The Four Stages Of Retirement Planning Stewart Advisory Services

The Four Stages Of Retirement Planning Stewart Advisory Services The old “three legged stool” of retirement that used to consist of 1) a company pension, 2) social security benefits, and 3) individual savings, is now teetering on one and half legs. the guaranteed incomes of company pensions are a thing of the past, and many in the younger generations are not holding out much hope for social security. At stewart advisory services, we believe in proactive planning to achieve the retirement lifestyle you’ve worked so hard to earn. our comprehensive services are designed to put your finances in order and keep them that way to and through retirement. entering your 50’s and 60’s, the questions can start piling up:.

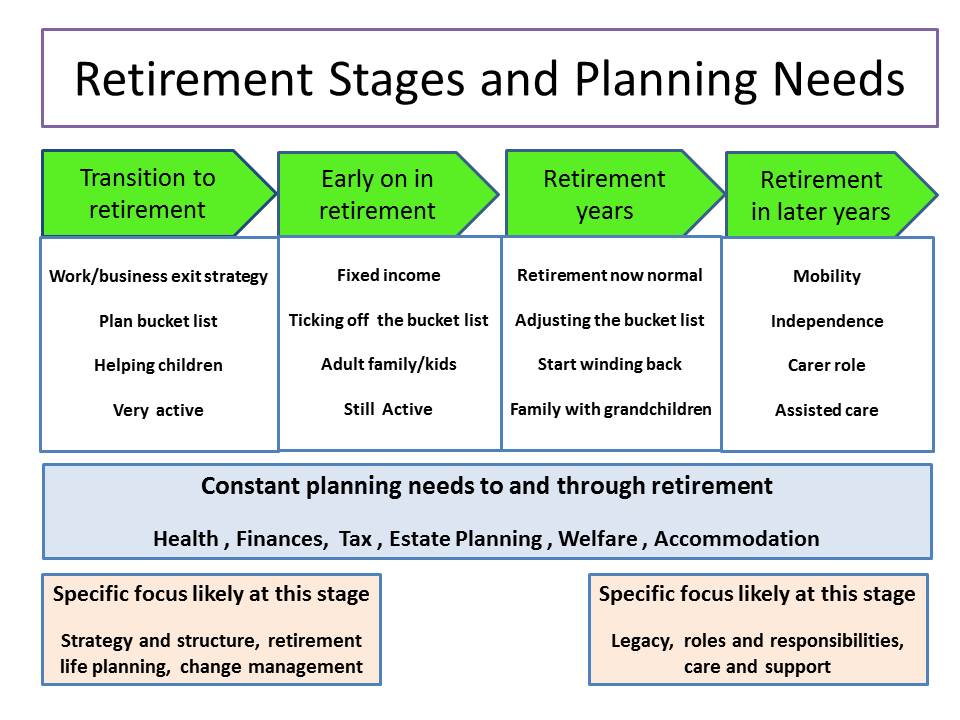

Retirement Stages And Planning Needs Primetime Phase 4: the reinvest and rewire phase. if you can break through into phase 4, that means you’ve been able to discover something that is meaningful to you and gives you a sense of accomplishment. You should also meet with a financial advisor to discuss the myriad of new challenges that retirement brings, such as: creating a distribution plan to ensure that your savings last. managing your money in a tax advantaged way. preparing for healthcare needs and health insurance. keeping up with inflation. Phase 4: the later years. health care is a major expense in the later years of retirement. according to fidelity, the average 65 year old couple should plan to spend $300,000 on health care. Phase 2: early retirement. enjoy the freedom of retirement by engaging in activities you love, such as traveling or pursuing hobbies. adjust to the changes in your lifestyle and start thinking, then find new things and establish some healthy habits to stay active and fulfilled. phase 3: mid retirement.

Stages Of Retirement Learn About Various Stages Start Planning Phase 4: the later years. health care is a major expense in the later years of retirement. according to fidelity, the average 65 year old couple should plan to spend $300,000 on health care. Phase 2: early retirement. enjoy the freedom of retirement by engaging in activities you love, such as traveling or pursuing hobbies. adjust to the changes in your lifestyle and start thinking, then find new things and establish some healthy habits to stay active and fulfilled. phase 3: mid retirement. Most people go through three stages of retirement. in the first — let's call it the exploring stage — you're likely going to try new things and pursue your passions and hobbies. you might later transition to the nesting stage, with more predictable routines and a greater focus on home and family. and later comes a reflecting stage, where. First, you have to plan for the money part, which makes sense. that’s what everybody does. but what most people don’t know is they also need to plan for the emotional side or the psychological side. as we go through the five stages, you’ll see how both of these play a part in retirement. stage one: pre retirement . pre retirement occurs.

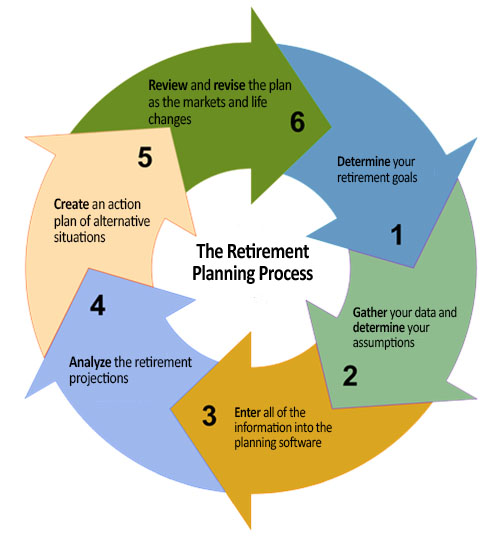

Retirement Planning Step By Step First Point Wealth Management Most people go through three stages of retirement. in the first — let's call it the exploring stage — you're likely going to try new things and pursue your passions and hobbies. you might later transition to the nesting stage, with more predictable routines and a greater focus on home and family. and later comes a reflecting stage, where. First, you have to plan for the money part, which makes sense. that’s what everybody does. but what most people don’t know is they also need to plan for the emotional side or the psychological side. as we go through the five stages, you’ll see how both of these play a part in retirement. stage one: pre retirement . pre retirement occurs.

Mapping Out The 4 Stages Of Retirement Planning Chatterton Associates

Comments are closed.