The Irs Just Announced The 2022 401 K And Ira Contribution Limits

The Irs Just Announced The 2022 401 K And Ira Contribution Limits Ir 2024 285, nov. 1, 2024. washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2025 has increased to $23,500, up from $23,000 for 2024. the irs today also issued technical guidance regarding all cost‑of‑living adjustments affecting dollar limitations for pension. The irs has announced the 2025 contribution limits for 401(k) and iras. employees can defer $23,500 into workplace plans, a modest increase from $23,000 in 2024. the change applies to 401(k)s, 403.

Simple Ira Contribution Limits 2022 Choosing Your Gold Ira The internal revenue service (irs) announced on friday, nov. 1, that the amount individuals can contribute to their 401 (k) plans in 2025 has increased to $23,500, up from $23,000 for 2024. the irs also issued technical guidance regarding all cost of living adjustments affecting dollar limitations for pension plans and other retirement related. In 2025, you can contribute up to $23,500 to your 401 (k) at work, or up to $31,000 if you’re 50 or older. next year, employees aged 60 to 63 will benefit from an even higher contribution limit. The ira catch‑up contribution limit for individuals aged 50 and over is not subject to an annual cost‑of‑living adjustment and remains $1,000. the catch up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan is increased to $7,500, up from. Irs tax tip 2021 170, november 17, 2021. next year taxpayers can put an extra $1,000 into their 401 (k) plans. the irs recently announced that the 2022 contribution limit for 401 (k) plans will increase to $20,500. the agency also announced cost‑of‑living adjustments that may affect pension plan and other retirement related savings next year.

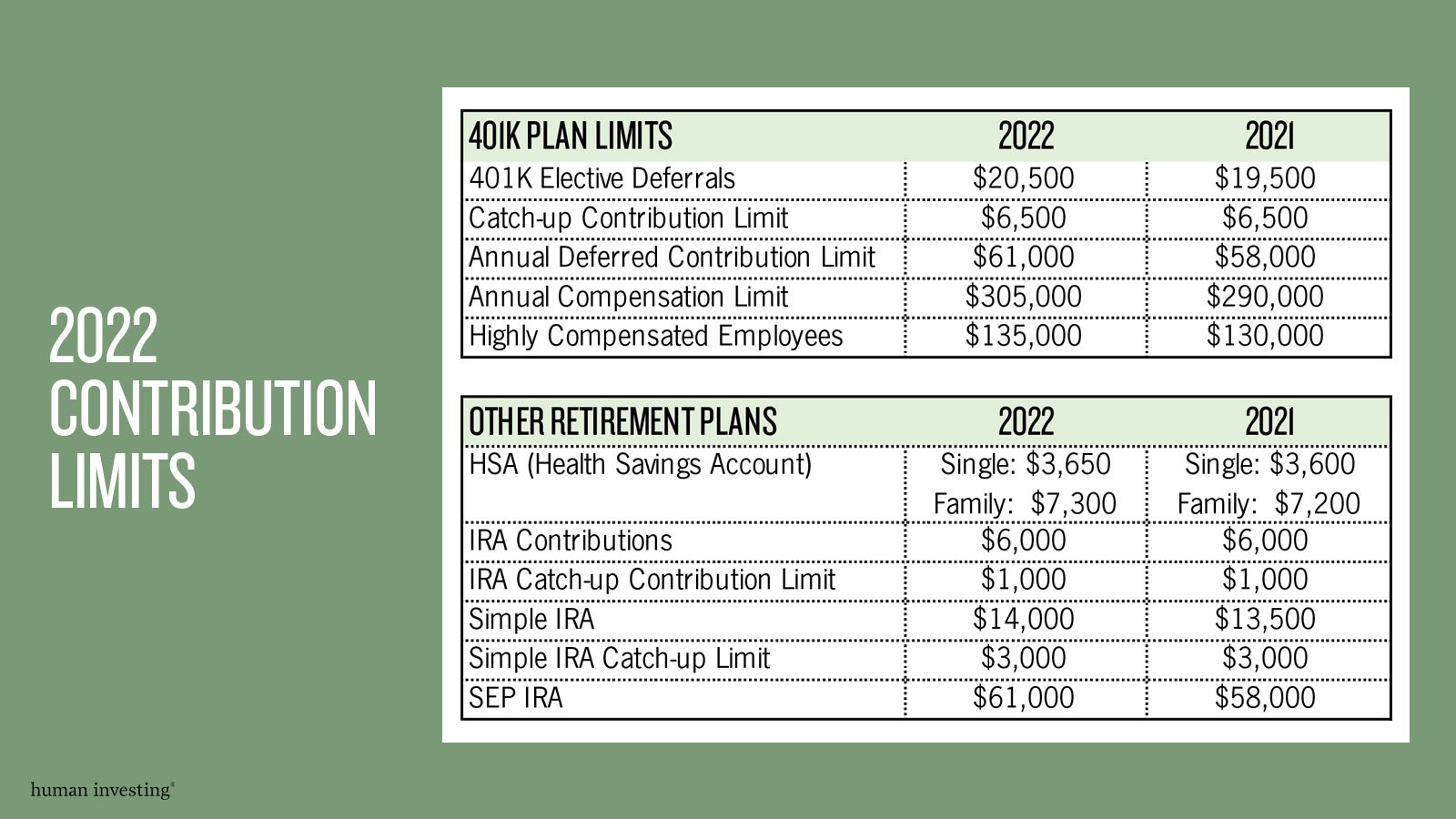

The Irs Has Increased Contribution Limits For 2022 Human Investing The ira catch‑up contribution limit for individuals aged 50 and over is not subject to an annual cost‑of‑living adjustment and remains $1,000. the catch up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan is increased to $7,500, up from. Irs tax tip 2021 170, november 17, 2021. next year taxpayers can put an extra $1,000 into their 401 (k) plans. the irs recently announced that the 2022 contribution limit for 401 (k) plans will increase to $20,500. the agency also announced cost‑of‑living adjustments that may affect pension plan and other retirement related savings next year. The irs sets the maximum that you and your employer can contribute to your 401 (k) each year. in 2023, the most you can contribute to a roth 401 (k) and contribute in pretax contributions to a traditional 401 (k) is $22,500. in 2024, this rises to $23,000. those 50 and older can contribute an additional $7,500 in 2023 and 2024. The maximum contribution taxpayers can make to 401 (k) plans in 2022 is $20,500. for taxpayers 50 and older, an additional $6,500 catch up amount brings the total to $27,000. the $20,500 limit.

Comments are closed.