Tracing Three Decades Of Foreign Direct Investment Booms And Busts And

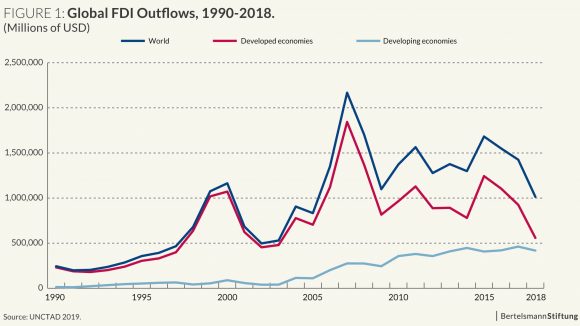

Tracing Three Decades Of Foreign Direct Investment Booms And Busts And The trade war waged by the us administration is also an investment war: in 2018, global foreign direct investment (fdi) declined again – the third year in row. for the world economy, this is a disadvantageous development and has negatively impacted global economic growth in 2018. even though annual fdi flows tend to be unstable and frequently. Foreign direct investment (fdi) is a pivotal objective for countries seeking to bolster their economic development and global competitiveness. by delving into the relationship between freedom and fdi using the freedom and prosperity indexes and examining institutional mechanisms to influence investment, we shed light on the dynamics that determine a country’s attractiveness to foreign investors.

Tracing Three Decades Of Foreign Direct Investment Booms And Busts And Cora jungbluth. senior expert china and asia pacific. bertelsmann stiftung. nachricht schreiben. 49 (5241)81 81482. vita. cora is senior expert for china and the asia pacific at the bertelsmann stiftung, gütersloh. in the europe’s future program, she focuses on eu china relations, foreign direct investment (fdi) and international trade. Jirasavetakul, l.f., & rahman, j. (2018). foreign direct investment in new member states of the eu and western balkans: taking stock and assessing prospects. imf working papers, 18 187. jungbluth, c. (2019). tracing three decades of foreign direct investment booms and busts and their recent decline. blog global economic dynamics. Research examining emerging economy inward and outward foreign direct investment (fdi) flows is on a significant upward trajectory. in this bibliometric analysis covering 806 articles published between 1994 and 2019, we map key aspects of its contours. our analysis proceeds in two sequential phases involving a performance analysis, followed by a thematic analysis. our performance analysis. Unctad's world investment report 2023 shows that, after a strong rebound in 2021, global foreign direct investment (fdi) fell by 12% in 2022 to $1.3 trillion.explore the interactive chart below trends in fdi inflows and outflows in countries and regions between 1990 and 2022.see the latest data ananalysis in world investment report 2024.

Foreign Direct Investment 1970 2019 Download Scientific Diagram Research examining emerging economy inward and outward foreign direct investment (fdi) flows is on a significant upward trajectory. in this bibliometric analysis covering 806 articles published between 1994 and 2019, we map key aspects of its contours. our analysis proceeds in two sequential phases involving a performance analysis, followed by a thematic analysis. our performance analysis. Unctad's world investment report 2023 shows that, after a strong rebound in 2021, global foreign direct investment (fdi) fell by 12% in 2022 to $1.3 trillion.explore the interactive chart below trends in fdi inflows and outflows in countries and regions between 1990 and 2022.see the latest data ananalysis in world investment report 2024. Bureau of economic analysis. " foreign direct investment in the united states (fdius) national bureau for economic research. " the merits of horizontal vs. vertical fdi in the presence of uncertainty. foreign direct investment, or fdi, is when businesses from one country invest in firms in another one. for most countries, its pros outweigh its. Using a new data set linking credit growth and financial crises for 38 advanced and emerging economies over 1970–2011, we study the role of foreign credit growth (that is, domestic credit growth in the rest of the world) in affecting the probability of experiencing domestic banking crises. our results provide novel empirical evidence.

Is Foreign Direct Investment Responsible For Boom And Bust Cycles Bureau of economic analysis. " foreign direct investment in the united states (fdius) national bureau for economic research. " the merits of horizontal vs. vertical fdi in the presence of uncertainty. foreign direct investment, or fdi, is when businesses from one country invest in firms in another one. for most countries, its pros outweigh its. Using a new data set linking credit growth and financial crises for 38 advanced and emerging economies over 1970–2011, we study the role of foreign credit growth (that is, domestic credit growth in the rest of the world) in affecting the probability of experiencing domestic banking crises. our results provide novel empirical evidence.

Comments are closed.