The Savers Credit Who Qualifies And How It Works

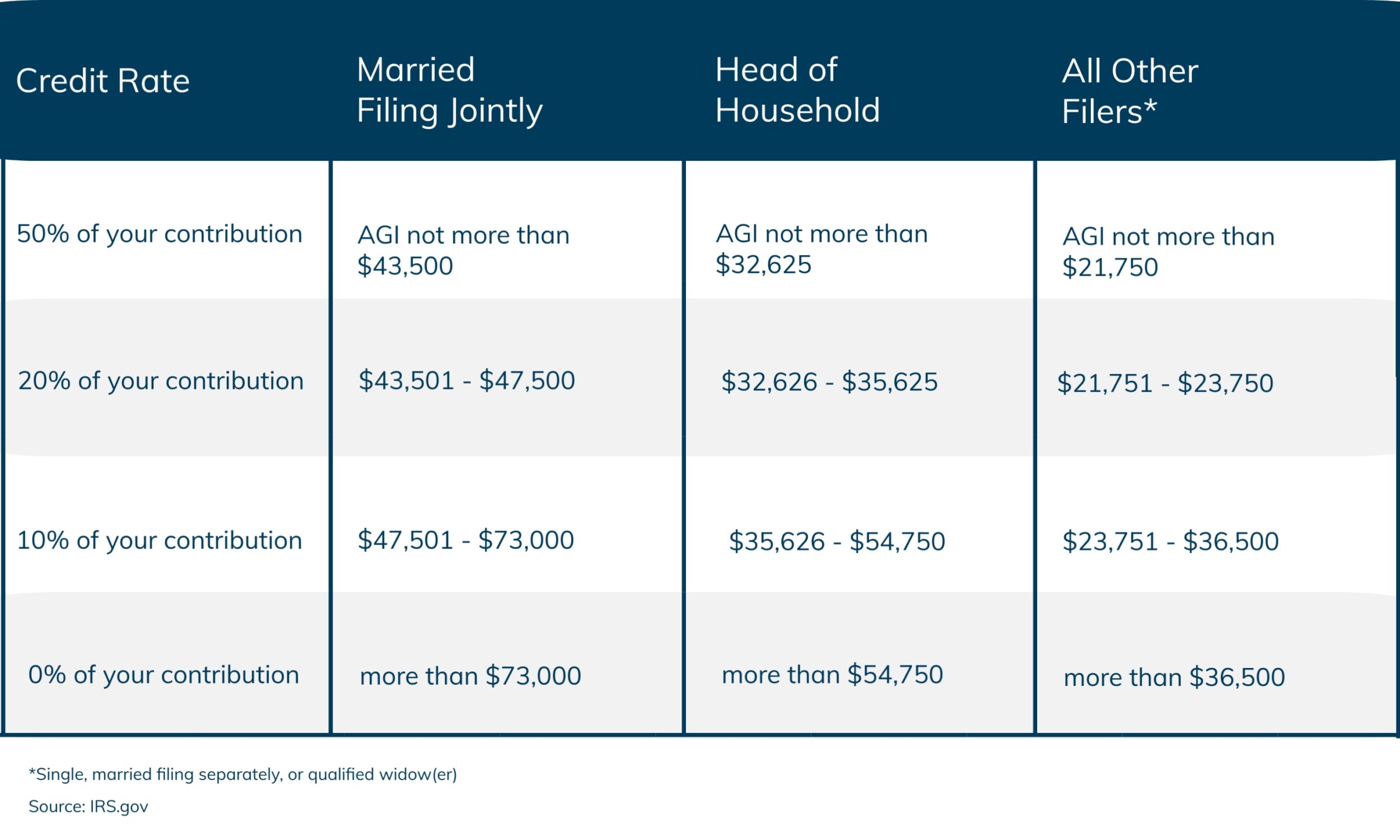

The Saver S Credit Who Qualifies And How It Works Youtube The maximum contribution amount that may qualify for the credit is $2,000 ($4,000 if married filing jointly), making the maximum credit $1,000 ($2,000 if married filing jointly). use the chart below to calculate your credit. example: jill, who works at a retail store, is married and earned $41,000 in 2021. jill’s spouse was unemployed in 2021. Saver’s credit rates for 2025. the adjusted gross income thresholds below apply to income earned in 2025, which is reported on tax returns filed in 2026. married filing jointly. 50% of.

What You Need To Know About The Saver S Credit The saver's credit is a tax credit that low and moderate income individuals may claim for qualified contributions to eligible retirement accounts. it is a nonrefundable credit, meaning it can only reduce taxes, even to a point where taxes may be reduced to $0. you may still receive a tax refund if you had taxes withheld greater than your tax. The qualified retirement savings contribution credit, often referred to as the saver’s credit, is a tax incentive designed to encourage low and moderate income individuals to save for retirement. by contributing to qualified retirement plans, such as traditional iras, roth iras, 401(k) plans, 403(b) plans, and 457 plans, eligible taxpayers. The saver's credit is worth up to $2,000 ($4,000 if filing jointly). it helps low and moderate income individuals and couples save for retirement. Anyone who plans to claim the saver's credit on their taxes will complete form 8880 and file it with their tax return. to be eligible for the saver's credit, you must: be at least 18 years old.

What Is The Savers Credit And How Does It Work The saver's credit is worth up to $2,000 ($4,000 if filing jointly). it helps low and moderate income individuals and couples save for retirement. Anyone who plans to claim the saver's credit on their taxes will complete form 8880 and file it with their tax return. to be eligible for the saver's credit, you must: be at least 18 years old. Individuals with iras have until april 15, 2024 the due date for filing their 2023 return to set up a new ira or add money to an existing ira for 2023. both roth and traditional iras qualify. individuals with workplace retirement plans still have time to make qualifying retirement contributions and get the saver's credit on their 2023 tax. 2023 saver’s credit income limits. the maximum possible tax credit is capped at $1,000 for a single filer or $2,000 if you’re married and filing jointly. if you’re single and your agi.

Comments are closed.