The Most Common Hidden Mortgage Costs And How To Avoid Them Photo

The Most Common Hidden Mortgage Costs And How To Avoid Them Photo Now, though, you’ll incur moving expenses — and if you’re smart, you’ll have started toting those up ahead of time, as soon as you signed the purchase agreement, in fact. on average. The cost: varies, but expect to pay up to $500. 3. loan origination fee. a loan origination fee is one of the biggest closing costs you’ll encounter when taking out a mortgage. sometimes this fee is identified by one of its other monikers: the underwriting fee, the processing fee or the administrative fee.

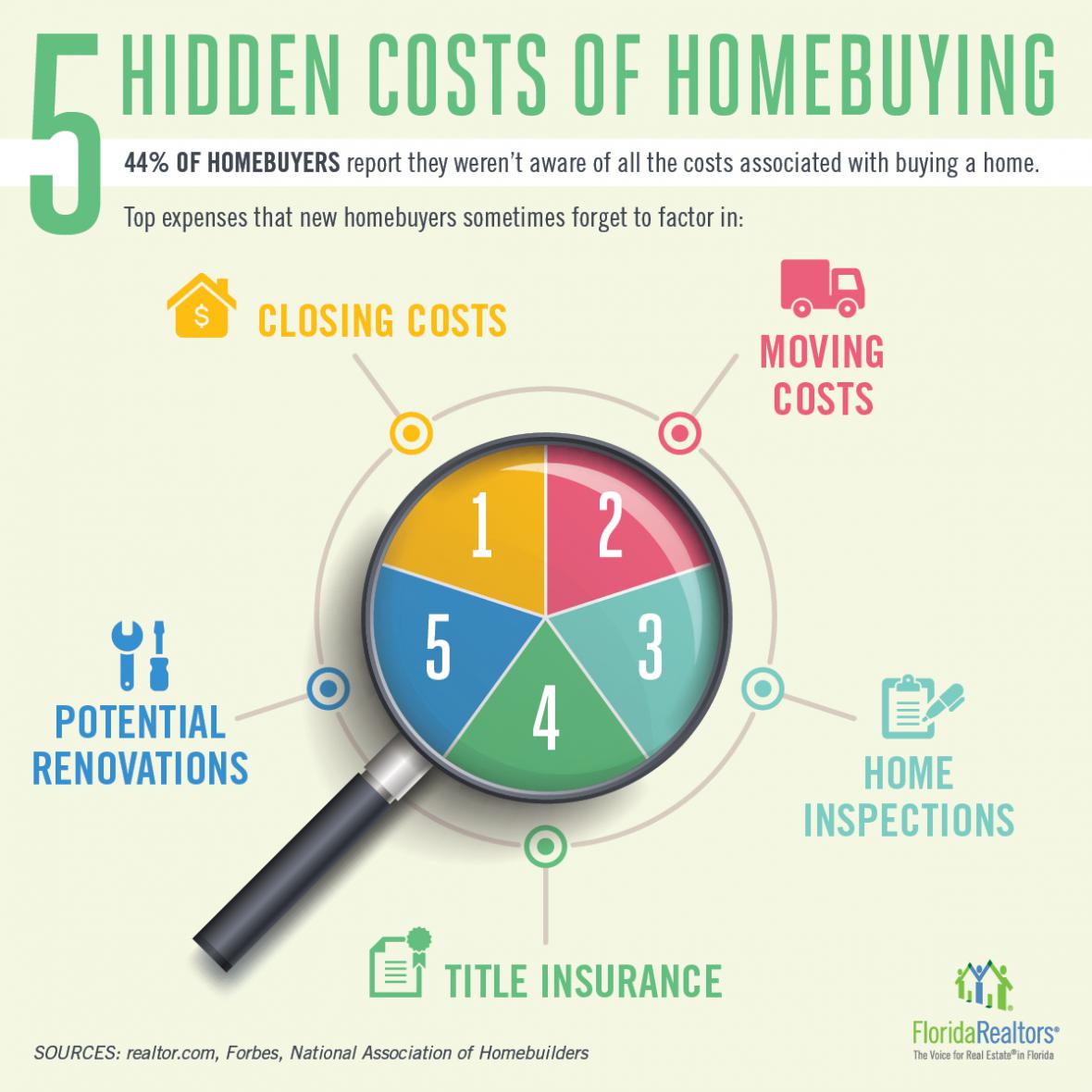

Hidden Costs Of Homebuying Florida Realtors The best time to get a sense of the costs involved in home ownership is before you begin to look for one, especially since the “hidden costs” of owning a home can top $14,000 a year for the average u.s. homeowner and exceed $22,000 in pricey metros such as san francisco and new york. the sum — which pencils out to $1,180 a month for the. When it comes to a mortgage, principal is calculated by subtracting the down payment from the home’s selling price. for example, if you buy a $300k home with a $40k down payment, the principal of your loan is $260k. each monthly mortgage payment chips away at your principal balance. while principal is not a hidden cost in the mortgage process. In 2021, the national average closing cost for a single family property was $6,905, including taxes, a rise of 13.4% on the year prior, according to real estate services firm closingcorp. beyond. Closing costs are the fees you’ll have to pay at your home closing (when the title of the property is transferred from the seller to you), such as the application fee, points, and homeowners insurance premiums. according to a recent survey from zillow, you’ll typically pay between 2% and 5% of the purchase price of the home.

Avoid Hidden Costs When Buying A House Watsons Property In 2021, the national average closing cost for a single family property was $6,905, including taxes, a rise of 13.4% on the year prior, according to real estate services firm closingcorp. beyond. Closing costs are the fees you’ll have to pay at your home closing (when the title of the property is transferred from the seller to you), such as the application fee, points, and homeowners insurance premiums. according to a recent survey from zillow, you’ll typically pay between 2% and 5% of the purchase price of the home. The most expensive investment a person makes in their lifetime is most often a house. many lenders require 20% down on a home before they’ll offer their more favorable mortgage rates. as of july 2022, the average house price in the u.s. hovers around $428,000. that means homeowners hoping to put 20% down will have to fork over a whopping $85,600. Below are the 21 most common hidden costs when it comes to buying a home: 1. home appraisal. a home appraisal is a critical step in the home buying process, providing an independent assessment of the property's value. lenders require it to ensure the home's price matches its market value.

Hidden Costs Of Buying A Home One Click Life The most expensive investment a person makes in their lifetime is most often a house. many lenders require 20% down on a home before they’ll offer their more favorable mortgage rates. as of july 2022, the average house price in the u.s. hovers around $428,000. that means homeowners hoping to put 20% down will have to fork over a whopping $85,600. Below are the 21 most common hidden costs when it comes to buying a home: 1. home appraisal. a home appraisal is a critical step in the home buying process, providing an independent assessment of the property's value. lenders require it to ensure the home's price matches its market value.

What Are The Hidden Costs When Buying A Home Mortgagenb

Comments are closed.