The Tila Respa Integrated Disclosure Rule Trid Nmls Mortgage

Nmls Exam Tila Respa Integrated Disclosure Rule Trid Youtube Main trid provisions and official interpretations can be found in: § 1026.19 (e), (f), and (g), procedural and timing requirements. § 1026.37, content of the loan estimate. § 1026.38, content of the closing disclosure. supplement i to part 1026 (including official interpretations for the above provisions). The build act does so by amending the underlying statutes for the trid rule (i.e., tila and respa). if the housing assistance loan meets the criteria established in the build act, creditors of qualifying loans have the option of using the hud 1, gfe, and til disclosures, collectively, in lieu of the loan estimate and closing disclosure.

The Tila Respa Integrated Disclosure Rule Trid Nmls Mortgage While searching for a mortgage, you might come across the term “trid” or the phrase “know before you owe.”. trid is an acronym that stands for tila respa integrated disclosures. it combines two federal laws, the truth in lending act (tila) and the real estate settlement procedures act (respa). both protect borrowers by requiring lenders. On july 7, 2017, the cfpb released a final rule amending the trid mortgage disclosure rule and clarified the ability to share the cd with third parties a victory for real estate professionals nationwide. the final rule became effective on october 10, 2017, with mandatory compliance required by october 1, 2018. Der tila and respa sections 4 and 5. section 1032(f) of the dodd frank act mandated that the bureau propose for public comment rules and model disclosures that integrate the tila a. respa disclosures by july 21, 2012. the bureau satisfied this statutory mandate and issued pro. An introduction to trid the cfpb tila respa integrated disclosure rule (“trid”) covers closedend mortgage s only if loan the application for the loan was submitted to a creditor or mortgage broker on or after august 1, 2015. the rules are explicit that no part of the rules will apply to a loan that was applied for prior to the effective date.

Tila Respa Integrated Disclosure Rule Trid Free Tutorial Youtube Der tila and respa sections 4 and 5. section 1032(f) of the dodd frank act mandated that the bureau propose for public comment rules and model disclosures that integrate the tila a. respa disclosures by july 21, 2012. the bureau satisfied this statutory mandate and issued pro. An introduction to trid the cfpb tila respa integrated disclosure rule (“trid”) covers closedend mortgage s only if loan the application for the loan was submitted to a creditor or mortgage broker on or after august 1, 2015. the rules are explicit that no part of the rules will apply to a loan that was applied for prior to the effective date. Tila respa integrated disclosurefaqs. ila respa integrated disclosure faqsthe questions and answers below pertain to compliance with the tila respa integrated. isclosure rule (trid or trid rule). reviewing these questions and answers is not a substitute for reviewing tila, respa, regulation z, or its official interpreta. As of october 3, 2015, the cfpb combined all mortgage rate and fee disclosures mandated under tila and respa into two simple forms to make it easier for consumers to understand their mortgages. this initiative is called the tila respa integrated disclosure rule, often referred to as trid. the new disclosures.

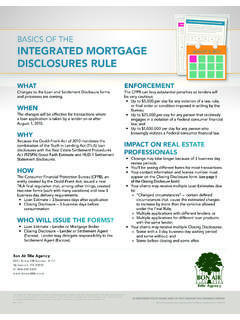

Basics Of The Integrated Mortgage Disclosures Rule Tila Respa Tila respa integrated disclosurefaqs. ila respa integrated disclosure faqsthe questions and answers below pertain to compliance with the tila respa integrated. isclosure rule (trid or trid rule). reviewing these questions and answers is not a substitute for reviewing tila, respa, regulation z, or its official interpreta. As of october 3, 2015, the cfpb combined all mortgage rate and fee disclosures mandated under tila and respa into two simple forms to make it easier for consumers to understand their mortgages. this initiative is called the tila respa integrated disclosure rule, often referred to as trid. the new disclosures.

Mortgage Matters Trid Tila Respa Integrated Disclosure Principle

Tila Respa Integrated Disclosure Rule Home Express Home Loans

Comments are closed.