Tvalue Online Future Value Of An Annuity

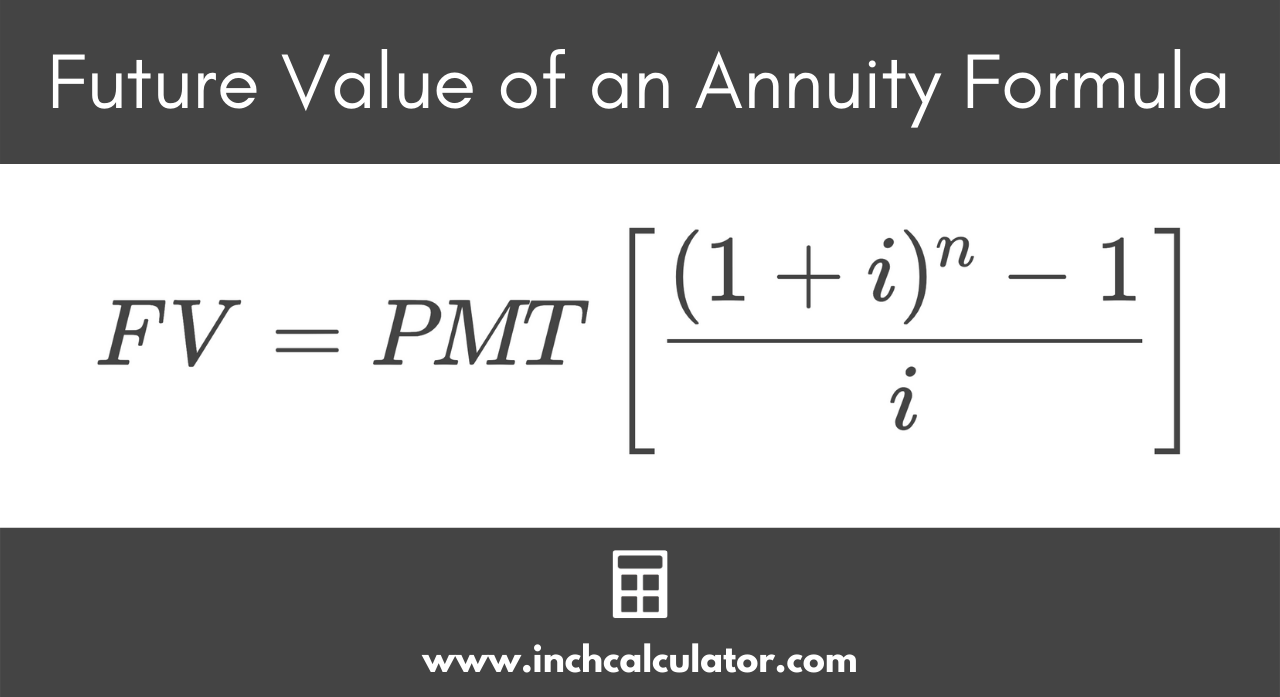

Future Value Of An Annuity Formula Example And Excel Template Future value of an annuity. f v = p m t i [(1 i) n − 1] (1 i t) where r = r 100, n = mt where n is the total number of compounding intervals, t is the time or number of periods, and m is the compounding frequency per period t, i = r m where i is the rate per compounding interval n and r is the rate per time unit t. To calculate the future value of an annuity: define the periodic payment you will do (p), the return rate per period (r), and the number of periods you are going to contribute (n). calculate: (1 r)ⁿ minus one and divide by r. multiply the result by p, and you will have the future value of an annuity.

Future Value Of Annuity Formula With Calculator Calculating the future value of an annuity involves determining the total value of a series of future cash flows, typically received at regular intervals, by. The future value calculator can be used to calculate the future value (fv) of an investment with given inputs of compounding periods (n), interest yield rate (i y), starting amount, and periodic deposit annuity payment per period (pmt). number of periods (n). An online annuity calculator makes calculating the growth of an insurance annuity easy. with just a few data points, you can decide if an annuity will provide the investment return that meets your financial needs. step 1: enter the starting principal amount. this is the initial amount that you deposited to open the annuity. After setting the above parameters, you can read that the annuity's future value is $15,528.23. annuity with fixed withdrawal let's say you have 10,000 dollars savings and you decide to buy an annuity with a 5 percent interest rate (compounded monthly) where you can withdraw 100 dollars at the beginning of each month.

Future Value Of An Annuity Calculator Inch Calculator An online annuity calculator makes calculating the growth of an insurance annuity easy. with just a few data points, you can decide if an annuity will provide the investment return that meets your financial needs. step 1: enter the starting principal amount. this is the initial amount that you deposited to open the annuity. After setting the above parameters, you can read that the annuity's future value is $15,528.23. annuity with fixed withdrawal let's say you have 10,000 dollars savings and you decide to buy an annuity with a 5 percent interest rate (compounded monthly) where you can withdraw 100 dollars at the beginning of each month. Following is the formula for finding future value of an ordinary annuity: fva = p * ( (1 i) n 1) i) where, fva = future value. p = periodic payment amount. n = number of payments. i = periodic interest rate per payment period, see periodic interest calculator for conversion of nominal annual rates to periodic rates. When calculating the future value of an annuity, it is important to remember the time value of money (tvm): when all else is equal, money will be worth more today than it will be worth in the future. would you rather have $10,000 today or receive $1,000 per year for the next 12 years?.

Futurevaluetables For Annuity Values 4 Decimals Places Present Following is the formula for finding future value of an ordinary annuity: fva = p * ( (1 i) n 1) i) where, fva = future value. p = periodic payment amount. n = number of payments. i = periodic interest rate per payment period, see periodic interest calculator for conversion of nominal annual rates to periodic rates. When calculating the future value of an annuity, it is important to remember the time value of money (tvm): when all else is equal, money will be worth more today than it will be worth in the future. would you rather have $10,000 today or receive $1,000 per year for the next 12 years?.

Future Value Of Annuity Calculator Calculate Future Value Of Annuity

Comments are closed.