Uk Open Banking Adoption Is On The Rise According To New Yapily

Uk Open Banking Adoption Is On The Rise According To New Yapily London, 29 april 2021: new data, released by yapily, the leading open banking infrastructure provider, finds all of the uk’s major retail banks have made significant improvements in open banking api response times over the last 12 months since q1 2020. the data was compiled by yapily through its open banking infrastructure and monitoring. Since q1 2020, yapily has seen the number of open banking payments increase by 365%, on average, every quarter. this exponential growth in payments made through open banking apis is tangible proof from the market that supports research predicting over two thirds (64%) of uk adults will be adopters by 2022, along with 71% of smes.

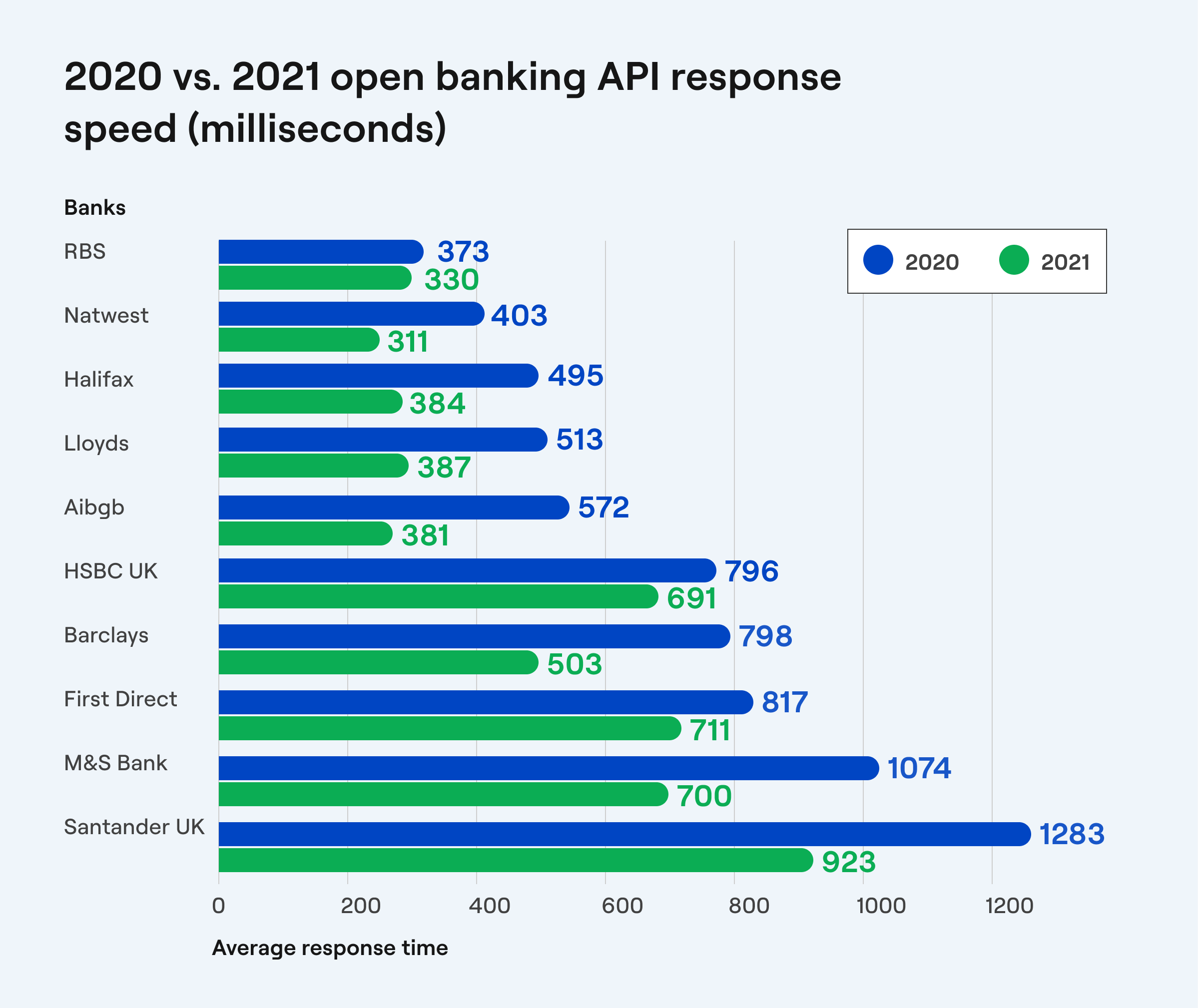

New Data From Yapily Further Proof Open Banking Adoption Is Rising 19 october 2023. over 1 in 9 brits now use open banking services as open banking payments reach record high. 9.7m payments made in june 2023, an increase of 88% on the same month in 2022. we have seen further growth since the cut off point for this report (june 2023), with 10.8m payments made in august 2023. double the volume of payments in the. The data, which covers the six months to june 2023, reveals that over 1 in 9 (11%) british consumers are active users of open banking, an increase from 7% in december 2021. it also shows the power of payments in driving the take up of open banking by uk businesses and consumers: 9.7m payments were made in june 2023, an increase of 88% on june 2022. The number of open banking payments recorded by obl (based on data provided by the cma9 banks subject to the retail banking market investigation order) reached 14.5 million in january 2024. this is a record high and represents 69% year on year growth. 8% of these payments were variable recurring payments and 92% single immediate payments. The data, which analyses the average open banking api response times across 10 of the uk’s top traditional banks, reveals that 100% have improved their response speed between 2020 and 2021, in some cases by up to 37%. at the end of 2021, cumulatively over 26.6 million open banking payments had been made in the uk, an increase of more than 500.

Open Banking Top Priority For Uk Banks The number of open banking payments recorded by obl (based on data provided by the cma9 banks subject to the retail banking market investigation order) reached 14.5 million in january 2024. this is a record high and represents 69% year on year growth. 8% of these payments were variable recurring payments and 92% single immediate payments. The data, which analyses the average open banking api response times across 10 of the uk’s top traditional banks, reveals that 100% have improved their response speed between 2020 and 2021, in some cases by up to 37%. at the end of 2021, cumulatively over 26.6 million open banking payments had been made in the uk, an increase of more than 500. The uk was followed by countries such as ireland, and germany in outscoring the opposition in their adoption of open banking in the eu open banking league table. the league table based on data. Today, new data released by yapily — the leading open banking infrastructure provider — reveals that uk banks have continued to invest in open banking technology as user adoption grows. the data, which analyses the average open banking api response times across 10 of the uk’s top traditional banks, reveals that 100% have improved their response speed between 2020 and 2021, in some cases.

Open Banking Adoption The Uk Hits 5 Million Customers Benchmark The uk was followed by countries such as ireland, and germany in outscoring the opposition in their adoption of open banking in the eu open banking league table. the league table based on data. Today, new data released by yapily — the leading open banking infrastructure provider — reveals that uk banks have continued to invest in open banking technology as user adoption grows. the data, which analyses the average open banking api response times across 10 of the uk’s top traditional banks, reveals that 100% have improved their response speed between 2020 and 2021, in some cases.

Comments are closed.