The History Of The Medicare Donut Hole Bobby Brock Insurance

The History Of The Medicare Donut Hole Bobby Brock Insurance The affordable care act (aca) called for the end of the donut hole over a series of years. the medicare donut hole officially closed for the 2020 plan year. you may wonder how the mediations are paid for if you’re only paying 25% and your plan is paying no more than 5%. the answer is different for generic medications and name brand ones. for. The donut hole is also referred to as the coverage gap and it is part of every medicare part d plan, including those that are part of a medicare advantage plan. after you and your insurance company has spend a certain about of medications, you enter the coverage gap. when you enter the coverage gap, you will pay more for your prescription.

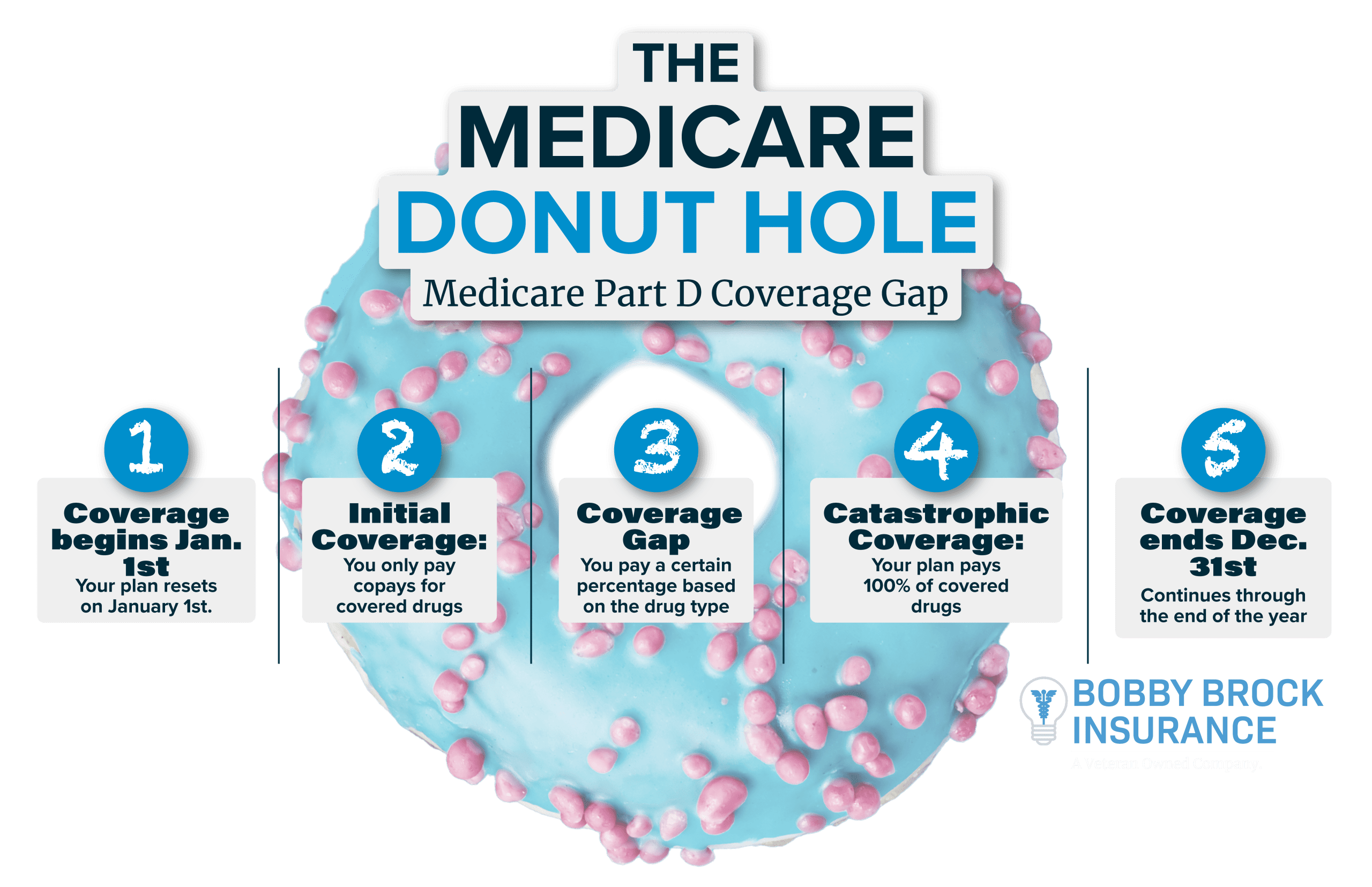

The History Of The Medicare Donut Hole Bobby Brock Insurance However, your insurance carrier is still paying. once both you and the insurer collectively pay $4,130 in total, your coverage gap begins and you are now in the donut hole. in the donut hole, you are required to pay 25% of the cost of the medication whereas before you were only required to pay a small copay. Medicare part d beneficiaries who reach the donut hole will also pay a maximum of 25% co pay on generic drugs purchased while in the coverage gap (receiving a 75% discount). for example: if you reach the 2020 donut hole, and your generic medication has a retail cost of $100, you will pay $25. the $25 that you spend will count toward your troop. The "donut hole" or "doughnut hole" is a stage of health insurance coverage where insurance covers less of your prescription drug costs. in 2024, you reach the donut hole stage when your total drug costs reach $5,030. that includes what you and your plan have paid for your medications. all medicare prescription drug plans, including part d. The donut hole is the third of four phases or stages of medicare part d coverage. it comes after the deductible and initial coverage phases, but before catastrophic coverage. in the donut hole.

The History Of The Medicare Donut Hole Bobby Brock Insurance The "donut hole" or "doughnut hole" is a stage of health insurance coverage where insurance covers less of your prescription drug costs. in 2024, you reach the donut hole stage when your total drug costs reach $5,030. that includes what you and your plan have paid for your medications. all medicare prescription drug plans, including part d. The donut hole is the third of four phases or stages of medicare part d coverage. it comes after the deductible and initial coverage phases, but before catastrophic coverage. in the donut hole. 2024 will be the last year medicare part d enrollees have to go through the donut hole coverage phase. due to the inflation reduction act, starting in 2025, all medicare part d plans will have a $2,000 maximum out of pocket limit. thus, taking away the need for the donut hole phase. once you meet the $2,000 limit is 2025, you will not be. The gap in the middle was called the donut hole. initially, enrollees paid 100% of the cost of their drugs while in the donut hole. but the aca gradually closed the donut hole over several years. it “closed” in 2020, which meant that enrollees with standard part d coverage paid 25% of the cost of their drugs while in the donut hole.

Medicare Donut Hole How It Works And How To Get Out 2024 will be the last year medicare part d enrollees have to go through the donut hole coverage phase. due to the inflation reduction act, starting in 2025, all medicare part d plans will have a $2,000 maximum out of pocket limit. thus, taking away the need for the donut hole phase. once you meet the $2,000 limit is 2025, you will not be. The gap in the middle was called the donut hole. initially, enrollees paid 100% of the cost of their drugs while in the donut hole. but the aca gradually closed the donut hole over several years. it “closed” in 2020, which meant that enrollees with standard part d coverage paid 25% of the cost of their drugs while in the donut hole.

Part D Donut Hole Vs The Coverage Gap Bobby Brock Insurance

Comments are closed.