The Future Of Banking Is Open How To Seize The Open Banking

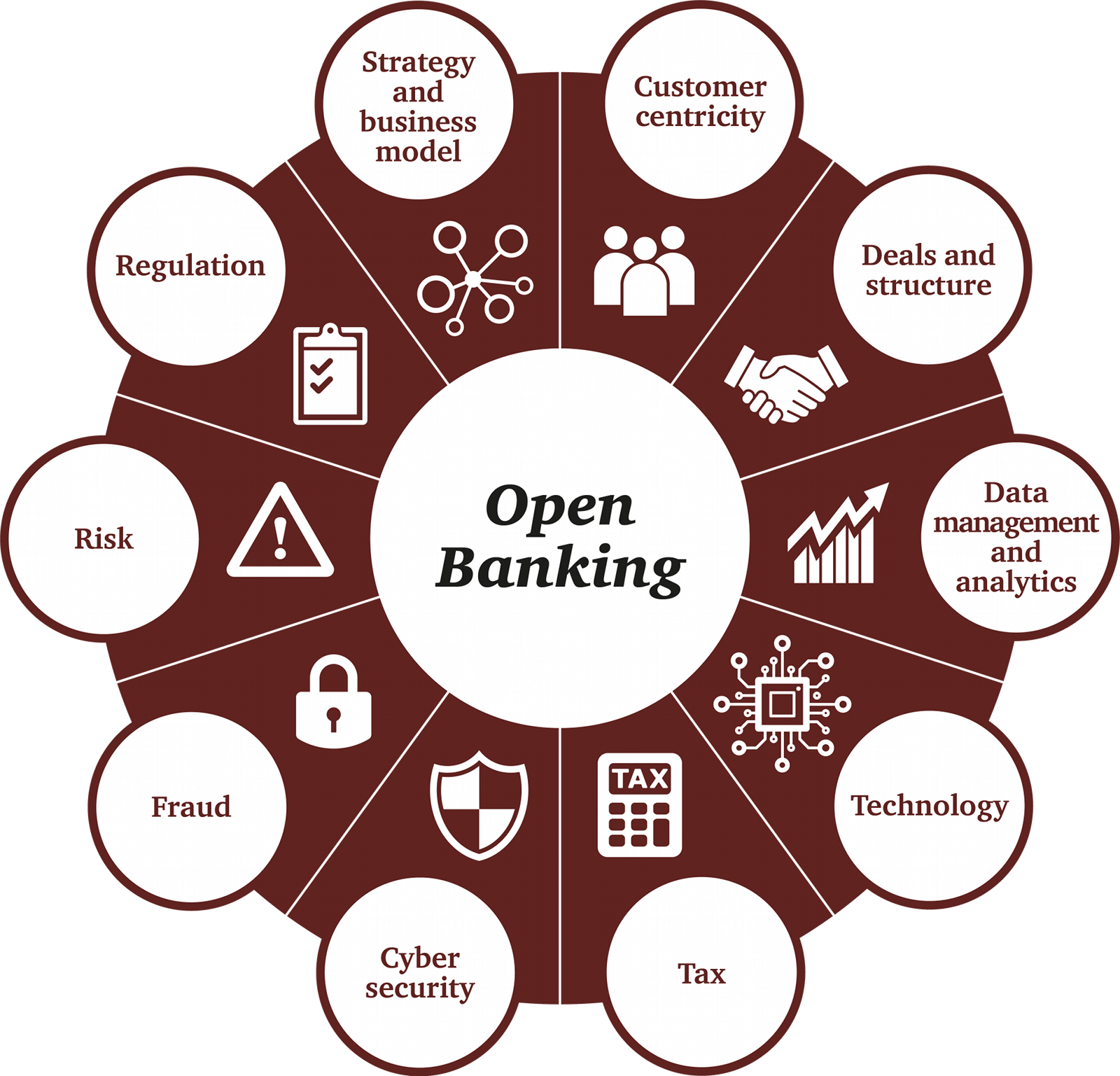

The Future Of Banking Is Open How To Seize The Open Banking Vate in areas like payments.while many customers’ concerns about security and privacy currently outweigh the perceived benefits, there is already a large target mark. t for open banking solutions. we estimate that open banking has the potential to create a revenue opportunity of at least £7.2bn by 2022. Open banking creates a significant market opportunity and potential to disrupt the financial services landscape. open banking is here and will transform the way we are able to pay for goods and.

The Future Of Banking Is Open How To Seize The Open Banking Open banking creates a significant market opportunity and potential to disrupt the financial services landscape. pwc and the open data institute have conducted extensive research into customer adoption and how the financial services ecosystem and technology firms are responding to open banking. A message from the open data institute at the open data institute, we work as such, open banking has the with companies and governments potential to radically transform to build an open, trustworthy data the way in which we engage in ecosystem, where people can get banking services, receive money value from data and its impacts do no and make payments. The events of 2020 and our reliance on digital interactions and banking self service have only cemented the urgency and need for banks to become more digital. as banks chart their course to digitization, open banking is emerging as a capability banks will also need to confront to remain competitive and keep the pace of an increasingly digital. 4. digital technology is critical to future success. our report with the eiu found that 87% of countries have some form of open apis in place. the building blocks are there, but open banking can only be successful and sustainable if it has consumer confidence. consumers must see a clear benefit from sharing their data.

Future Of Banking How To Seize The Open Banking Opportunity The events of 2020 and our reliance on digital interactions and banking self service have only cemented the urgency and need for banks to become more digital. as banks chart their course to digitization, open banking is emerging as a capability banks will also need to confront to remain competitive and keep the pace of an increasingly digital. 4. digital technology is critical to future success. our report with the eiu found that 87% of countries have some form of open apis in place. the building blocks are there, but open banking can only be successful and sustainable if it has consumer confidence. consumers must see a clear benefit from sharing their data. While many customers’ concerns about security and privacy currently outweigh the perceived benefits, there is already a large target market for open banking solutions. the report estimates that open banking has the potential to create a revenue opportunity of at least £7.2 billion by 2022 across retail and sme markets. If open banking becomes a top down compliance directive, it can become just a box ticking exercise. cfpb in its october announcement said consumers would get access to their data “free of junk fees.

Comments are closed.