The Different Types Of Permanent Life Insurance A Comprehensive Guide

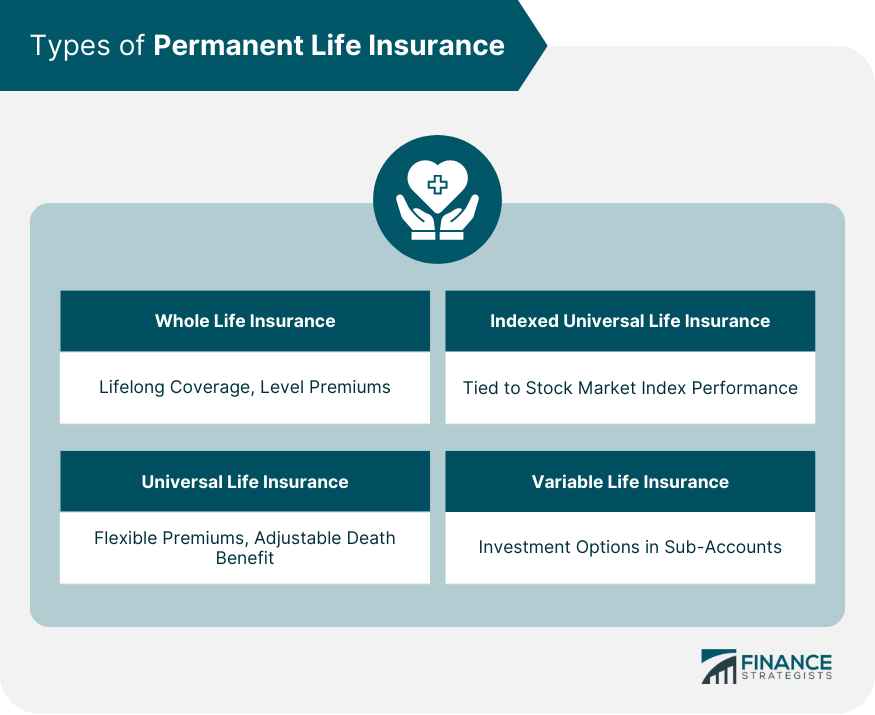

Affordable Permanent Life Insurance Types of permanent life insurance policies. whole life insurance. universal life insurance. variable life insurance. indexed universal life insurance. whole life insurance. whole life insurance is perhaps the most straightforward type of permanent life insurance. it offers a guaranteed death benefit and a savings component, known as the cash. Based on your risk level, the insurer determines your eligibility, premiums, and coverage amount. the table below highlights the core differences between term and permanent life insurance. term.

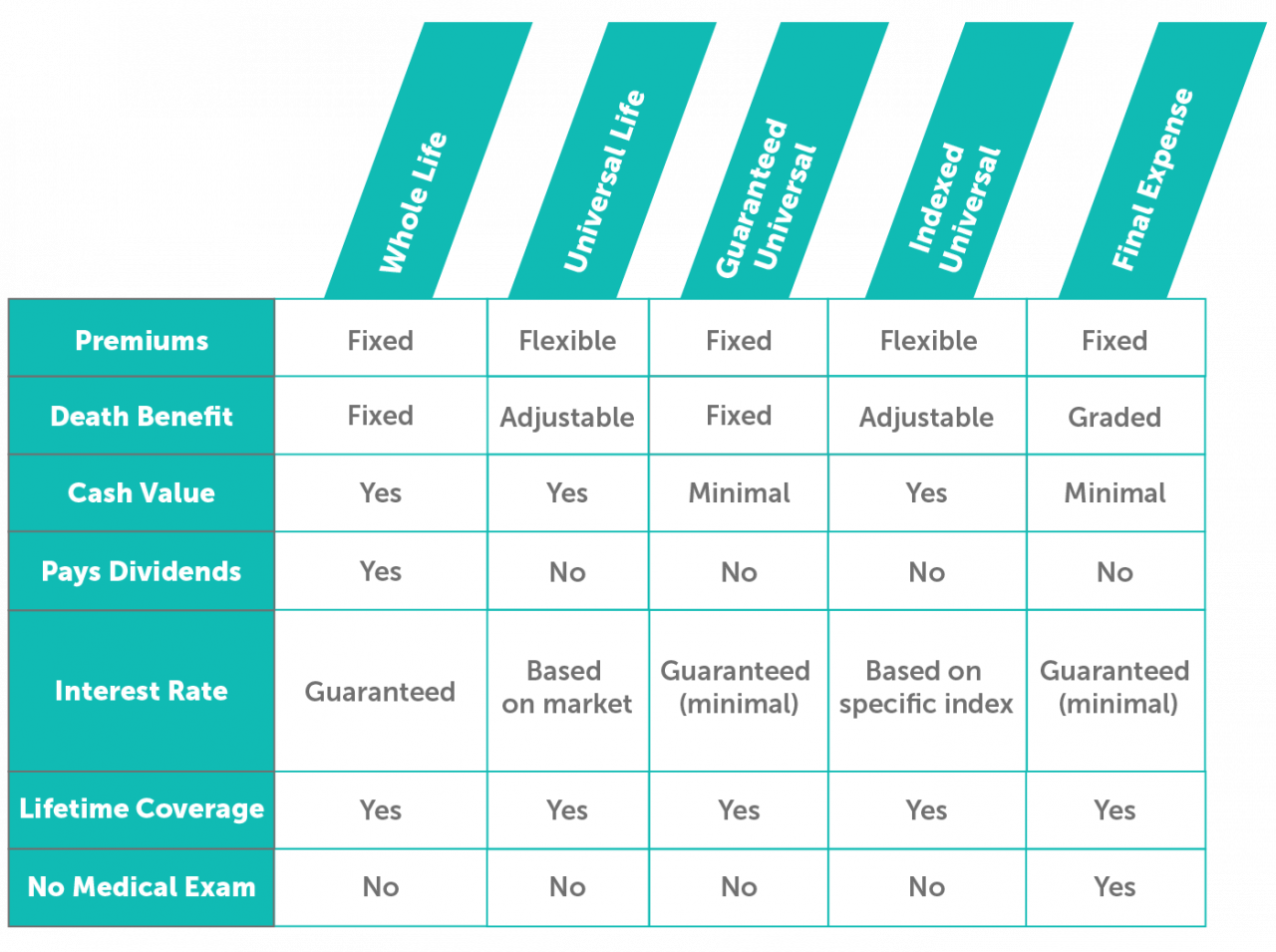

Permanent Life Insurance Definition Types How To Choose A guaranteed universal life (gul) policy is arguably the simplest type of permanent life insurance. it is basically a term policy that lasts your entire life. when you buy a gul plan, you get a policy with a set amount and regular payment. if you pay the premium on time, your rate and death benefit are guaranteed to stay the same. Most joint life insurance policies are permanent life insurance policies. there are two main types of joint life policies: first to die, which pays out when either one of the two insured people dies, and second to die, also known as survivorship life insurance. survivorship policies pay out when both people insured by the policy die. There are three basic types of whole life policies: nonparticipating whole life. offers lifetime protection with fixed premiums, death benefit and cash value growth. medical exams are mandatory unless the policy starts from a term conversion. policy owners can customize the features of the policy with added riders. A life insurance policy is a contract with an insurance company that provides a lump sum payment to beneficiaries you choose in the event of your death. the policy must be in force at the time of.

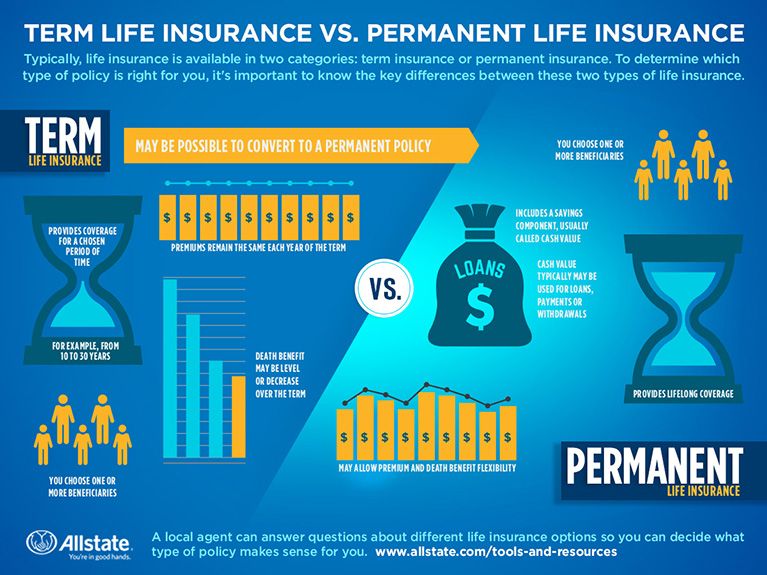

Permanent Life Insurance 101 What You Need To Know Allstate There are three basic types of whole life policies: nonparticipating whole life. offers lifetime protection with fixed premiums, death benefit and cash value growth. medical exams are mandatory unless the policy starts from a term conversion. policy owners can customize the features of the policy with added riders. A life insurance policy is a contract with an insurance company that provides a lump sum payment to beneficiaries you choose in the event of your death. the policy must be in force at the time of. Permanent life insurance. a type of life insurance that usually lasts a lifetime and includes a cash value component. premium. the cost of maintaining a life insurance policy. term life insurance. There are two main types of life insurance products: term and permanent life insurance term life insurance offers protection for a designated timeframe.; permanent life insurance policies like whole life or universal life extend coverage for the insured's entire lifetime and have the potential to build up a cash value as time progresses.

What Is Permanent Life Insurance Complete Guide Permanent life insurance. a type of life insurance that usually lasts a lifetime and includes a cash value component. premium. the cost of maintaining a life insurance policy. term life insurance. There are two main types of life insurance products: term and permanent life insurance term life insurance offers protection for a designated timeframe.; permanent life insurance policies like whole life or universal life extend coverage for the insured's entire lifetime and have the potential to build up a cash value as time progresses.

A Complete Guide To The Types Of Permanent Life Insurance

Comments are closed.