Top Fintech Trends 2022 Silicon Valley Bank

Top Fintech Trends 2022 Silicon Valley Bank For example, 43% of fintechs cut payroll in q3 2022, compared to 25% cutting in q1 2022. overall we’re seeing stalling growth rates, which 66% of fintechs growing slower than they were in q2 2022. for the increasing stable of fintech unicorns — up 38% from q4 2021 — they’re facing the longest ipo drought since 2018 19. Companies heed warnings to rein in spending. according to svb proprietary data, more fintech companies decreased net burn in q3 2022 than at any point since the onset of the covid 19 pandemic. the cuts help illustrate that companies are right sizing their expenses to match decreased expectations for spending and slower revenue growth.

Top Fintech Trends 2022 Silicon Valley Bank The data. this year’s report reveals a fintech sector that’s cutting costs and finding opportunities in generative ai while managing headwinds from higher interest rates and heightened scrutiny. note: total raised divided by post money valuation for fintech companies with ai as a tech vertical. source: svb proprietary data and svb analysis. The future of fintech: 2024 forecast, trends & risks subscribe now get the financial brand's free email newsletter before its collapse in early 2023, silicon valley bank enjoyed an enviable position at the nexus of west coast digital innovation and venture capital. now a division of first citizens, svb is working to reclaim its role and resumes. 3. plaid ($425 million) plaid, a fintech company known for connecting apps to users’ bank accounts, raised $425 million in a series e funding round at a valuation of $13.4 billion. the round was led by altimeter capital, with participation from silver lake, ribbit capital, and other prominent investors. A new report from silicon valley bank – a division of first citizens bank – reveals how the fintech ecosystem has shown resilience among the vc slowdown. according to the future of fintech.

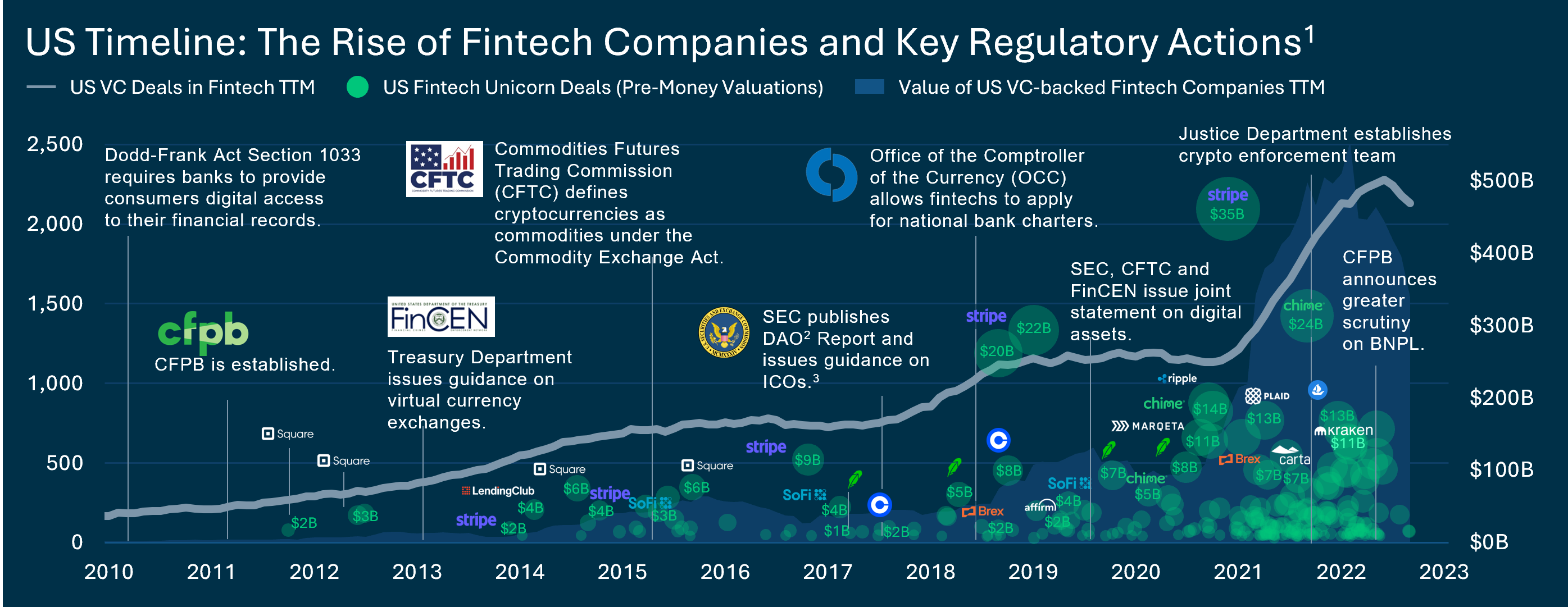

State Of Fintech Report 2022 Silicon Valley Bank 3. plaid ($425 million) plaid, a fintech company known for connecting apps to users’ bank accounts, raised $425 million in a series e funding round at a valuation of $13.4 billion. the round was led by altimeter capital, with participation from silver lake, ribbit capital, and other prominent investors. A new report from silicon valley bank – a division of first citizens bank – reveals how the fintech ecosystem has shown resilience among the vc slowdown. according to the future of fintech. Wherever your bank is headquartered, plan a trip to silicon valley for your executives and innovation team to get to know these 15 fintech companies that every bank should meet. small business. 1. sizeup. what it does: sizeup helps banks empower small business customers to make smarter decisions through big data. Venture capital (vc) investment in fintech companies reached a new high in 2021, surpassing the previous record set in 2020 of $166billion. the consumer and business shift toward digital brought about by the pandemic has buoyed interest in fintech startups. in 2021, fintech companies were 14 per cent of all vc deals but accounted for 18 per.

Comments are closed.