The Best Time Of Year To Retire To Maximize Your Benefits

The Best Time Of Year To Retire To Maximize Your Benefits Workers can begin claiming social security benefits early, at age 62. this will reduce their monthly benefit amounts, however, with the reduction based on the number of months they receive benefits before reaching full retirement age. employees born before 1959 who retire between age 66 and age 67 (depending on the exact year of birth) are. For example, if you started working at a company on sept. 1, 2002, you may get credit for 24 years of service if you retire on sept. 3, 2025 even though you only worked one day into your 24th year.

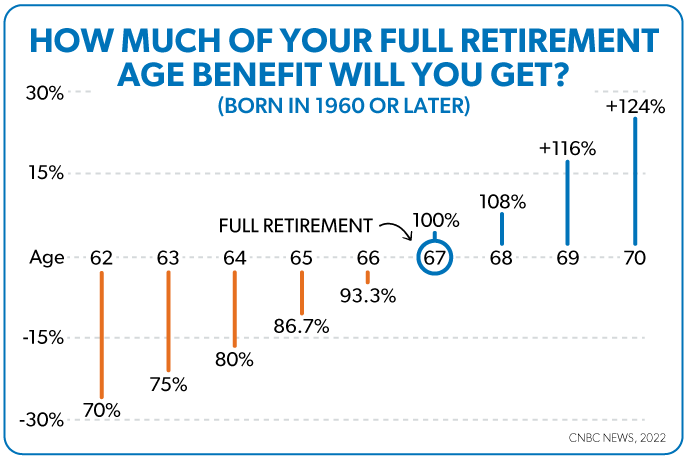

What Is Full Retirement Age And What Does It Mean For Your Ramsey Deciding the best time of the year to retire for social security benefits depends on a few factors. if you retire and start benefits before your full retirement age (fra), your monthly repayments will be permanently reduced. for example, retiring at 62 can cut your benefits by as much as 30%. in contrast, you'll receive full benefits if you. This is a common date for federal employees, who are the kings and queens of gaming the retirement system. retiring on december 31 is likely to maximize your unpaid annual leave check. there’s a. Your retirement plan. your workplace retirement plan rules can also impact the right time of year to retire. if you're getting a pension from an employer, it'll probably start on the first of the month. stopping work on the last day of the month means you won't go without pay as your pension will begin right away. The rules have recently changed. it used to be that beginning at age 70 1 2 years, you were required to take a minimum distribution from retirement accounts such as 401k plans and traditional iras.

The Best Time Of The Year To Retire Financially Find Out Now Your retirement plan. your workplace retirement plan rules can also impact the right time of year to retire. if you're getting a pension from an employer, it'll probably start on the first of the month. stopping work on the last day of the month means you won't go without pay as your pension will begin right away. The rules have recently changed. it used to be that beginning at age 70 1 2 years, you were required to take a minimum distribution from retirement accounts such as 401k plans and traditional iras. However, according to the setting every community up for retirement enhancement act of 2019, if you reached 70 1 2 on jan. 1, 2020, or after, you do not have to take your first required minimum. To help you navigate this big decision, here are 10 social security calculators to consider: social security retirement estimator. u.s. news retirement calculator. planning for retirement. social.

Retirement Should Be The Best Time Of Your Life When You Can Relax And However, according to the setting every community up for retirement enhancement act of 2019, if you reached 70 1 2 on jan. 1, 2020, or after, you do not have to take your first required minimum. To help you navigate this big decision, here are 10 social security calculators to consider: social security retirement estimator. u.s. news retirement calculator. planning for retirement. social.

Retirement Planning Tips To Maximize Your Benefits

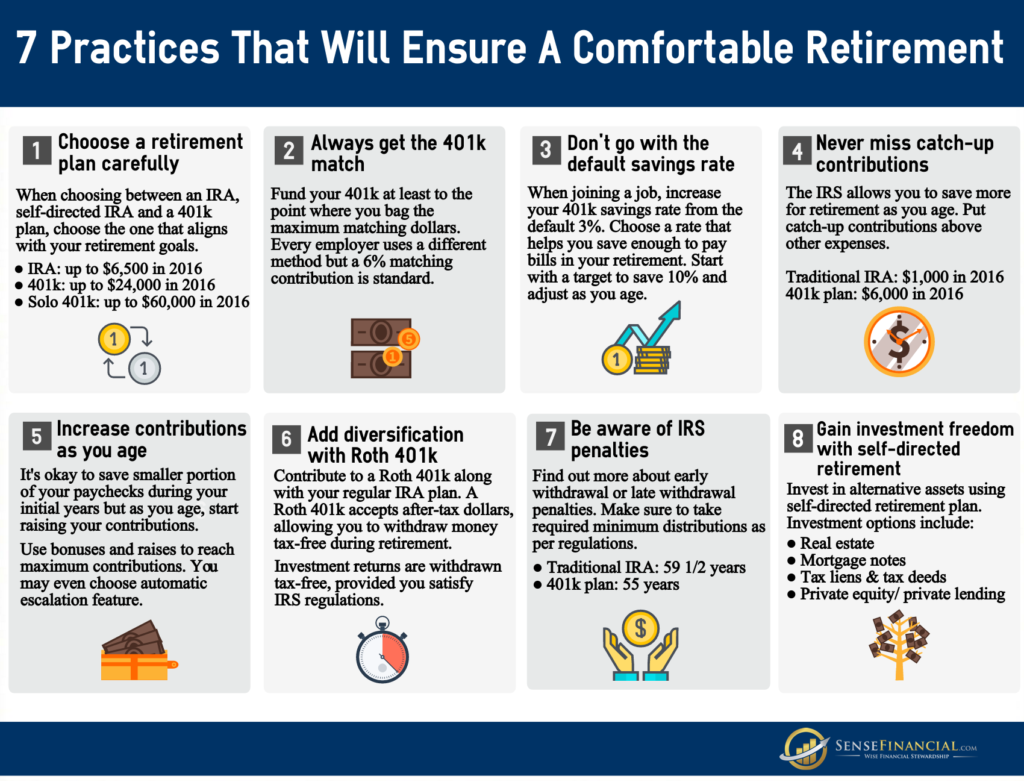

Infographic 8 Retirement Tips That Will Ensure A Comfortable Retirement

Comments are closed.