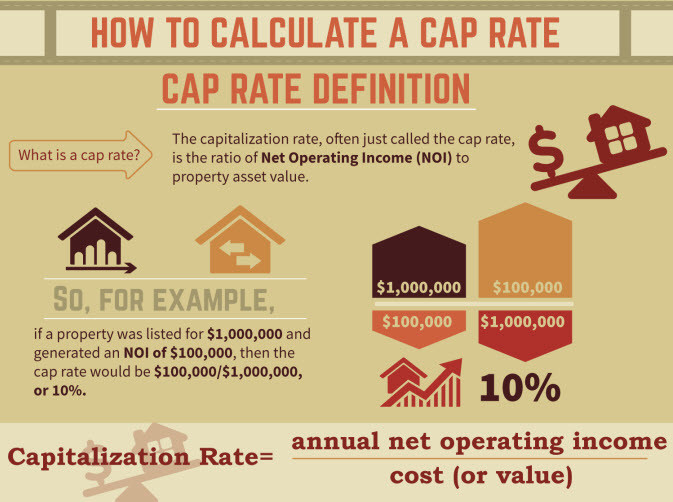

Understanding Cap Rate A Beginner S Guide For Commercial Real Estate In the world of commercial real estate, one of the essential metrics that brokers and investors rely on is the cap rate, or capitalization rate. the cap rate is a fundamental tool for evaluating investment opportunities and estimating potential returns. in this article, we will demystify the concept of the cap rate, explain. A cap rate would be the anticipated cash on cash return if the asset were purchased in all cash. for example, if an office building is listed at $1,000,000 with a 10% cap rate, that means that the annual noi is $100,000. to find the value of a property, we divide the noi of $100,000 by the 10% cap rate (100,000 .1), which brings you to $1,000,000.

The Beginner S Guide To The Cap Rate Calculation In Real Estate Mashvisor Emilee says the calculation is to divide rental income minus expenses (noi) by the market value or proposed purchase price of the property. let’s use a property that generates $100,000 per year in net operating income as an example. if you purchase the property for $1 million, you’ll have a cap rate of 10%. but if you purchase the same. The cap rate is a ratio that compares a property’s net operating income (noi) to its purchase price or market value. it is widely used in commercial real estate to estimate the potential return on investment for a property, without considering the effects of financing. that means that the cap rate would be your estimated return if you bought. The cap rate formula. annual net operating income (noi) the property’s market value. calculated by dividing a property’s net operating income by its asset value, the cap rate is an assessment of the yield of a property over one year. for example, a property worth $14 million generating $600,000 of noi would have a cap rate of 4.3%. Cap rates are calculated by dividing the noi by the market value of the property. for example, if a property generates $100,000 in noi and is valued at $1 million, the cap rate would be 10% ($100,000 divided by $1 million). cap rates can also be used to estimate the value of a property by multiplying the noi by the cap rate.

Understanding Cap Rate In Commercial Real Estate The cap rate formula. annual net operating income (noi) the property’s market value. calculated by dividing a property’s net operating income by its asset value, the cap rate is an assessment of the yield of a property over one year. for example, a property worth $14 million generating $600,000 of noi would have a cap rate of 4.3%. Cap rates are calculated by dividing the noi by the market value of the property. for example, if a property generates $100,000 in noi and is valued at $1 million, the cap rate would be 10% ($100,000 divided by $1 million). cap rates can also be used to estimate the value of a property by multiplying the noi by the cap rate. 3. calculate cap rate. using the cap rate formula: cap rate = noi divided by market value or acquisition cost. for example, if a property generates an noi of $100,000 and its market value is $1,000,000, the cap rate would be: cap rate = $100,000 divided by $1,000,000 = 0.10 or 10%. applications of cap rate. Calculate the cap rate: divide the noi by the current market value of the property. the result is the cap rate, expressed as a percentage.for example, if an eight unit building generates $139,200 annually in gross income and has operational expenses of 35%, the noi would be $90,480.

What Does Cap Rate Mean In Commercial Real Estate Blog 3. calculate cap rate. using the cap rate formula: cap rate = noi divided by market value or acquisition cost. for example, if a property generates an noi of $100,000 and its market value is $1,000,000, the cap rate would be: cap rate = $100,000 divided by $1,000,000 = 0.10 or 10%. applications of cap rate. Calculate the cap rate: divide the noi by the current market value of the property. the result is the cap rate, expressed as a percentage.for example, if an eight unit building generates $139,200 annually in gross income and has operational expenses of 35%, the noi would be $90,480.

Comments are closed.