Ultimate Guide To The Benefits Of A Va Loan

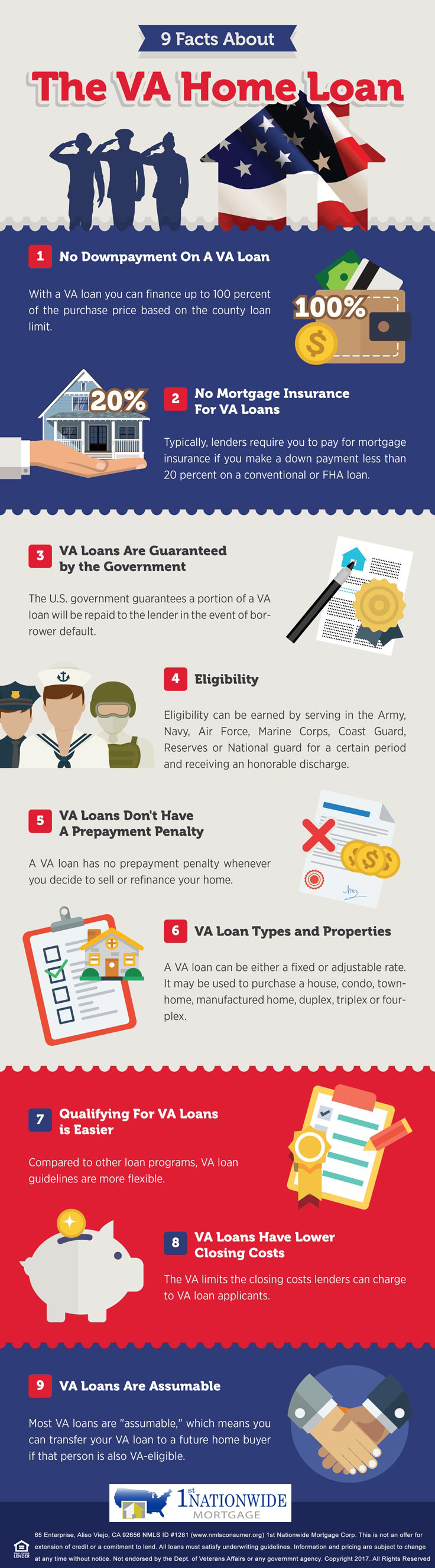

Ultimate Guide To The Benefits Of A Va Loan The ultimate guide to a va loan. in the united states, the average household has more than $130,000 in debt, and the number of people living paycheck to paycheck is on the rise. with this kind of financial burden, it can be hard to save up for a down payment, let alone qualify for a va home loan with traditional underwriting guidelines. The va funding fee is a one time fee to the va that keeps the program running for future generations. the va funding fee ranges from 0.5% to 3.3%, depending on the loan type and if the applicant makes a down payment. those receiving va disability and purple heart recipients do not pay the va funding fee.

The Ultimate Guide To Va Loans Price Mortgage When using the benefit for the first time, veterans pay 2.15% of the loan amount on a purchase or cash out refinance. for all subsequent uses, the fee rises to 3.3% of the loan amount. the funding fee for a va streamline refinance is 0.5%. buyers can lower their funding fee exposure by making a down payment. 1. no down payment. one of the most well known benefits of va loans is the ability to purchase a new home without needing a down payment. rather than paying 5%, 10%, 20% or more of the home’s. There are two types of entitlements: basic and bonus (or secondary). basic entitlement guarantees up to $36,000, or 25% of a loan up to $144,000. bonus entitlement can cover the loan up to 25% of the conforming loan limit, which significantly increases the maximum loan amount without a down payment for eligible veterans. Va loan funding fee rates. the rate of a va loan's funding fee can vary based on several factors and can range from 1.2% to 3.3%. the table below outlines the most common types of va loans and their respective fees for those who are exempt from paying the fee, as well as first time or repeat users: use.

An Overview Of The Powerful Benefits Of A Va Home Loan There are two types of entitlements: basic and bonus (or secondary). basic entitlement guarantees up to $36,000, or 25% of a loan up to $144,000. bonus entitlement can cover the loan up to 25% of the conforming loan limit, which significantly increases the maximum loan amount without a down payment for eligible veterans. Va loan funding fee rates. the rate of a va loan's funding fee can vary based on several factors and can range from 1.2% to 3.3%. the table below outlines the most common types of va loans and their respective fees for those who are exempt from paying the fee, as well as first time or repeat users: use. Va home loan benefits guide. updated on july 11th, 2024. joe wallace. the va loan benefit is designed to help qualifying active duty, reserve, national guard, veterans, and surviving spouses build, buy, renovate, or refinance a home. you can explore many options with a va home loan and the department of veterans affairs offers other housing. Va home loans are provided by private lenders, such as banks and mortgage companies. va guarantees a portion of the loan, enabling the lender to provide you with more favorable terms. read our guide for buying a home. before you buy, be sure to read the va home loan buyer's guide.

Comments are closed.