The Key Lesson From The Crash Of 1929 That Still Rings True Today

The Key Lesson From The Crash Of 1929 That Still Rings True Today Significance for investors. the 5 lessons are explored in more depth below. 1. buy and hold investing is not a sure bet. even over the course of decades, it may be a losing strategy. the dow jones. Blog summary. ziad k. abdelnour's "lessons learned from the 1929 stock market crash," published on march 15, 2021, serves as a historical analysis of the great depression and its implications for modern investors. abdelnour draws parallels between past and current economic indicators, highlighting the importance of understanding market cycles.

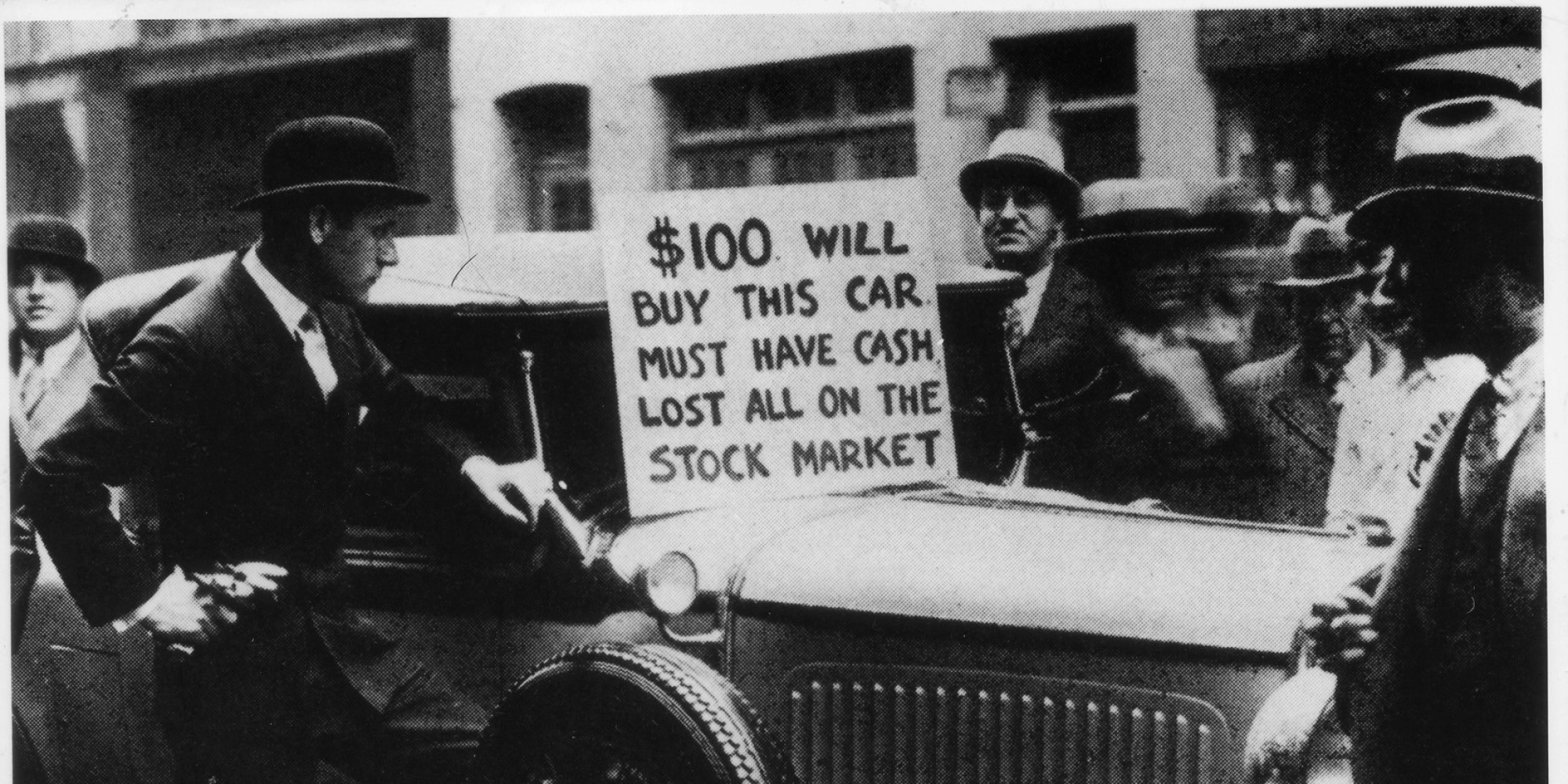

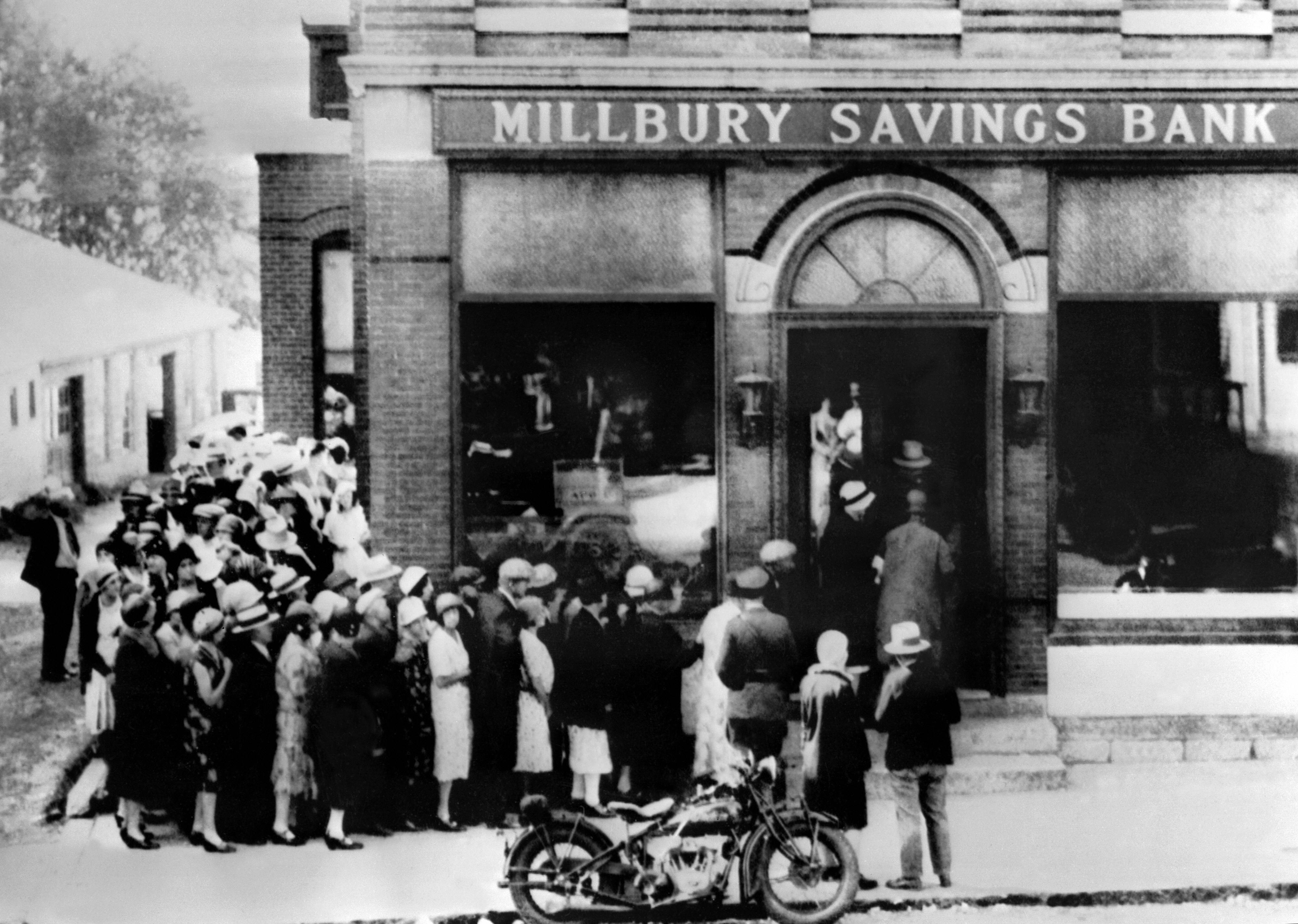

The Key Lesson From The Crash Of 1929 That Still Rings True Today Key takeaways. the 1929 stock market crash led to a big money loss and started the great depression. too much debt and price inflation caused the crash. banks made mistakes, too. the crash hurt workers and families a lot. many lost their jobs or homes. today, we use lessons from 1929 to avoid making the same mistakes in our money matters. Key takeaways – wall street crash of 1929: causes & lessons. the wall street crash of 1929 serves as a reminder of the consequences of uncontrolled economic growth, speculative investing, and the neglect of risk management. the crash not only devastated the us economy but also had a global impact, contributing to the great depression of the. Olivia b. waxman. october 24, 2019. by the end of thursday, oct. 24, 1929, the new york stock exchange had rebounded from the 10% dip that the market had taken earlier that day. but then stocks. 7 the account that we present is, in our opinion, the academic consensus, although on this issue we note that meltzer (2003, 252 257) and other scholars suggest that the crash was a symptom, not a contributing force, to the contraction in 1929. 8 friedman and schwartz (1963) outline these lessons in their coverage of the stock market crash.

The Key Lesson From The Crash Of 1929 That Still Rings True Today Olivia b. waxman. october 24, 2019. by the end of thursday, oct. 24, 1929, the new york stock exchange had rebounded from the 10% dip that the market had taken earlier that day. but then stocks. 7 the account that we present is, in our opinion, the academic consensus, although on this issue we note that meltzer (2003, 252 257) and other scholars suggest that the crash was a symptom, not a contributing force, to the contraction in 1929. 8 friedman and schwartz (1963) outline these lessons in their coverage of the stock market crash. The wall street crash of 1929 was a defining moment in modern economic history. the sudden collapse of the american stock market on october 29, 1929, known as black tuesday, triggered a chain reaction that plunged the world into the great depression, the worst economic crisis of the 20th century. this article will explore the causes. The wall street crash of 1929, also called the great crash, was a sudden and steep decline in prices in the united states in late october of that year. over the course of four business days—black thursday (october 24) through black tuesday (october 29)—the dropped from 305.85 points to 230.07 points, representing a decrease in stock prices.

The Key Lesson From The Crash Of 1929 That Still Rings True Today The wall street crash of 1929 was a defining moment in modern economic history. the sudden collapse of the american stock market on october 29, 1929, known as black tuesday, triggered a chain reaction that plunged the world into the great depression, the worst economic crisis of the 20th century. this article will explore the causes. The wall street crash of 1929, also called the great crash, was a sudden and steep decline in prices in the united states in late october of that year. over the course of four business days—black thursday (october 24) through black tuesday (october 29)—the dropped from 305.85 points to 230.07 points, representing a decrease in stock prices.

An Old Photo Of A Man Standing In Front Of A Pile Of Papers On The Floor

Comments are closed.