The Loan Estimate And Closing Disclosure Your Guide

The Loan Estimate And Closing Disclosure Your Guide Integrated disclosure guide to the loan estimate and closing disclosure forms this guide is current as of the date set forth on the cover page. it has been updated to reflect the final rule issued on july 7, 2017 and published on august 11, 2017. november 2017 consumer financial protection bureau tila respa integrated disclosure guide to the. Use our closing disclosure explainer to review and understand the details within your disclosure before closing on your mortgage loan. some lenders may provide you with an initial loan worksheet, which can be any type of document explaining your estimated rates, terms, and payments based on initial information you’ve provided.

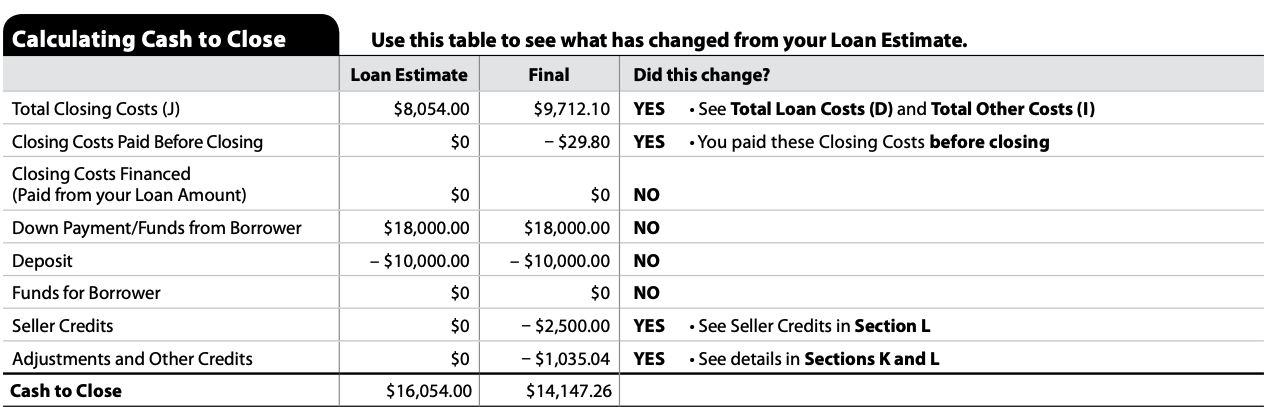

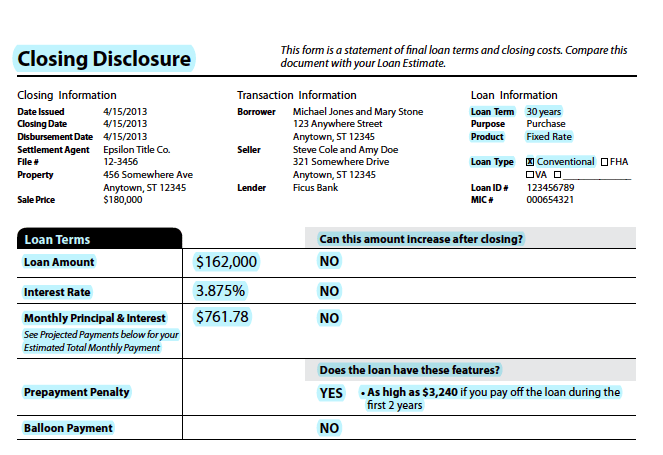

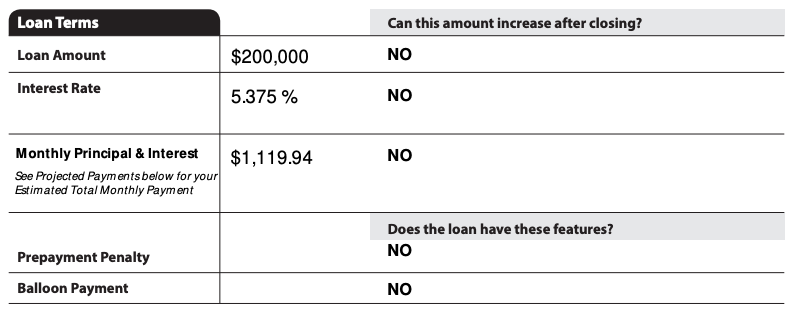

Understanding The Loan Estimate Le And Closing Disclosure Cd What Here’s what you’ll find on each page of your closing disclosure: page 1. contains the same information as your loan estimate, in the same format. it’s easy to compare these pages to look for changes. page 2. breaks down who pays each closing cost (borrower, seller, or other) and when (before closing or at closing). Main trid provisions and official interpretations can be found in: § 1026.19 (e), (f), and (g), procedural and timing requirements. § 1026.37, content of the loan estimate. § 1026.38, content of the closing disclosure. supplement i to part 1026 (including official interpretations for the above provisions). Guide includes most of the requirements concerning completing the loan estimate and closing disclosure. however, this guide may not illustrate all of the permutations of the information required or omitted from the loan estimate or closing disclosure for any particular transaction. only the tila respa rule and its official interpretations. In which the consumer must pay additional funds to satisfy the existing mortgage loan securing the property and other existing debt to consummate the transaction. download pdf. page 3 of closing disclosure (summaries of transactions) disclosure of consumer funds from a simultaneous second lien credit transaction.

The Loan Estimate And Closing Disclosure Your Guide Guide includes most of the requirements concerning completing the loan estimate and closing disclosure. however, this guide may not illustrate all of the permutations of the information required or omitted from the loan estimate or closing disclosure for any particular transaction. only the tila respa rule and its official interpretations. In which the consumer must pay additional funds to satisfy the existing mortgage loan securing the property and other existing debt to consummate the transaction. download pdf. page 3 of closing disclosure (summaries of transactions) disclosure of consumer funds from a simultaneous second lien credit transaction. Getty. the closing disclosure is one of the most important documents you’ll get during the mortgage lending process because it spells out all of the details of your home loan, including how much. The closing disclosure is a five page form that describes the critical aspects of your mortgage loan, including purchase price, loan fees, interest rate, estimated real estate taxes, insurance, closing costs and other expenses. it’s important that you review it thoroughly – in fact, it’s one of the most important steps you can take while.

The Loan Estimate And Closing Disclosure Your Guide Getty. the closing disclosure is one of the most important documents you’ll get during the mortgage lending process because it spells out all of the details of your home loan, including how much. The closing disclosure is a five page form that describes the critical aspects of your mortgage loan, including purchase price, loan fees, interest rate, estimated real estate taxes, insurance, closing costs and other expenses. it’s important that you review it thoroughly – in fact, it’s one of the most important steps you can take while.

Comments are closed.