Trend Reversal Trading Strategy

Complete Guide To Trend Reversal Trading As A Trading Strategy In this trend reversal trading strategy guide, you’ve learned: never catch a falling knife or trade the first pullback of a downtrend. understand the 4 stages of the market so you know when the price is likely to make a trend reversal. trend reversal trading setups: support & resistance, the breakout, and the pullback. The trend reversal strategy is any analysis or trading technique a trader uses to identify the end of one trend and the beginning of another. trend reversal strategies can be used on any timeframe and can mean the difference between a big win, a break even, or a loss, as being able to effectively spot a reversal is the fastest way to get into a.

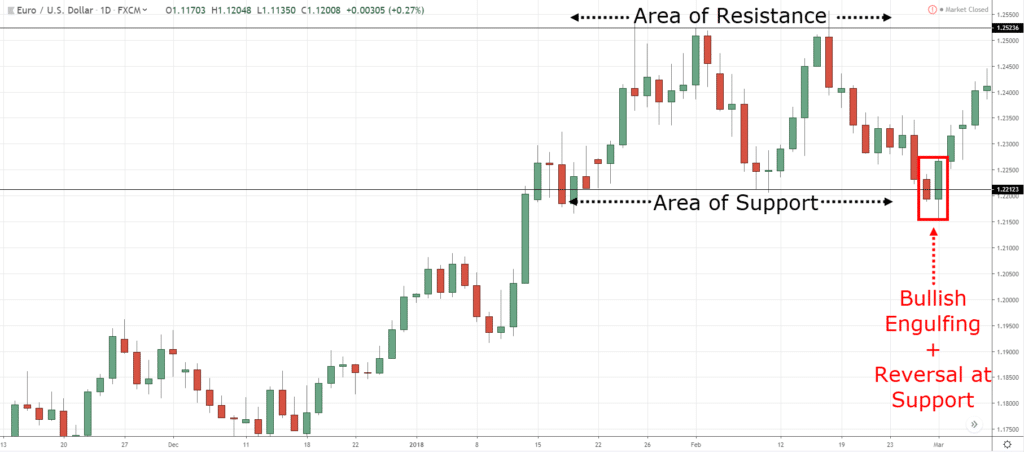

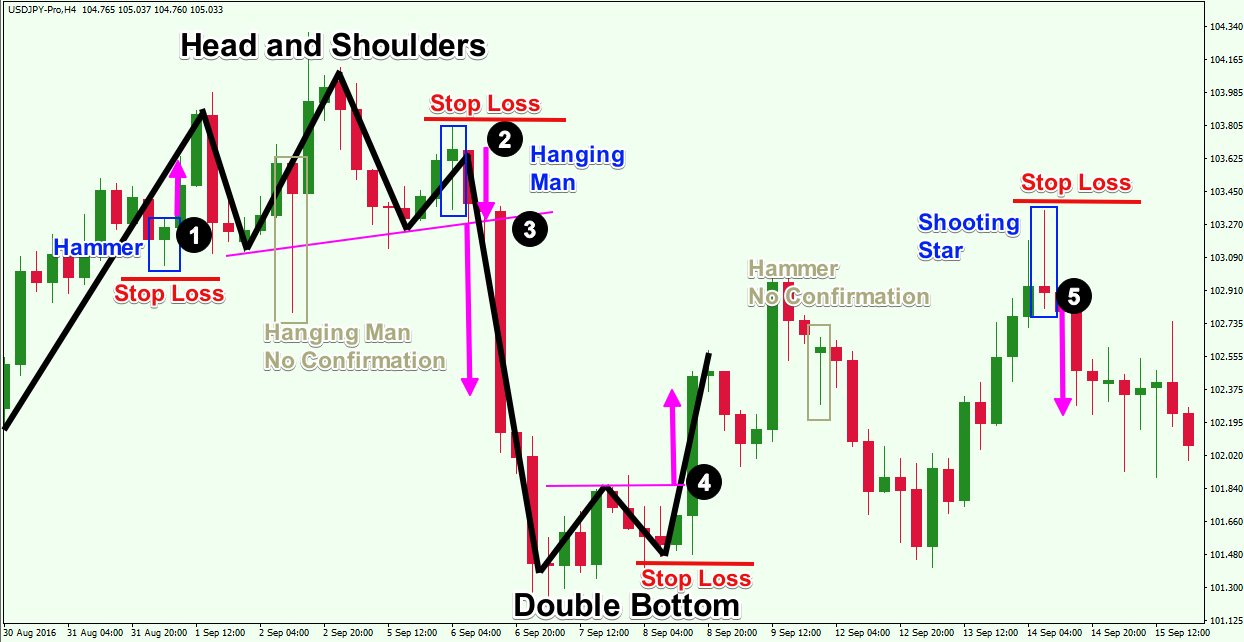

Top Forex Reversal Patterns That Every Trader Should Know Forex The trend reversal trading strategy is a powerful approach used by traders to identify and profit from market shifts. in simple terms, it involves spotting the moment when a current market trend is about to reverse, allowing traders to capitalize on the price movement in the opposite direction. this strategy is essential for maximizing profits. Step #3: identify the trend to pattern ratio. the trend to pattern ratio is your next clue on this thrilling trading journey. calculate the number of bars in the trend versus the trend reversal pattern. and as you can see: the trend reversal pattern is 3:1 so…. In total, five signals were generated and the profit was 2,923.77 points. the trader would have been in the market for 381 (7.3 years) of the total 713.4 weeks (14.1 years), or 53% of the time. Macd. the moving average convergence and divergence (macd) is an oscillator that is developed from two moving averages. when applied in a chart, it usually moves to the lower panel. the indicator can be used in both trend trading and also reversals. a reversal in a macd happens when the two moving averages make a crossover.

Learning To Trade The 123 Pattern Reversal Trading Strategy Forex Academy In total, five signals were generated and the profit was 2,923.77 points. the trader would have been in the market for 381 (7.3 years) of the total 713.4 weeks (14.1 years), or 53% of the time. Macd. the moving average convergence and divergence (macd) is an oscillator that is developed from two moving averages. when applied in a chart, it usually moves to the lower panel. the indicator can be used in both trend trading and also reversals. a reversal in a macd happens when the two moving averages make a crossover. What is trend reversal? a trend reversal is a shift in the market or asset’s direction. it can happen in any market — stocks, forex, crypto — you name it. traders use trend reversals to identify when to enter or exit a trade. understanding trend reversals is crucial for both short term and long term trading strategies. In this trend reversal trading strategy guide, you’ve learned: never catch a falling knife or trade the first pullback of a downtrend. understand the 4 stages of the market so you know when the price is likely to make a trend reversal. trend reversal trading setups: support & resistance, the breakout, and the pullback.

Comments are closed.