Threat Risk Management Process Chart

Threat Risk Management Process Chart Risk management process but also outlines the approach necessary to identify, assess, and prioritize the risks to federal facilities. this approach is followed by a coordinated application of countermeasures to minimize, monitor, and control the probability of an undesirable event and its associated impact. risk management decisions are based. Are an integral part of the risk management process. this job aid can be used as quick reference material or as a starting point in your own risk management analysis using the blank worksheets located at the end. impact risk and threat vulnerability scales during the analysis process; values are assigned corresponding to the impact of asset.

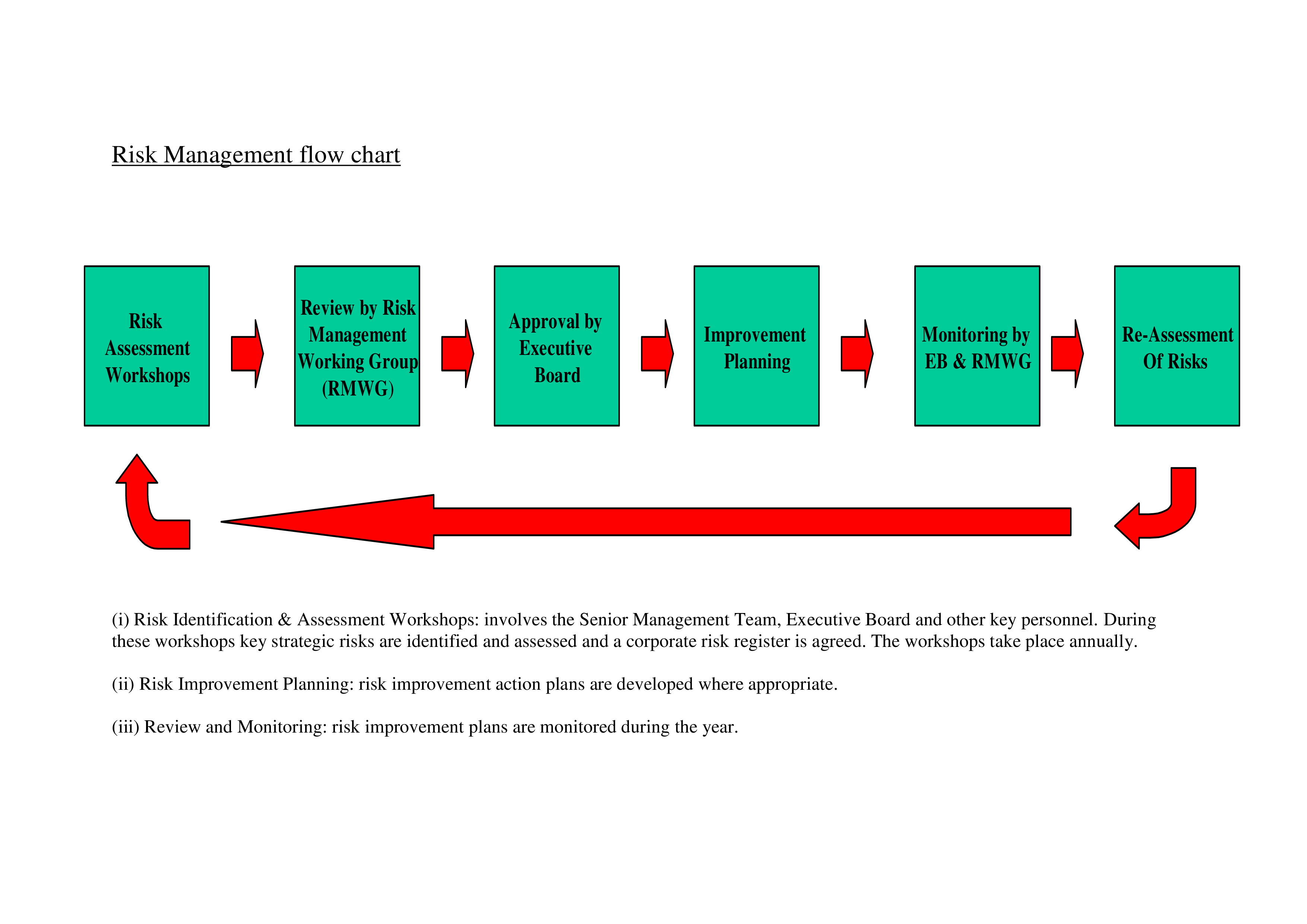

Risk Management Flow Chart Templates At Allbusinesstemplates This chart provides an easy to understand diagram of a process with which to make security risk management decisions. although most security practitioners will recognize the role threats, vulnerabilities and risk play in making those decisions, this chart will help them to remember the equally important aspects necessary to ensure a proper. The risk management process. risk management is a five step process that provides a framework for collecting and evaluating information to: • assess assets (identify value of asset and degree of impact if asset is damaged or lost) • assess threats (type and degree of threat) • assess vulnerabilities (identification and extent of. The process is essentially the same for any type of entity and includes the following five core steps for documenting, assessing and managing risks. 1. identify risks. the first step in the risk management process is to determine the potential business risks your organization faces. that requires some context: to consider what could go wrong. An effective risk assessment helps organizations understand and prioritize potential threats by evaluating the impact of risks. here's a brief risk assessment template for reference: assessment type: tier 1: high risk (significant business exposure) tier 2: medium risk (moderate impact) tier 3: low risk (minimal impact) inherent risk: the risk.

Five Core Steps Of The Risk Management Process The process is essentially the same for any type of entity and includes the following five core steps for documenting, assessing and managing risks. 1. identify risks. the first step in the risk management process is to determine the potential business risks your organization faces. that requires some context: to consider what could go wrong. An effective risk assessment helps organizations understand and prioritize potential threats by evaluating the impact of risks. here's a brief risk assessment template for reference: assessment type: tier 1: high risk (significant business exposure) tier 2: medium risk (moderate impact) tier 3: low risk (minimal impact) inherent risk: the risk. Steps of the risk management process. identify the risk. analyze the risk. prioritize the risk. treat the risk. monitor the risk. with any new project comes new risks lying in wait. these risks can differ from misalignment between stakeholders to lack of resources to major regulatory changes in the industry. Risk management process – step 1 identify assets. let’s take a look at each step of the risk management process. the first step in the process is to identify assets. the goal of the first step is to determine the value of each asset and prioritize the assets based on the consequence of the loss.

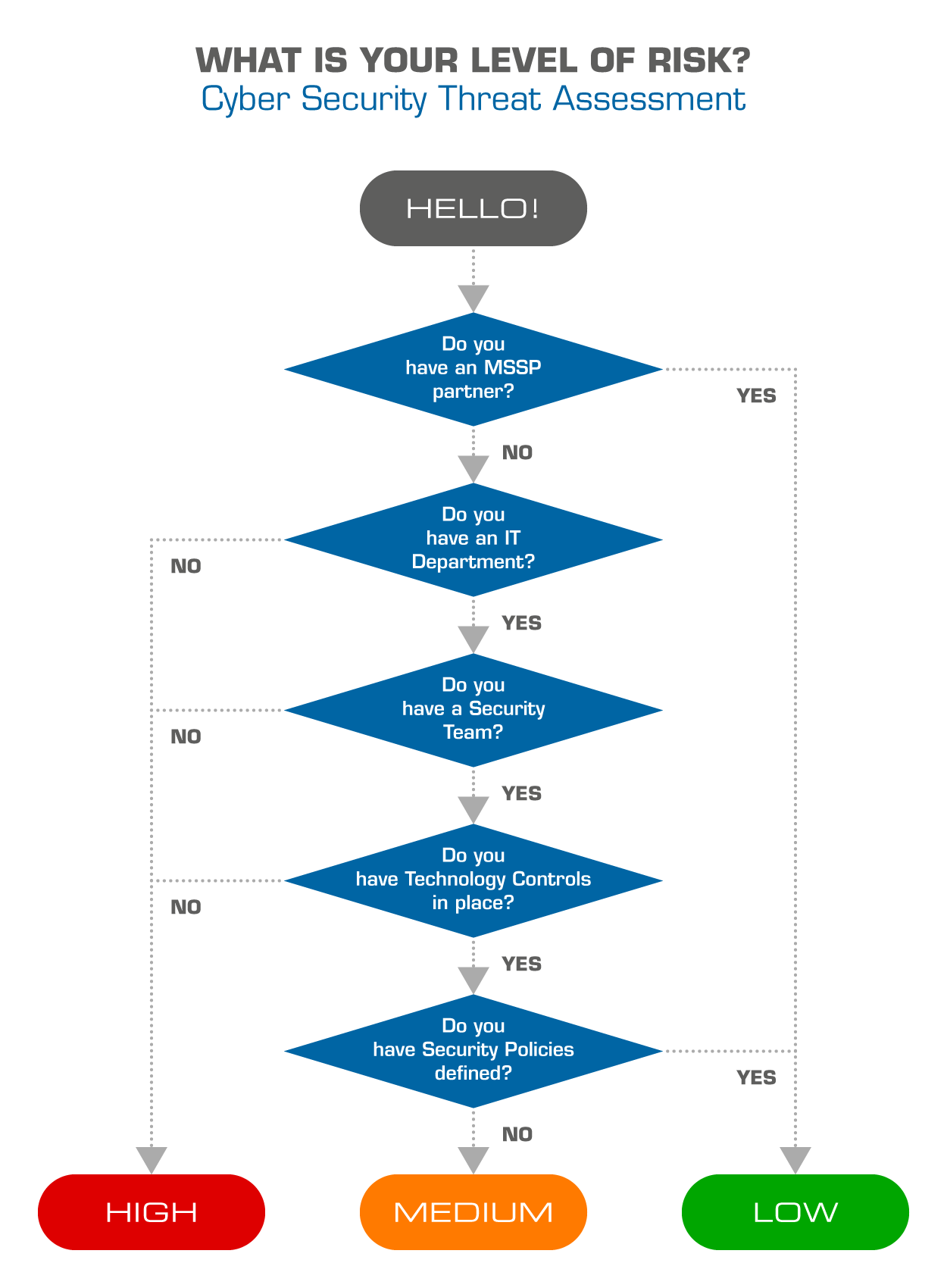

Cyber Security Threat Assessment How To Manage Risk Wbm Technologies Steps of the risk management process. identify the risk. analyze the risk. prioritize the risk. treat the risk. monitor the risk. with any new project comes new risks lying in wait. these risks can differ from misalignment between stakeholders to lack of resources to major regulatory changes in the industry. Risk management process – step 1 identify assets. let’s take a look at each step of the risk management process. the first step in the process is to identify assets. the goal of the first step is to determine the value of each asset and prioritize the assets based on the consequence of the loss.

Comments are closed.