This Is The Second Loan Estimate I Receive From The Lender Which Makes

This Is The Second Loan Estimate I Receive From The Lender Which Makes A loan estimate shows your projected closing costs, monthly payment, interest rate, and annual percentage rate, among other details based on the amount, type, and terms of the loan. because. The bottom line: loan estimates provide valuable information. the loan estimate covers the key details of a loan, such as loan terms, projected payments, closing costs and estimated cash to close. it gives borrowers a clear picture of a mortgage loan’s costs and terms, empowering them to compare lender offers and choose the best financing.

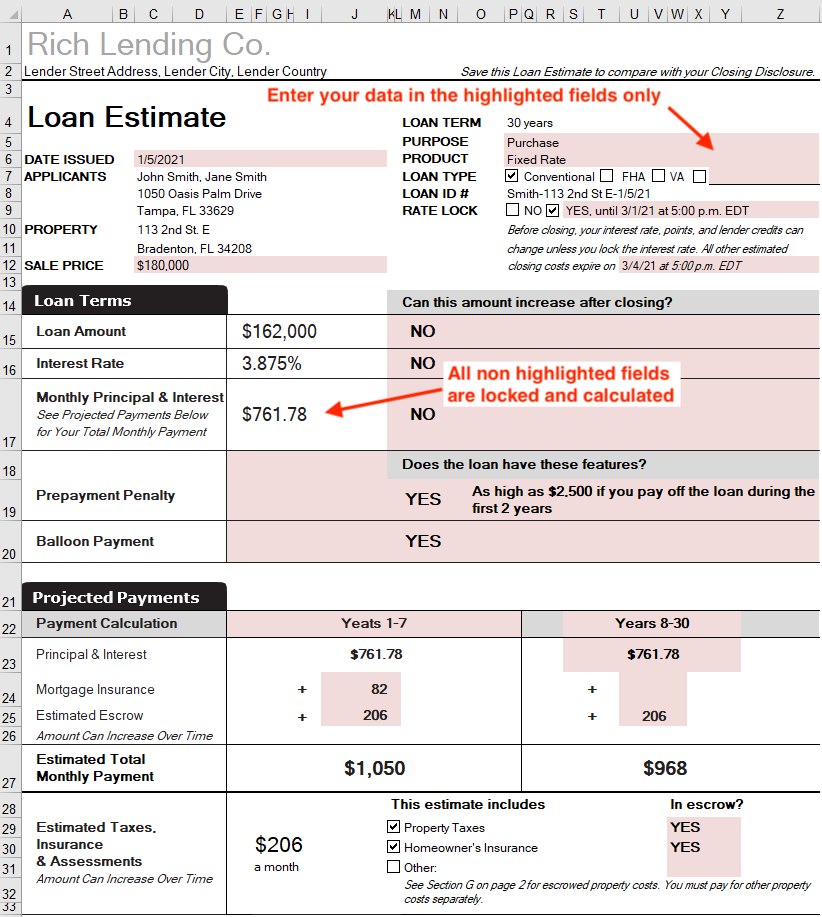

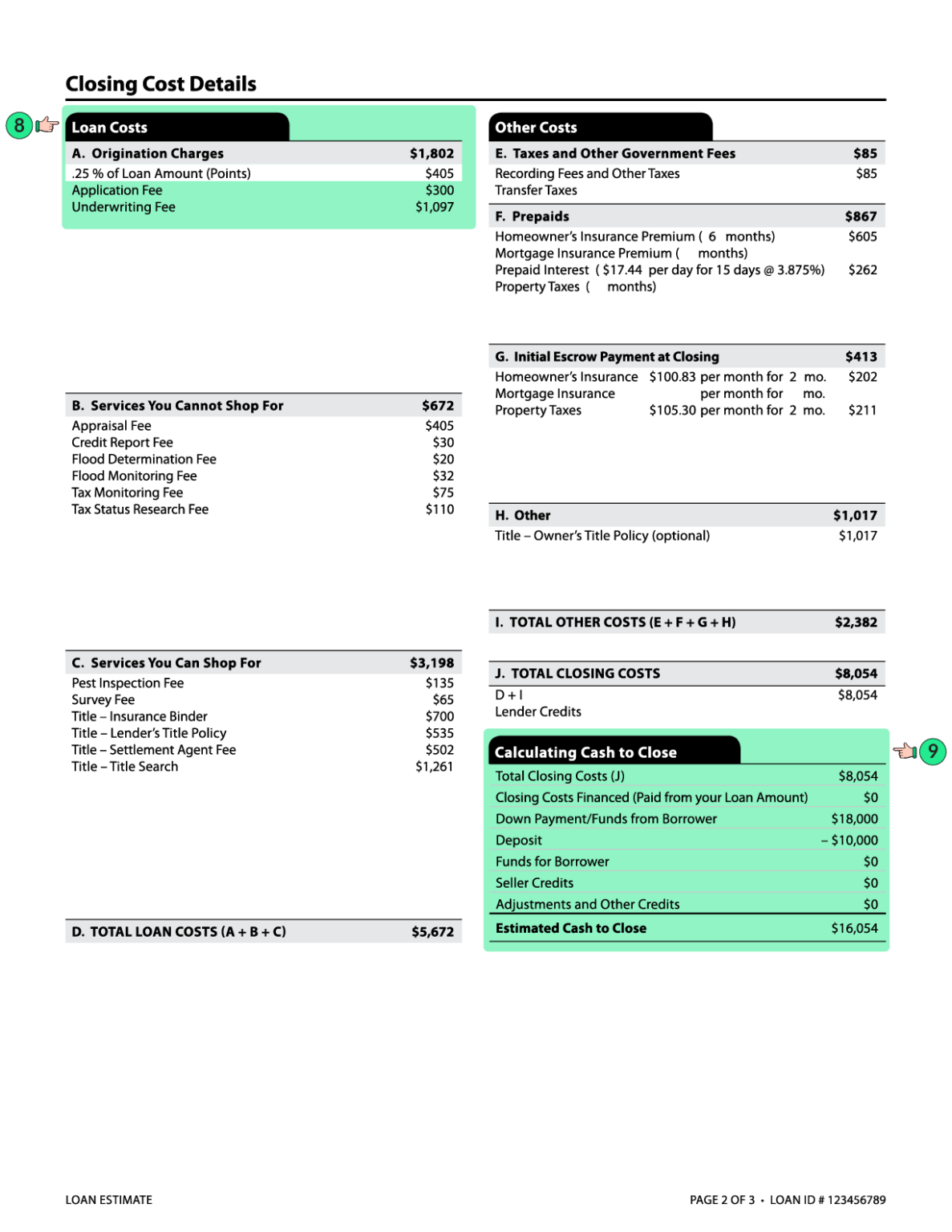

Create Example Loan Estimate Form In Lender Spreadsheet A loan estimate isn’t an indication that your loan application has been approved or denied. you don’t need to have a signed contract for the property that you’re receiving a loan estimate for. you’re not obligated to pay an application fee other than a reasonable fee for the lender to run a credit report. if your interest rate or loan. It includes principal and interest, insurance, escrow payments, taxes, and other assessments. closing costs: this is the total you’ll owe in lender fees and other fees, minus any lender credits. itemized closing costs follow on page 2. apr: this is the loan’s fees and interest rate expressed as an annual percentage. A loan estimate tells you important details about a mortgage loan you have requested. use this tool to review your loan estimate to make sure it reflects what you discussed with the lender. if something looks different from what you expected, ask why. request multiple loan estimates from different lenders so you can compare and choose the loan. The lender must give a new loan estimate if key information changes. for example, the loan offer may change and require a new loan estimate if the property appraisal comes in lower than expected.

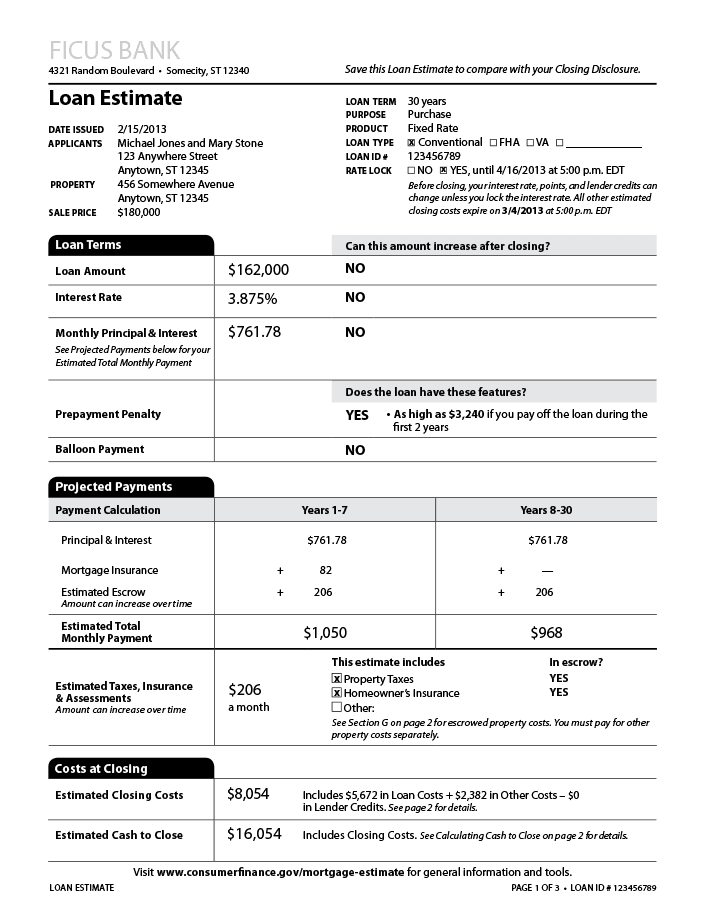

What Is A Loan Estimate How To Read And What To Look For A loan estimate tells you important details about a mortgage loan you have requested. use this tool to review your loan estimate to make sure it reflects what you discussed with the lender. if something looks different from what you expected, ask why. request multiple loan estimates from different lenders so you can compare and choose the loan. The lender must give a new loan estimate if key information changes. for example, the loan offer may change and require a new loan estimate if the property appraisal comes in lower than expected. Loan details. at the top of your loan estimate, you’ll find some basic details: the name of the lender, the property’s address, and the price you and the seller have agreed to in your contract. loan term: this is the number of years the mortgage will last. 30 and 15 year mortgages are most common. Technically, a loan estimate is only binding on the date it’s issued. the lender has to give you the loan, with exactly the terms listed in the loan estimate, if on that day you take steps to accept the loan and lock your rate in. like stock prices, interest rates change daily — so if you don’t lock in your mortgage rate, there’s no.

Loan Estimate Explainer Consumer Financial Protection Bureau Loan details. at the top of your loan estimate, you’ll find some basic details: the name of the lender, the property’s address, and the price you and the seller have agreed to in your contract. loan term: this is the number of years the mortgage will last. 30 and 15 year mortgages are most common. Technically, a loan estimate is only binding on the date it’s issued. the lender has to give you the loan, with exactly the terms listed in the loan estimate, if on that day you take steps to accept the loan and lock your rate in. like stock prices, interest rates change daily — so if you don’t lock in your mortgage rate, there’s no.

Sample Loan Estimate The Document Template

Comments are closed.