The Complete Guide To 1031 Exchange Rules

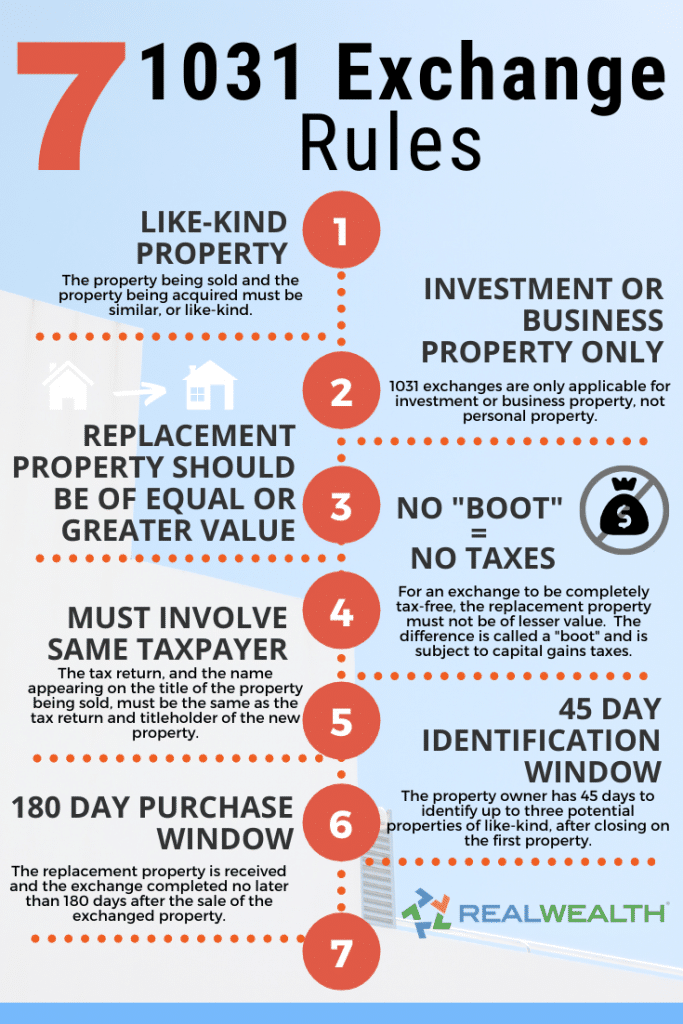

The Complete Guide To 1031 Exchange Rules The 1031 exchange, while advantageous, is bound by stringent regulations set forth by the irs. to qualify for this tax deferral strategy, you must meet specific criteria and follow certain rules. A 1031 exchange has a tight schedule, so you must act precisely according to the rules provided by the irs to avoid paying the capital gains tax. how 1031 exchanges work examples. a 1031 exchange is a multi step process with strict adherence to numerous irs guidelines to keep the tax deferred status.

1031 Exchange Rules Success Stories For Real Estate Investors 2021 Our guide covers everything you need to know about 1031 exchanges, including how clever's co founder, ben mizes, used the 1031 strategy to expand his real estate portfolio from one unit to 26 units. given their complexity, consulting an accountant or tax professional before starting an exchange is your best bet. To do a 1031 exchange, the new property you’re purchasing needs to be “like kind” the property you’re selling. according to the irs.gov website, a like kind property must be “of the same nature or character, even if they differ in grade or quality.”. that’s pretty vague, but the rules are pretty generous. 1. 1031 exchanges are also known as 'like kind' exchanges, and that matters. section 1031 of the irc defines a 1031 exchange as when you exchange real property used for business or held as an. The straightforward guide to the 1031 exchange – updated for 2022. a 1031 exchange allows investors to swap like kind property, postponing capital gains tax, but in case it is confusing, we give you a detailed guide that will tell you all about the 1031 exchange concepts, rules, and more. william stern. published june 21, 2022.

1031 Exchange Guide Rules Benefits Blue Rock Financial Group 1. 1031 exchanges are also known as 'like kind' exchanges, and that matters. section 1031 of the irc defines a 1031 exchange as when you exchange real property used for business or held as an. The straightforward guide to the 1031 exchange – updated for 2022. a 1031 exchange allows investors to swap like kind property, postponing capital gains tax, but in case it is confusing, we give you a detailed guide that will tell you all about the 1031 exchange concepts, rules, and more. william stern. published june 21, 2022. What is a 1031 exchange? a 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a way to postpone capital gains tax on the sale of a business or investment property by. Hire a qualified intermediary first. before you consider a 1031 exchange, hire someone to act as your qualified intermediary. this professional or organization can guide you through the entire process. importantly, this person can also hold (or park) the proceeds of the sale of one property and release it when it’s time to purchase another.

Comments are closed.