Tila Respa Integration Disclosure Timeline Example

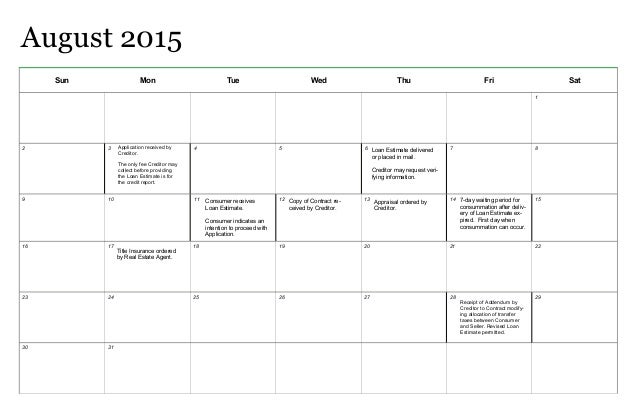

Tila Respa Integration Disclosure Timeline Example Contract refers to the real estate purchase contract between the consumer and seller. application is defined in regulation z § 1026.2(a)(3). llpa is a loan level pricing adjustment or any other secondary market risk based pricing mechanism. issue means to deliver or place in the mail the applicable disclosure discussed in the example. Contract refers to the real estate purchase contract between the consumer and seller. application is defined in regulation z § 1026.2(a)(3). llpa is a loan level pricing adjustment or any other secondary market risk based pricing mechanism. issue means to deliver or place in the mail the applicable disclosure discussed in the example.

Tila Respa Integration Disclosure Timeline Example Ppt Main trid provisions and official interpretations can be found in: § 1026.19 (e), (f), and (g), procedural and timing requirements. § 1026.37, content of the loan estimate. § 1026.38, content of the closing disclosure. supplement i to part 1026 (including official interpretations for the above provisions). 3 tila respa integrated disclosure faqs cfr § 1026.22(a)(4). for example, i f the apr and finance charge are overstated because the interest rate has decreased, the apr is considered accurate. thus, the creditor may provide the corrected closing disclosure to the consumer at consummation, and is not required to. The cfpb tila respa integrated disclosure rule (“trid”) covers closedend mortgage s only if loan the application for the loan was submitted to a creditor or mortgage broker on or after august 1, 2015. the rules are explicit that no part of the rules will apply to a loan that was applied for prior to the effective date. Balloon payment is a payment that is more than two times a regular periodic payment. (§ 1026.37(b)(5)) r, also disclose, as applicable:§ the maximum amount of the prepayment penalty and the date when the period during which the p. nalty may be imposed terminates. for example, as high as $3,240 if you pay off.

Tila Respa Integration Disclosure Timeline Example The cfpb tila respa integrated disclosure rule (“trid”) covers closedend mortgage s only if loan the application for the loan was submitted to a creditor or mortgage broker on or after august 1, 2015. the rules are explicit that no part of the rules will apply to a loan that was applied for prior to the effective date. Balloon payment is a payment that is more than two times a regular periodic payment. (§ 1026.37(b)(5)) r, also disclose, as applicable:§ the maximum amount of the prepayment penalty and the date when the period during which the p. nalty may be imposed terminates. for example, as high as $3,240 if you pay off. Integrated disclosures part 5 – common questions. 015presented by the consumer financial protection bureauthe content of this webinar is cu. ent as of the date the webinar was originally presented. this webinar has not been updated since its original presentation date and does not reflect the changes and clarific. Obile home or by a dwelling not attached to real property.the trid rule applies to all lenders making mortgage loans, including community banks, unless the lender extended credit to a consumer 25 or fewer times including mortgage loans, or made five or fewer mortgage l. sure requirements, including:construction only loan.

Tila Respa Integration Disclosure Timeline Example Ppt Integrated disclosures part 5 – common questions. 015presented by the consumer financial protection bureauthe content of this webinar is cu. ent as of the date the webinar was originally presented. this webinar has not been updated since its original presentation date and does not reflect the changes and clarific. Obile home or by a dwelling not attached to real property.the trid rule applies to all lenders making mortgage loans, including community banks, unless the lender extended credit to a consumer 25 or fewer times including mortgage loans, or made five or fewer mortgage l. sure requirements, including:construction only loan.

Comments are closed.