The Next Great Bull Market In Gold Has Begun Gold Survival Guide

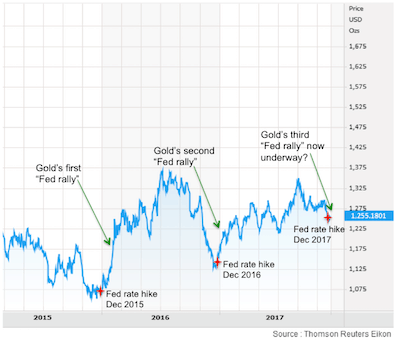

The Next Great Bull Market In Gold Has Begun Gold Survival Guide Here's a possible chronology for the next great bull market in gold. including the counterintuitive relationship between interest rate increases and gold prices. and also the current gold demand and supply imbalance. The most important piece of evidence that the next great bull market in gold has begun is the technical behavior of the prior bear market itself. over many decades, commodities rallies have exhibited 50% retracements (bear markets) before resuming their long term upward trends based on the slow, steady devaluation of the fiat currency in which.

The Next Great Bull Market In Gold Has Begun Gold Survival Guide As long as gold remains above the $2,000 to $2,100 zone (which is now a support zone), there is a high likelihood that another phase of the yellow metal’s long term bull market has just begun. New multi year gold bull market has begun. let us first define what has recently happened to the gold price. from a technical perspective, as you can see in the chart below, the price of gold has broken out from a multi year consolidation phase. if we may use history as our guide, we are now entering a multi year bull market. From a technical perspective, gold will remain in a confirmed long term uptrend as long as it stays above that uptrend line — after all, a trend in motion tends to remain in motion. if you look at gold’s price action of the past five years, you can see that there has been a strong resistance zone overhead from $2,000 to $2,100. May 15, 2024may 15, 2024by glenn thomas. 15may. this article explores the fascinating world of historical cycles, outlining a potential timeline for when gold and silver might culminate their current growth phase and reach full valuation. it also looks at property cycles to see how these might interact and compare to precious metals cycles.

The Next Great Bull Market In Gold Has Begun Gold Survival Guide From a technical perspective, gold will remain in a confirmed long term uptrend as long as it stays above that uptrend line — after all, a trend in motion tends to remain in motion. if you look at gold’s price action of the past five years, you can see that there has been a strong resistance zone overhead from $2,000 to $2,100. May 15, 2024may 15, 2024by glenn thomas. 15may. this article explores the fascinating world of historical cycles, outlining a potential timeline for when gold and silver might culminate their current growth phase and reach full valuation. it also looks at property cycles to see how these might interact and compare to precious metals cycles. A new, long term, secular bull market in gold has begun. this new trend will take gold past $1,400 per ounce by the end of 2018, past $4,000 per ounce by 2020 (if not sooner) and ultimately to. Currently, gold is worth 3%, which goes to show there is ample upside for gold in this bull run. let’s also have a look at the value of the monetary gold supporting the us dollar broad money supply.

Comments are closed.