The Three Credit Bureaus Why They Re Important

The Three Credit Bureaus Explained Creditrepair The three major credit bureaus are equifax, experian and transunion. the credit bureaus manage records on your accounts, balances and the payments you make. each credit bureau operates. In the united states, there are three major credit bureaus: transunion, experian and equifax. while other smaller credit reporting agencies exist, these three companies are responsible for the vast majority of credit reporting activity. each of these companies also provides a separate credit report, so consumers who want information about their.

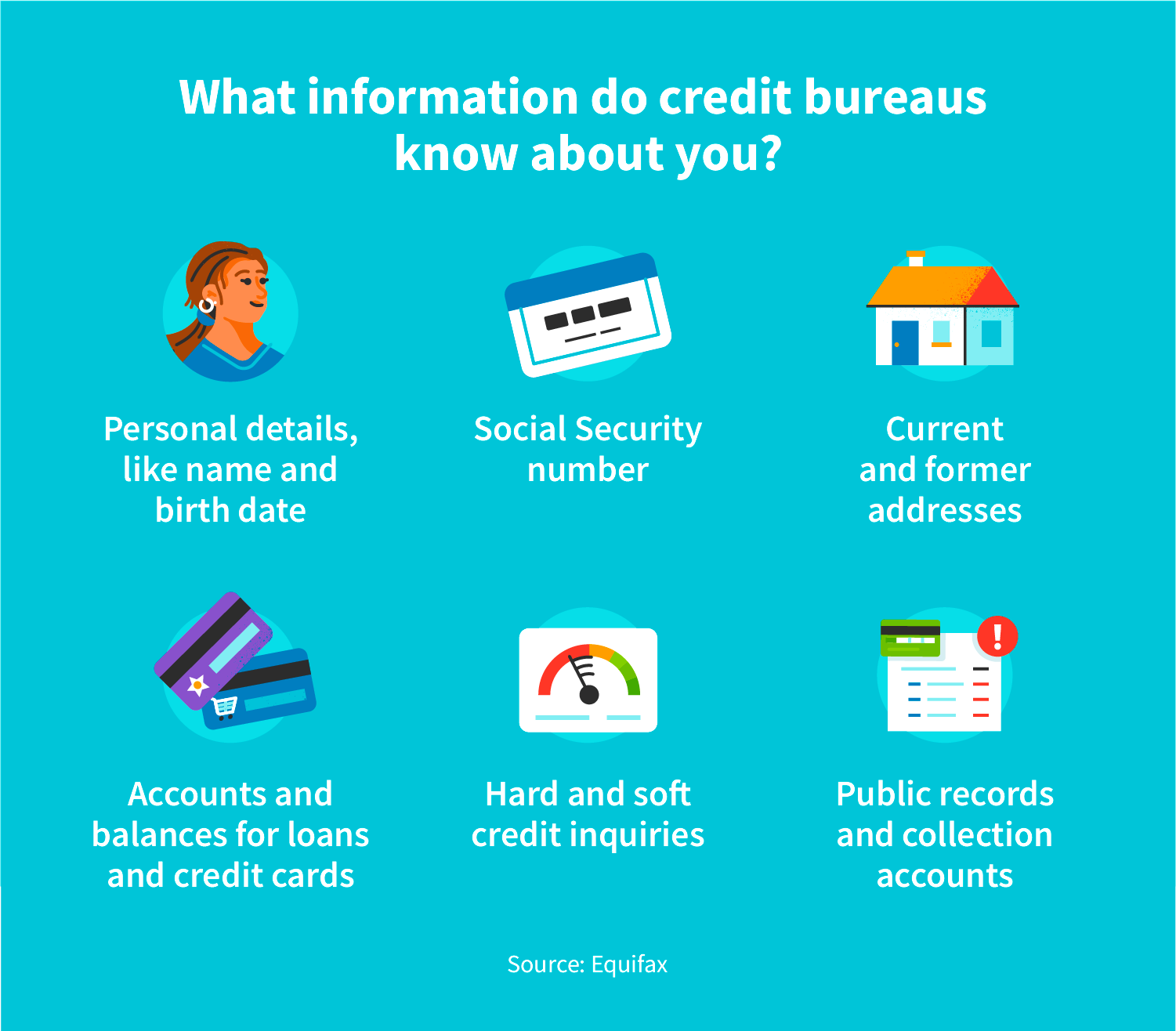

The Three Credit Bureaus Why They Re Important Lexington Law Equifax, experian and transunion are the three main consumer credit bureaus. they collect and store information about you that they use to generate your credit reports, which are used as the basis of your credit scores. editorial note: intuit credit karma receives compensation from third party advertisers, but that doesn’t affect our editors. The three major credit bureaus are equifax®, experian® and transunion®. credit bureaus are sometimes called credit reporting agencies or consumer reporting companies. they’re different from credit scoring companies, such as vantagescore® and fico®. credit reports contain information about people’s identity, credit history and credit. The top 3 credit bureaus. in the u.s., the top three consumer reporting bureaus are equifax, experian, and transunion. this trio dominates the market for collecting information about consumers in. The three major credit bureaus are equifax, experian and transunion. credit bureaus gather and maintain data on consumers' credit use, which means that if you have a credit card or a loan, you.

The Three Credit Bureaus Explained Creditrepair The top 3 credit bureaus. in the u.s., the top three consumer reporting bureaus are equifax, experian, and transunion. this trio dominates the market for collecting information about consumers in. The three major credit bureaus are equifax, experian and transunion. credit bureaus gather and maintain data on consumers' credit use, which means that if you have a credit card or a loan, you. The three main credit bureaus are equifax, experian and transunion. all three companies work essentially the same way: they collect information on your credit behavior and sell that data to other companies that use it to decide your creditworthiness. these credit reporting agencies can collect this information without your permission, but what. Not all credit card companies report on the same schedule, but if they report to one of the three major credit bureaus, you can expect them to report monthly at least. credit bureaus prefer to receive information on the billing cycle date, but you can ask your credit card company for more information about exactly when they report.

Comments are closed.