The Ultimate Tool Of Trading Fibonacci Retracement Tool Key Levels

The Ultimate Tool Of Trading Fibonacci Retracement Tool Key Levels How to draw fibonacci retracements correctly. step 1) select the fibonacci retracement tool. step 2) locate the beginning and end of the current price swing. step 3) drag the tool from the beginning of the swing to the end. 3 effective ways to use retracements in your trading. #1 to get into strong moves. The charting software automagically calculates and shows you the retracement levels. as you can see from the chart, the fibonacci retracement levels were .7955 (23.6%), .7764 (38.2%), .7609 (50.0%*), .7454 (61.8%), and .7263 (76.4%). now, the expectation is that if aud usd retraces from the recent high, it will find support at one of those.

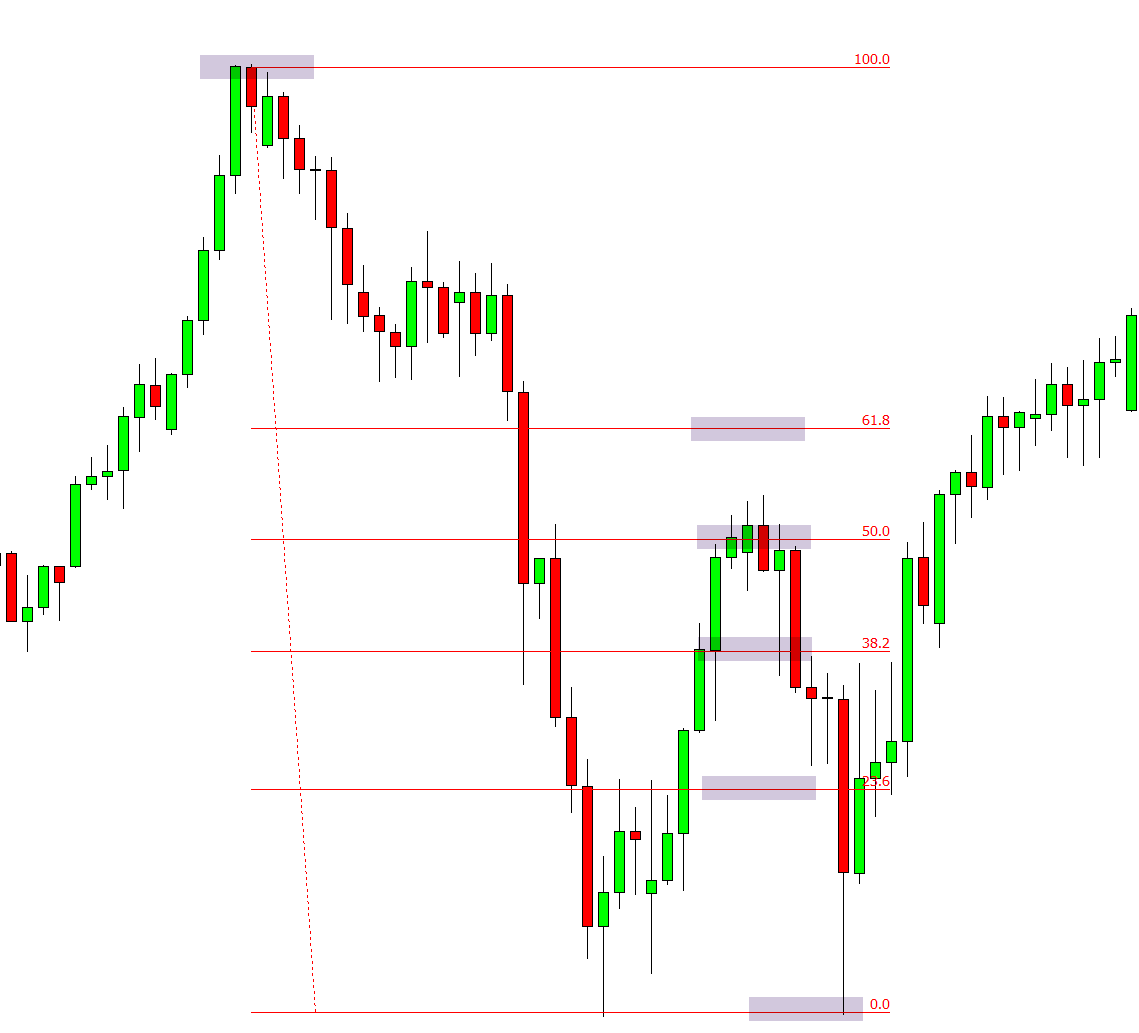

Understanding Fibonacci Retracements A Comprehensive Guide For Traders The fibonacci retracement levels. all of these numbers (0.236, 0.5, 0.618, etc ) are calculated by dividing the fibonacci sequence numbers, or deriving it from them: 13 55 = 0.236. 13 34 = 0.382. Fibonacci retracement levels such as 23.6%, 38.2%, 50%, and 61.8% are essential for determining support and resistance levels, which are vital for establishing entry and exit points in your trades. these key levels act as potential areas for price corrections within an overall trend, allowing you to anticipate market reactions effectively. Identify the swing high ($150) and swing low ($100). apply the fibonacci retracement tool on your chart. the tool will plot key levels at 23.6%, 38.2%, 50%, and 61.8% of the price range. for example, the 38.2% retracement level would be $150 – ($50 x 0.382) = $130.90, a possible support level where the price might reverse. Fibonacci trading involves using the fibonacci sequence and ratios to identify potential support and resistance levels in the market. this technique is widely used in technical analysis to predict price movements and set profit targets. understanding fibonacci retracements can be a powerful tool in your trading arsenal, offering a mathematical.

Fibonacci Retracement Trading Strategies With Free Pdf Identify the swing high ($150) and swing low ($100). apply the fibonacci retracement tool on your chart. the tool will plot key levels at 23.6%, 38.2%, 50%, and 61.8% of the price range. for example, the 38.2% retracement level would be $150 – ($50 x 0.382) = $130.90, a possible support level where the price might reverse. Fibonacci trading involves using the fibonacci sequence and ratios to identify potential support and resistance levels in the market. this technique is widely used in technical analysis to predict price movements and set profit targets. understanding fibonacci retracements can be a powerful tool in your trading arsenal, offering a mathematical. Step 2: draw fibonacci retracement levels. now the fun step; drawing the fibonacci retracement tool. after selecting the tool, you start from the swing low point and drag the levels to the highest point in an uptrend and vice versa in a downtrend. simple as that. Plot fibonacci levels: use the fibonacci retracement tool to connect swing highs and lows. key levels like 23.6%, 38.2%, 50%, and 61.8% can reveal potential retracement points. watch price reactions: keep an eye on how the price behaves around fibonacci levels. if these levels align with other market signals, it could signal a good entry or the.

How To Use Fibonacci Retracement Like An Expert Day Trader Step 2: draw fibonacci retracement levels. now the fun step; drawing the fibonacci retracement tool. after selecting the tool, you start from the swing low point and drag the levels to the highest point in an uptrend and vice versa in a downtrend. simple as that. Plot fibonacci levels: use the fibonacci retracement tool to connect swing highs and lows. key levels like 23.6%, 38.2%, 50%, and 61.8% can reveal potential retracement points. watch price reactions: keep an eye on how the price behaves around fibonacci levels. if these levels align with other market signals, it could signal a good entry or the.

Trading Tip 6 How To Use The Fibonacci Retracement Tool Youtube

Comments are closed.