The Different Types Of Health Insurance Plans Financeadri

Understanding The Different Types Of Health Insurance Plans Alliance One of these types of health plans: hmo, ppo, epo, or pos higher out of pocket costs than many types of plans; like other plans, if you reach the maximum out of pocket amount, the plan pays 100%. Finding the right health insurance plan for your needs can be time consuming and confusing. before you start researching plans, it’s important to understand the difference between an hmo, ppo, epo, and pos health plan—the standard acronyms for the different types of managed care plans available in most areas.

Health Insurance Plans How Will Insurance Buddy Help Find The Right Plan Pos plans. a point of service (pos) plan is a health insurance plan that partners with a group of clinics, hospitals and doctors to provide care. with this type of plan, you’ll pay less out of pocket when you get care within the plan's network. pos plans often require coordination with a primary care provider (pcp) for treatment and referrals. A high deductible health plan (hdhp) has an annual health insurance deductible of at least $1,400 for an individual or $2,800 for a family in 2022. a plan considered high deductible will increase. Among the many factors to consider when you’re shopping for individual health insurance coverage is the type of managed care plan. hmo vs ppo vs epo vs pos: to make a decision about which works best for your situation, it’s crucial to understand the differences between the options and how they can affect your budget and access to medical providers. Hmo: a budget friendly plan. a health maintenance organization (hmo) plan is one of the most affordable types of health insurance. while it may have coinsurance, it generally has lower premiums and deductibles. it also often has fixed copays for doctor visits. it’s a good choice if you’re on a tight budget and don’t have many health issues.

Health Insurance Taxationwealth Among the many factors to consider when you’re shopping for individual health insurance coverage is the type of managed care plan. hmo vs ppo vs epo vs pos: to make a decision about which works best for your situation, it’s crucial to understand the differences between the options and how they can affect your budget and access to medical providers. Hmo: a budget friendly plan. a health maintenance organization (hmo) plan is one of the most affordable types of health insurance. while it may have coinsurance, it generally has lower premiums and deductibles. it also often has fixed copays for doctor visits. it’s a good choice if you’re on a tight budget and don’t have many health issues. Disclaimers. there are different types of health insurance plans to fit different needs. learn about options like aca, medicare, medicaid, cobra, short term and more. Exclusive provider organization (epo): a managed care plan where services are covered only if you use doctors, specialists, or hospitals in the plan’s network (except in an emergency). health maintenance organization (hmo): a type of health insurance plan that usually limits coverage to care from doctors who work for or contract with the hmo.

What Are The Different Types Of Health Insurance Plans Ljm Insurance Disclaimers. there are different types of health insurance plans to fit different needs. learn about options like aca, medicare, medicaid, cobra, short term and more. Exclusive provider organization (epo): a managed care plan where services are covered only if you use doctors, specialists, or hospitals in the plan’s network (except in an emergency). health maintenance organization (hmo): a type of health insurance plan that usually limits coverage to care from doctors who work for or contract with the hmo.

The Different Types Of Health Insurance Plans Financeadri

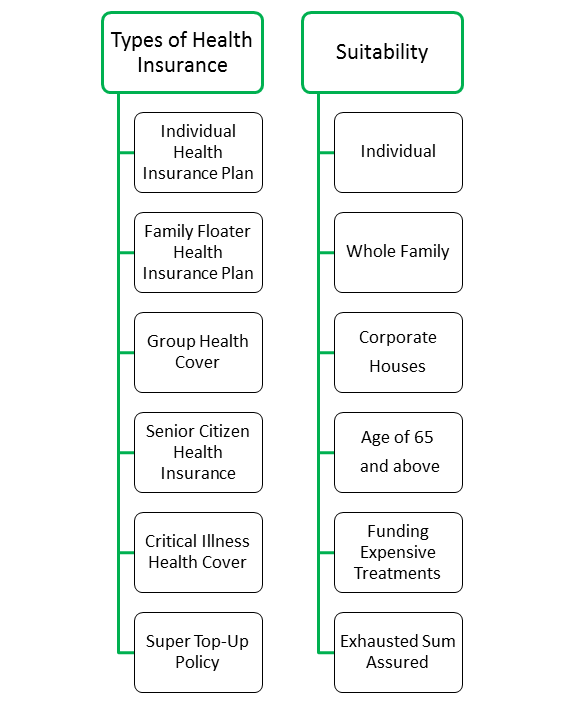

Types Of Health Insurance Plans

Comments are closed.