Three Major Credit Bureaus Doing Better Job At Responding To Consumer

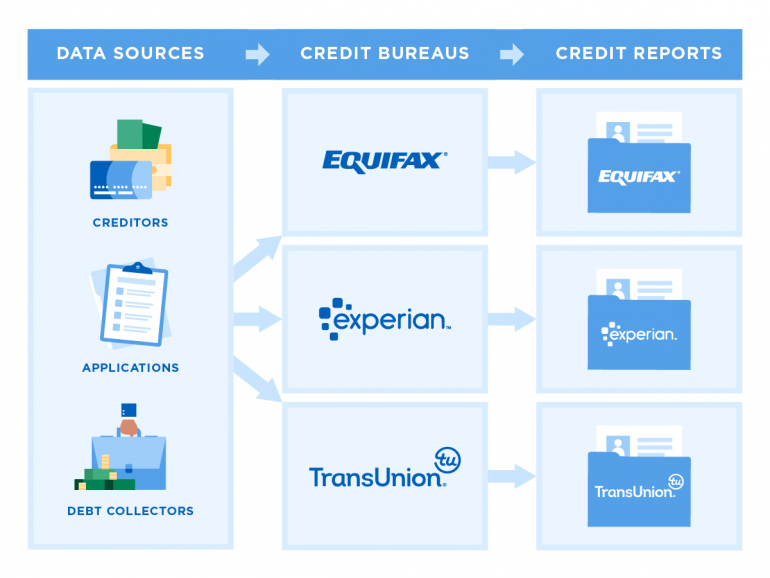

The Three Credit Bureaus Why They Re Important Lexington Law The three major credit bureaus are equifax, experian and transunion. the credit bureaus manage records on your accounts, balances and the payments you make. each credit bureau operates. The three main credit bureaus are equifax, experian and transunion. all three companies work essentially the same way: they collect information on your credit behavior and sell that data to other companies that use it to decide your creditworthiness. these credit reporting agencies can collect this information without your permission, but what.

The Three Credit Bureaus Explained Creditrepair During the covid 19 pandemic, everyone is eligible for free weekly credit reports from each of the three main credit reporting agencies. this benefit extends through april 20, 2022. equifax. experian. In the u.s., the top three consumer reporting bureaus are equifax, experian, and transunion. this trio dominates the market for collecting information about consumers in the credit markets. The three major credit bureaus are equifax®, experian® and transunion®. credit bureaus are sometimes called credit reporting agencies or consumer reporting companies. they’re different from credit scoring companies, such as vantagescore® and fico®. credit reports contain information about people’s identity, credit history and credit. The three major consumer credit bureaus are equifax, experian and transunion. a credit bureau is a company that gathers and stores various types of information about you and your financial accounts and history. it draws on this information to create your credit reports, which in turn form the basis for your credit scores.

Three Major Credit Bureaus Doing Better Job At Responding To Consumer The three major credit bureaus are equifax®, experian® and transunion®. credit bureaus are sometimes called credit reporting agencies or consumer reporting companies. they’re different from credit scoring companies, such as vantagescore® and fico®. credit reports contain information about people’s identity, credit history and credit. The three major consumer credit bureaus are equifax, experian and transunion. a credit bureau is a company that gathers and stores various types of information about you and your financial accounts and history. it draws on this information to create your credit reports, which in turn form the basis for your credit scores. The three major consumer credit bureaus are equifax, experian, and transunion. credit reporting agencies maintain and keep updated records of credit data, calculate credit scores based on credit history and issue credit reports. consumer reporting agencies can sell your credit information to credit card issuers, lenders, insurers and employers. But for practical purposes, and for the average consumer, experian, equifax, and transunion are what is typically meant by the term “credit bureaus.”. price: $19.95 $39.95 mo. myfico gives you access to credit reports and credit scores from all 3 credit bureaus. start monitoring your credit today with myfico.

Three Major Credit Bureaus Doing Better Job At Responding To Consumer The three major consumer credit bureaus are equifax, experian, and transunion. credit reporting agencies maintain and keep updated records of credit data, calculate credit scores based on credit history and issue credit reports. consumer reporting agencies can sell your credit information to credit card issuers, lenders, insurers and employers. But for practical purposes, and for the average consumer, experian, equifax, and transunion are what is typically meant by the term “credit bureaus.”. price: $19.95 $39.95 mo. myfico gives you access to credit reports and credit scores from all 3 credit bureaus. start monitoring your credit today with myfico.

O Que São Os Três Credit Bureaus Rencana

Comments are closed.