The Formula For The Future Value Of An Annuity Due таф Accountingtools тлж

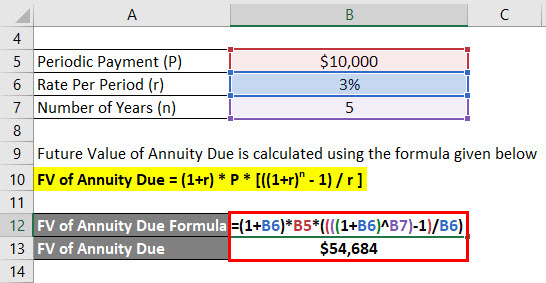

Future Value Of An Annuity Formula Example And Excel Template The annuity table contains a factor specific to the future value of a series of payments, when a certain interest earnings rate is assumed. when this factor is multiplied by one of the payments, you arrive at the future value of the stream of payments. for example, if there is an expectation to make 8 payments of $10,000 each into an investment. The formula for calculating the future value of an annuity due (where a series of equal payments are made at the beginning of each of multiple consecutive periods) is: p = (pmt [ ( (1 r)n 1) r]) (1 r) where: p = the future value of the annuity stream to be paid in the future. pmt = the amount of each annuity payment.

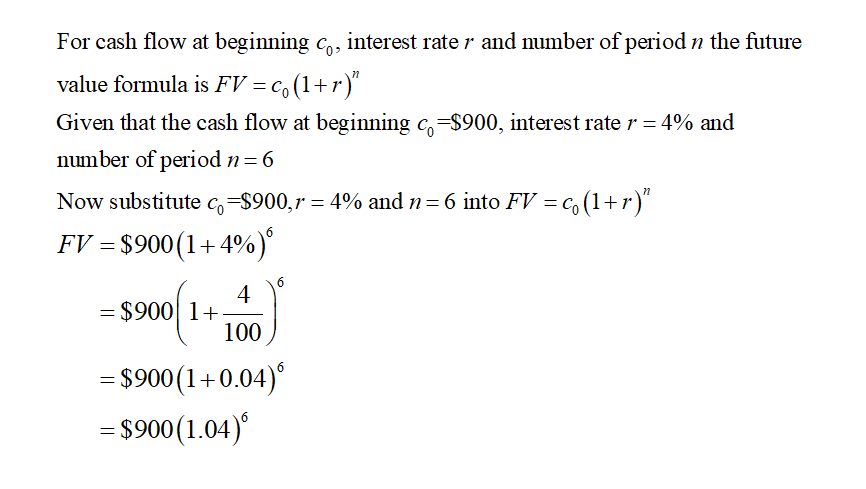

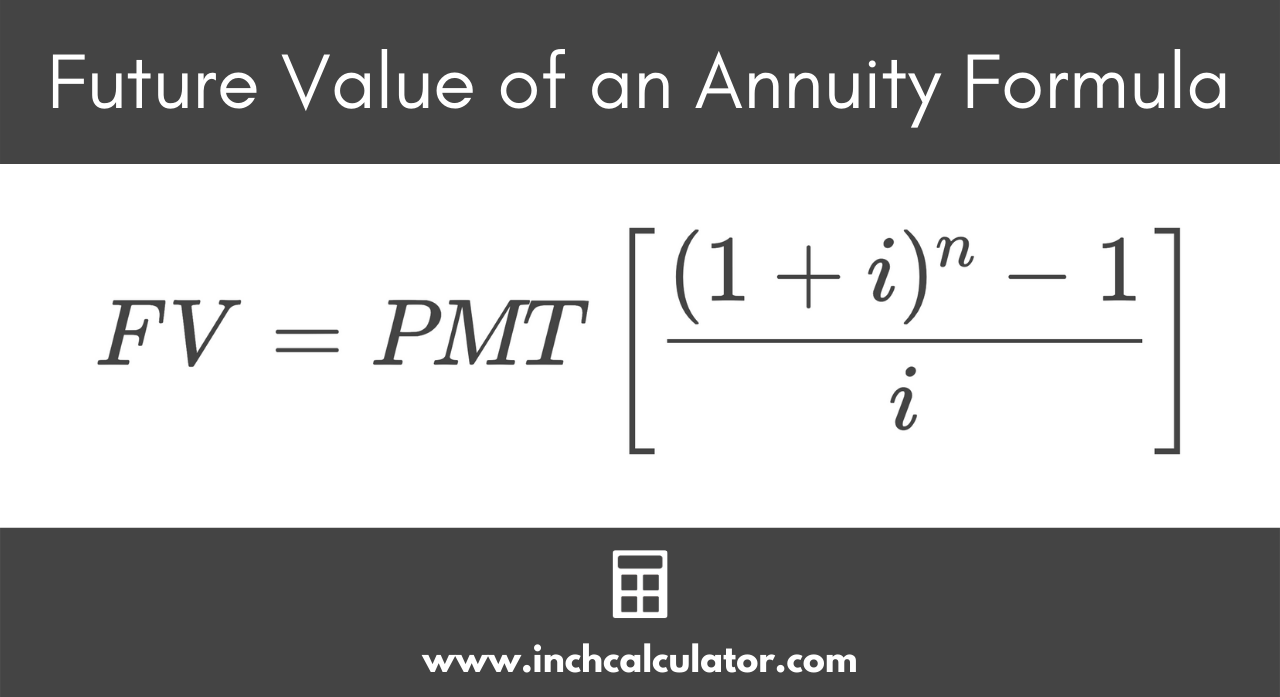

Future Value Of Annuity Due Formula With Calculator Future value of an annuity. f v = p m t i [(1 i) n − 1] (1 i t) where r = r 100, n = mt where n is the total number of compounding intervals, t is the time or number of periods, and m is the compounding frequency per period t, i = r m where i is the rate per compounding interval n and r is the rate per time unit t. There are a few different ways to determine the future value of annuity due formula. the first way is that we know that. this means that we can multiply the present value of annuity due formula by (1 r)n. the present value of annuity due formula is. notice that if we multiply the 2nd portion of this formula by (1 r)n, the numerator becomes (1 r. Future value of an annuity due. with an annuity due, payments are made at the beginning of each period. so the formula is slightly different. to find the future value of an annuity due, simply. Calculate the fv of annuity due for monthly payment using the above given information, = $2,000 * * (1 0.42%) 0.42%. future value of monthly payment will be . fv of annuity due = $106,471.56 ~ $106,472. so, with planned deposits, nixon is expected to have $106,472 which more than the amount ($100,000) required for his mba.

Future Value Of Annuity Due Formula Calculator Excel Template Future value of an annuity due. with an annuity due, payments are made at the beginning of each period. so the formula is slightly different. to find the future value of an annuity due, simply. Calculate the fv of annuity due for monthly payment using the above given information, = $2,000 * * (1 0.42%) 0.42%. future value of monthly payment will be . fv of annuity due = $106,471.56 ~ $106,472. so, with planned deposits, nixon is expected to have $106,472 which more than the amount ($100,000) required for his mba. Example of the annuity due payment formula using future value. as an example of the annuity due payment formula using future value, suppose that an individual would like to have $5,000 saved within 5 years. the individual plans on making equal deposits per year starting today into an account that has an effective annual rate of 3%. Ordinary annuities and annuities due differ in the timing of those recurring payments. the future value of an annuity is the total value of payments at a future point in time. the present value is.

The Formula For The Future Value Of An Annuity Due таф Accountingtools тлж Example of the annuity due payment formula using future value. as an example of the annuity due payment formula using future value, suppose that an individual would like to have $5,000 saved within 5 years. the individual plans on making equal deposits per year starting today into an account that has an effective annual rate of 3%. Ordinary annuities and annuities due differ in the timing of those recurring payments. the future value of an annuity is the total value of payments at a future point in time. the present value is.

Future Value Of An Annuity Calculator Inch Calculator

Comments are closed.