Traditional Ira Vs Roth Ira Which Is Best For You

Traditional Iras Vs Roth Iras Comparison 1st National Bank The main difference between a roth ira and a traditional ira is how and when you get a tax break. contributions to traditional iras are tax deductible, but withdrawals in retirement are taxable as. The best ira for you—a roth ira or a traditional ira—depends on the timing of their tax breaks, their eligibility standards, and the access they offer.

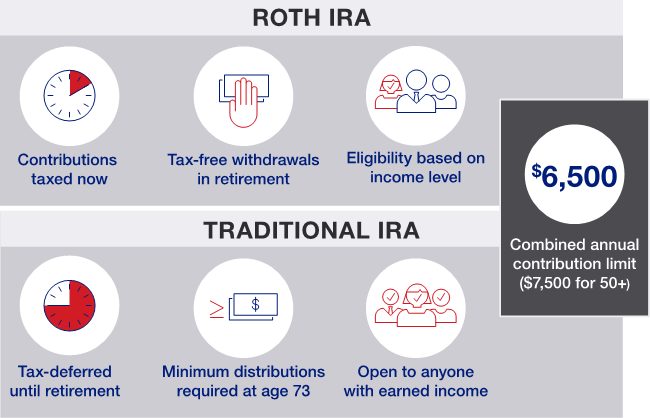

Traditional Vs Roth Ira Yolo Federal Credit Union With a roth 401 (k), you can contribute a portion or all your paycheck up to certain limits. you can also choose to have some of your paycheck go pre tax into a traditional 401 (k) and some post tax into a roth 401 (k). unlike a roth ira, contributions to a roth 401 (k) are not subject to earnings limits. this means if you aren't eligible to. In 2024, the annual contribution limit for iras, including roth and traditional iras, is $7,000. if you're age 50 or older, you can contribute an additional $1,000 annually. to be eligible to contribute the maximum amount to a roth ira in 2024, your modified adjusted gross income must be less than $146,000 if single and $230,000 if married and. As you compare roth vs. traditional iras, you should know that this isn’t an either or equation. both can be leveraged to increase your retirement savings. best roth ira accounts; best 401(k. The difference between a traditional ira and a roth ira comes down to taxes. with a roth ira, you contribute funds on which you’ve already paid income taxes, commonly referred to as post tax.

Roth Ira Vs Traditional Ira Which Is Best For You Youtube As you compare roth vs. traditional iras, you should know that this isn’t an either or equation. both can be leveraged to increase your retirement savings. best roth ira accounts; best 401(k. The difference between a traditional ira and a roth ira comes down to taxes. with a roth ira, you contribute funds on which you’ve already paid income taxes, commonly referred to as post tax. As mentioned above, traditional and roth iras differ mainly in their specific treatment of taxes during the contribution and withdrawal phases. traditional iras allow individuals to contribute pre tax dollars into a retirement account, which reduces their taxable income in the current year. with roth iras, individuals contribute post tax money. Common questions roth vs. traditional ira—which is best suited for me and my retirement goals? the right ira for you depends on many factors, such as your income level, what other retirement accounts you may have, and your age. generally speaking, a roth ira is best suited for those who expect to be in a higher tax bracket when they start taking withdrawals, and a traditional ira is best.

Roth Ira Vs Traditional Ira How To Know What Is Best For You As mentioned above, traditional and roth iras differ mainly in their specific treatment of taxes during the contribution and withdrawal phases. traditional iras allow individuals to contribute pre tax dollars into a retirement account, which reduces their taxable income in the current year. with roth iras, individuals contribute post tax money. Common questions roth vs. traditional ira—which is best suited for me and my retirement goals? the right ira for you depends on many factors, such as your income level, what other retirement accounts you may have, and your age. generally speaking, a roth ira is best suited for those who expect to be in a higher tax bracket when they start taking withdrawals, and a traditional ira is best.

How Does An Ira Work U S Bank

Comments are closed.